AT&T Wireless 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 : :

2006 AT&T Annual Report

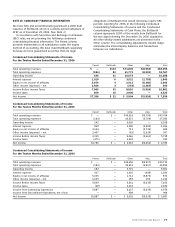

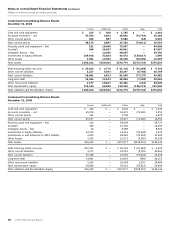

The consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles.

The integrity and objectivity of the data in these financial statements, including estimates and judgments relating to matters not

concluded by year-end, are the responsibility of management, as is all other information included in the Annual Report, unless

otherwise indicated.

The financial statements of AT&T Inc. (AT&T) have been audited by Ernst & Young LLP, Independent Registered Public Accounting

Firm. Management has made available to Ernst & Young LLP all of AT&T’s financial records and related data, as well as the minutes

of stockholders’ and directors’ meetings. Furthermore, management believes that all representations made to Ernst & Young LLP

during its audit were valid and appropriate.

Management maintains disclosure controls and procedures that are designed to ensure that information required to be dis-

closed by AT&T is recorded, processed, summarized, accumulated and communicated to its management, including its principal

executive and principal financial officers, to allow timely decisions regarding required disclosure, and reported within the time

periods specified by the Securities and Exchange Commission’s rules and forms.

Management also seeks to ensure the objectivity and integrity of its financial data by the careful selection of its managers, by

organizational arrangements that provide an appropriate division of responsibility and by communication programs aimed at ensur-

ing that its policies, standards and managerial authorities are understood throughout the organization.

The Audit Committee of the Board of Directors meets periodically with management, the internal auditors and the independent

auditors to review the manner in which they are performing their respective responsibilities and to discuss auditing, internal

accounting controls and financial reporting matters. Both the internal auditors and the independent auditors periodically meet

alone with the Audit Committee and have access to the Audit Committee at any time.

Assessment of Internal Control

The management of AT&T is responsible for establishing and maintaining adequate internal control over financial reporting, as

defined in Rule 13a-15(f) or 15d-15(f) under the Securities Exchange Act of 1934. AT&T’s internal control system was designed to

provide reasonable assurance to the company’s management and Board of Directors regarding the preparation and fair presenta-

tion of published financial statements.

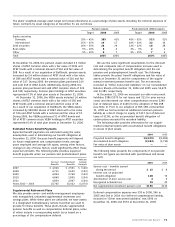

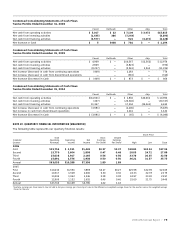

AT&T management assessed the effectiveness of the company’s internal control over financial reporting as of December 31,

2006. In making this assessment, it used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway

Commission (COSO) in Internal Control – Integrated Framework. We have excluded from the scope of our assessment of internal

control over financial reporting the operations and related assets of BellSouth and AT&T Mobility, which we acquired on December

29, 2006. At December 31, 2006 and for the period from December 29 through December 31, 2006, total assets and total rev-

enues subject to BellSouth’s internal control over financial reporting represented 27% and 0.2% of AT&T’s consolidated total assets

and total revenues as of and for the year ended December 31, 2006 and total assets and total revenues subject to AT&T Mobility’s

internal control over financial reporting represented 36% and 0.3% of AT&T’s consolidated total assets and total revenues as of and

for the year ended December 31, 2006. Based on its assessment, AT&T management believes that, as of December 31, 2006, the

Company’s internal control over financial reporting is effective based on those criteria.

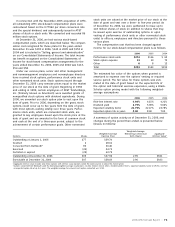

Ernst & Young LLP, an independent registered public accounting firm, has issued an attestation report on management’s

assessment of the company’s internal control over financial reporting. The attestation report is included on Page 82.

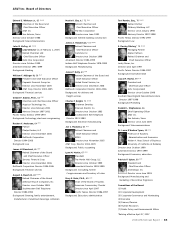

Edward E. Whitacre Jr. Richard G. Lindner

Chairman of the Board and Senior Executive Vice President and

Chief Executive Officer Chief Financial Officer

Report of Management