Advance Auto Parts 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-18

15, 2008. The Company will consider this standard when evaluating potential future transactions to which it would

apply.

In December 2009, the FASB issued ASU No. 2009-16, “Transfers and Servicing (Topic 860) Accounting for

Transfers of Financial Assets,” which amends the ASC for the issuance of SFAS No. 166, “Accounting for

Transfers of Financial Assets – an amendment of FASB Statement No. 140.” The amendments in this ASU clarifies

the requirements for isolation and limitations on portions of financial assets that are eligible for sale accounting and

requires enhanced disclosures about the risks that a transferor continues to be exposed to because of its continuing

involvement in transferred financial assets. ASU 2009-16 is effective for the Company’s fiscal year beginning after

November 15, 2009. The Company does not expect the adoption to have a material impact on its consolidated

financial statements.

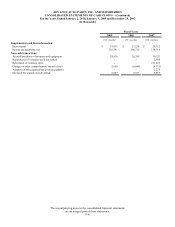

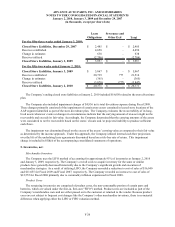

3. Change in Accounting Principle:

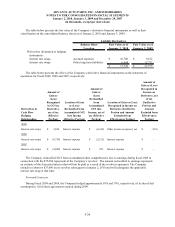

Effective January 4, 2009, the Company implemented a change in accounting principle for costs included in

inventory. Under the Company’s historical accounting policy, freight and other handling costs (collectively

“handling costs”) associated with moving merchandise inventories from our distribution centers to our retail stores

and handling costs associated with moving our merchandise inventories from our vendors to our distribution centers

were capitalized as inventory and expensed in cost of sales as inventory was sold. However, handling costs

associated with moving merchandise inventories from our HUB stores and PDQ®s to our retail stores after a

customer had special-ordered the merchandise were expensed as incurred in SG&A.

The change relates to capitalizing handling costs associated with moving merchandise inventories from our

HUB stores and PDQ®s to our retail stores, which are now treated as inventory product costs. Such costs are

includable in inventory and expensed in cost of sales as inventory is sold because they relate to the acquisition of

goods for resale by the Company. The Company has determined that it is preferable to capitalize such handling costs

into inventory because it better represents the costs incurred to prepare inventory for sale to the customer and it is

consistent with the Company’s treatment of other handling costs associated with moving merchandise inventories

from our distribution centers to our retail stores.

The change in accounting principle has been retrospectively applied to all prior periods presented herein related

to cost of sales and SG&A. However, because the inventory transferred is typically at the retail store for only one or

two days until customer pick-up, the current and historical impact of this change on the accompanying consolidated

balance sheets, consolidated net income, earnings per share, and consolidated statements of cash flows is not

material and, as a result, Inventories, net was not adjusted. Accordingly, there is no impact on any financial

statement line items other than cost of sales and SG&A, and there was no cumulative effect of the change in

accounting principle on retained earnings. The change in accounting principle was initially reported in the

Company’s Form 10-Q for the first quarter of Fiscal 2009. The table below represents the impact of the accounting

change on the current period presented and comparable periods presented, respectively: