Advance Auto Parts 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

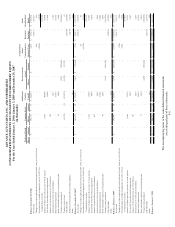

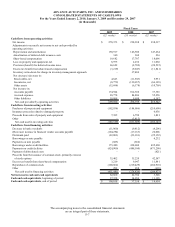

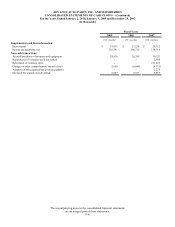

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2010, January 3, 2009 and December 29, 2007

(in thousands, except per share data)

.

F-16

Total cost of merchandise sold including: Payroll and benefit costs for retail and corporate

–Freight expenses associated with moving team members;

merchandise inventories from our vendors to Occupancy costs of retail and corporate facilities;

our distribution center, Depreciation related to retail and corporate assets;

–Vendor incentives, and Advertising;

–Cash discounts on payments to vendors; Costs associated with our commercial delivery

Inventory shrinkage; program, including payroll and benefit costs,

Defective merchandise and warranty costs; and transportation expenses associated with moving

Costs associated with operating our distribution merchandise inventories from our retail stores to

network, including payroll and benefit costs, our customer locations;

occupancy costs and depreciation; and Self-insurance costs;

Freight and other handling costs associated with Professional services;

moving merchandise inventories through our Other administrative costs, such as credit card

supply chain service fees, supplies, travel and lodging;

–From our distribution centers to our retail Closed store expenses; and

store locations, and Impairment charges, if any.

–From certain of our larger stores which stock a

wider variety and greater supply of inventory, or

HUB stores, and Parts Delivered Quickly warehouses,

or PDQ

®

s, to our retail stores after the customer

has special-ordered the merchandise.

Cost of Sales SG&A

New Accounting Pronouncements

In June 2009, the Financial Accounting Standards Board, or FASB, approved the FASB Accounting Standards

Codification, or ASC, as the single source of authoritative nongovernmental GAAP. All existing accounting standard

guidance issued by the FASB, American Institute of Certified Public Accountants, Emerging Issues Task Force and

related literature, excluding guidance from the Securities and Exchange Commission, or SEC, has been superseded

by the ASC. All other non-grandfathered, non-SEC accounting literature not included in the ASC has become non-

authoritative. The ASC did not change GAAP, but instead introduced a new structure that combines all authoritative

standards into a comprehensive, topically organized online database. The ASC was effective for interim or annual

periods ending after September 15, 2009.

Accordingly, the Company adopted the ASC as of October 10, 2009 as provided by Accounting Standards

Update, or ASU, No. 2009-01, “Topic 105 – Generally Accepted Accounting Principles – amendments based on

Statement of Financial Accounting Standards No. 168, The FASB Accounting Standards Codification TM and the

Hierarchy of Generally Accepted Accounting Principles.” As a result of this adoption, previous references to new

accounting standards and literature are no longer applicable. The Company has provided references to both new and

old guidance to assist in understanding the impacts of recently adopted accounting literature, particularly for

guidance adopted since the beginning of the current fiscal year but prior to the ASC.

Effective October 10, 2009, the Company adopted ASU No. 2009-05, “Fair Value Measurements and

Disclosures (ASC Topic 820): Measuring Liabilities at Fair Value.” This ASU provides amendments to ASC Topic

820-10, “Fair Value Measurements and Disclosures – Overall,” for the fair value measurement of liabilities. It

provides clarification that in circumstances in which a quoted price in an active market for the identical liability is

not available, a reporting entity is required to measure fair value using (a) a valuation technique that uses the quoted

price of the identical liability when traded as an asset or quoted prices for similar liabilities and/or (b) an income

approach valuation technique or a market approach valuation technique, consistent with the principles of ASC Topic

820. The adoption had no impact on the Company’s consolidated financial statements.