Advance Auto Parts 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

targeting certain stores with specific research and sales development efforts to help us better solve our customers’

problems and leverage the parts availability and merchandising improvements we are making in our stores.

Regarding consideration rate, we have made significant changes to our marketing program during the second half of

the year which includes a more targeted approach to attract our highest potential customers. We established a title

sponsorship with Monster Jam, a live family oriented motorsports event tour and television show highlighted by the

racing and freestyle competition of monster trucks. The Monster Jam tour destinations align closely with our store

footprint.

¾ Availability Excellence

Our Availability Excellence strategy represents our commitment to enhance the breadth and depth of our parts

availability in our stores and improve the speed of our parts delivery, in order to help us better serve both our

Commercial and DIY customers. In addition to our positive sales results, we believe our ongoing investments and

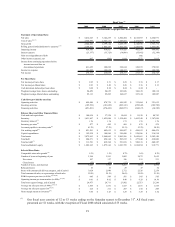

initiatives under this strategy are driving our strong gross profit results. Our gross profit for Fiscal 2009 increased

149 basis points compared to Fiscal 2008, excluding the non-cash inventory adjustment and impact of the 53rd week

in Fiscal 2008.

During Fiscal 2009, we made significant progress in capabilities to help drive our sales and gross profit growth,

including the continued improvement in parts availability, the strengthening and development of a price

optimization capability and implementation of the first phase of our core merchandising system. We also added six

net PDQ® facilities and 80 larger stores which stock a wider selection and greater supply of inventory, or HUB

stores, to our supply chain network and completed the implementation of engineered standards in all eight of our

distribution centers to improve productivity, increase efficiency and ultimately reduce distribution expenses.

We disposed of substantially all of the nonproductive inventory we identified in Fiscal 2008 by the end of Fiscal

2009. We continue to manage our inventory productivity by removing unproductive inventory from our store

assortments through utilizing markdown strategies and our vendor return privileges. We expect to manage more

effectively the growth in our inventory as compared to our sales growth.

¾ Superior Experience

Superior Experience is centered around our store operations and providing superior customer service. The

successful rollout and completion of Commercial and DIY initiatives in our stores is greatly dependent on the

Superior Experience strategy. The feedback from our customer satisfaction surveys, coupled with our Team Member

engagement surveys, provides the evidence of our continued focus and commitment to understand what our

customers need and how to engage our Team Members to fulfill that goal. We have a dedicated team of field

operations leaders who are leading the rollout of initiatives over our entire store chain in a very disciplined and

focused way. These initiatives include improving staffing, structuring operations to more effectively serve both

Commercial and DIY customers, providing sales development and coaching and driving gross profit improvements

through new battery warranty procedures, better pricing decisions and improved shrink control.

Store Divestiture Plan

For Fiscal 2009, we divested a total of 45 stores that were delivering strategically or financially unacceptable

results. These closures were in addition to 10 stores that we closed as part of our routine review and closure of

underperforming stores at or near the end of their respective lease terms. During Fiscal 2009, we recognized

expenses of $26.1 million related to our store divestiture plan. The majority of this expense was related to the

estimated remaining lease obligations at the time of the closures. As of January 2, 2010, we had completed our store

divestiture plan. Our total store closures for Fiscal 2010 are estimated at 10 to 15.

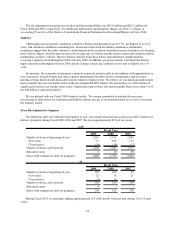

Change in Accounting Principle

We have retrospectively adjusted all comparable periods related to cost of sales and SG&A as a result of a

change in accounting principle effective January 4, 2009. We changed our accounting for freight and other handling

costs associated with transferring merchandise from our HUB stores and PDQ® facilities to our retail stores from

recording such costs as SG&A to recording such costs in cost of sales. This change, which had no impact to

operating income or cash flows, more accurately reflects the nature of the expense.