Advance Auto Parts 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-38

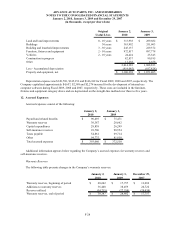

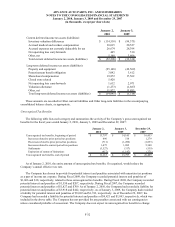

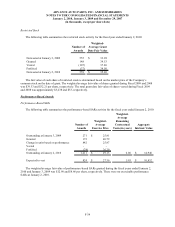

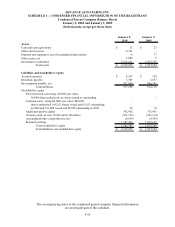

Black-Scholes Option Valuation Assumptions (1) 2009 2008 2007

Risk-free interest rate (2) 1.6% 2.5% 4.8%

Expected dividend yield 0.6% 0.8% 0.6%

Expected stock price volatility (3) 39.2% 32.3% 29.0%

Expected life of awards (in months) (4) 50 50 51

(1) Forfeitures are based on historical experience.

(2) The risk-free interest rate is based on a U.S. Treasury constant maturity interest rate whose term is consistent

with the expected life of the Company’s awards.

(3) Expected volatility is based on the historical volatility of the Company’s common stock for the period

consistent with the expected life of the Company’s awards.

(4) The expected life of the Company’s awards represents the estimated period of time until exercise and is based

on historical experience of previously granted awards.

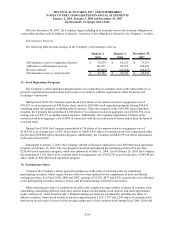

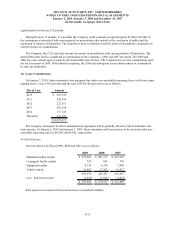

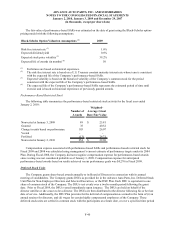

The following table summarizes the time-vested fixed stock option and time-vested SARs activity for the fiscal

year ended January 2, 2010:

Number of

Awards

Weighted-

Average

Exercise Price

Weighted-

Average

Remaining

Contractual

Term (in years)

Aggregate

Intrinsic Value

Outstanding at January 3, 2009 6,254 33.95$

Granted 519 40.79

Exercised (1,249) 31.38

Forfeited (248) 33.96

Outstanding at January 2, 2010 5,276 35.20$ 4.33 28,313$

Vested and expected to ves

t

5,076 35.22$ 4.26 27,098$

Outstanding and exercisable 3,132 35.60$ 3.47 15,379$

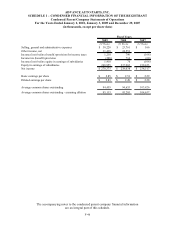

The weighted average fair value of SARs and stock options granted during the fiscal years ended January 2,

2010, January 3, 2009 and December 29, 2007, was $12.98, $8.66 and $11.39 per share, respectively. The aggregate

intrinsic value reflected in the table is based on the Company’s closing stock price of $40.48 as of the last trading

day of the period ended January 2, 2010. The aggregate intrinsic value of options and SARs (the amount by which

the market price of the stock on the date of exercise exceeded the exercise price) exercised during the fiscal years

ended January 2, 2010, January 3, 2009 and December 29, 2007, was $12,704, $25,890 and $33,179, respectively.