Advance Auto Parts 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

Interest Expense

Interest expense for Fiscal 2008 was $33.7 million, or 0.7% of net sales, as compared to $34.8 million, or 0.7%

of net sales, in Fiscal 2007. The decrease in interest expense was a result of lower average borrowing rates partially

offset by higher average outstanding borrowings as compared to Fiscal 2007.

Income Taxes

Income tax expense for Fiscal 2008 was $142.7 million, as compared to $144.3 million for Fiscal 2007. Our

effective income tax rate was 37.5% and 37.7% for Fiscal 2008 and Fiscal 2007, respectively.

Net Income

Net income for Fiscal 2008 was $238.0 million, or $2.49 per diluted share, as compared to $238.3 million, or

$2.28 per diluted share, for Fiscal 2007. As a percentage of net sales, net income for Fiscal 2008 was 4.6%, as

compared to 4.9% for Fiscal 2007. The increase in diluted earnings per share was primarily due to a reduced share

count as a result of the shares repurchased during Fiscal 2007. Net income and diluted earnings per share for Fiscal

2008 were reduced by the non-cash inventory adjustment of $23.7 million (net of tax) and $0.25, respectively. Our

results from the 53rd week contributed approximately $9.6 million of net income and earnings per diluted share of

$0.10.

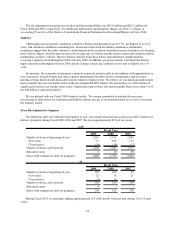

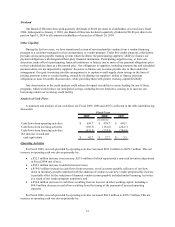

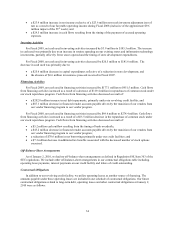

Quarterly Consolidated Financial Results (in thousands, except per share data)

16-Weeks 12-Weeks 12-Weeks 13-Weeks 16-Weeks 12-Weeks 12-Weeks 12-Weeks

Ended Ended Ended Ended Ended Ended Ended Ended

4/19/2008 7/12/2008 10/4/2008 1/3/2009 4/25/2009 7/18/2009 10/10/2009 1/2/2010

Net sales 1,526,132$ 1,235,783$ 1,187,952$ 1,192,388$ 1,683,636$ 1,322,844$ 1,262,576$ 1,143,567$

Gross profi

t

(1)

724,854 586,282 562,175 525,813 821,988 652,650 621,459 548,129

Net income 82,086 75,386 56,155 24,411 93,585 80,330 61,979 34,479

Net income per share:

Basic 0.86$ 0.79$ 0.59$ 0.26$ 0.99$ 0.84$ 0.65$ 0.37$

Diluted

(2)

0.86$ 0.78$ 0.58$ 0.26$ 0.98$ 0.83$ 0.65$ 0.36$

(1) Effective first quarter of Fiscal 2009, we implemented a change in accounting principle for costs included in inventory.

Accordingly, we have retrospectively applied the change in accounting principle to all prior periods presented herein

related to gross profit.

(2) Our diluted earnings per share reported for the second and third quarters of Fiscal 2008 have been reduced by $0.01,

respectively, as a result of the adoption of the two-class method. Refer to Footnote 14 of our consolidated financial

statements for further discussion of this adoption.

Liquidity and Capital Resources

Overview of Liquidity

Our primary cash requirements to maintain our current operations include payroll and benefits, the purchase of

inventory, contractual obligations and capital expenditures as well as the payment of quarterly cash dividends and

estimated income taxes. In addition, we have used available funds to repay borrowings under our revolving credit

facility and periodically repurchase shares of our common stock under our stock repurchase program. We have

funded these requirements primarily through cash generated from operations, supplemented by borrowings under

our credit facilities as needed. We believe funds generated from our expected results of operations, available cash

and cash equivalents, and available borrowings under our revolving credit facility will be sufficient to fund our

primary obligations for the next fiscal year.