AT&T Wireless 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

65

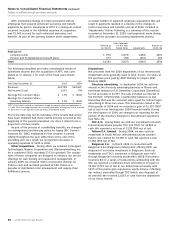

Foreign Currency Forward Contracts We enter into foreign

currency forward contracts to manage our exposure to

changes in currency exchange rates related to foreign-

currency-denominated transactions. At December 31, 2006

and 2005, our foreign exchange contracts consisted principally

of Euros, British pound sterling, Danish krone and Japanese

Yen. At December 31, 2006, the notional amounts under

contract were $440, of which $6 were designated as net

investment hedges. At December 31, 2005, the notional

amounts under contract were $623, of which $18 were

designated as net investment hedges. The remaining contracts

in both periods were not designated for accounting purposes.

There was no ineffectiveness recognized in earnings for these

contracts during 2006 and 2005. At December 31, 2006,

these foreign exchange contracts had a net carrying and fair

value asset of $1, comprised of an asset of $4 and a liability

of $3. At December 31, 2005, these foreign exchange con-

tracts had a net carrying and fair value liability of $8, com-

prised of an asset of $5 and a liability of $13. These contracts

were valued using current market quotes, which were

obtained from independent sources.

NOTE 9. INCOME TAXES

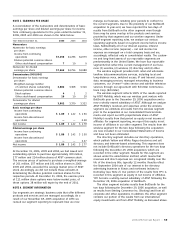

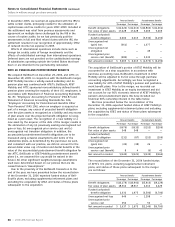

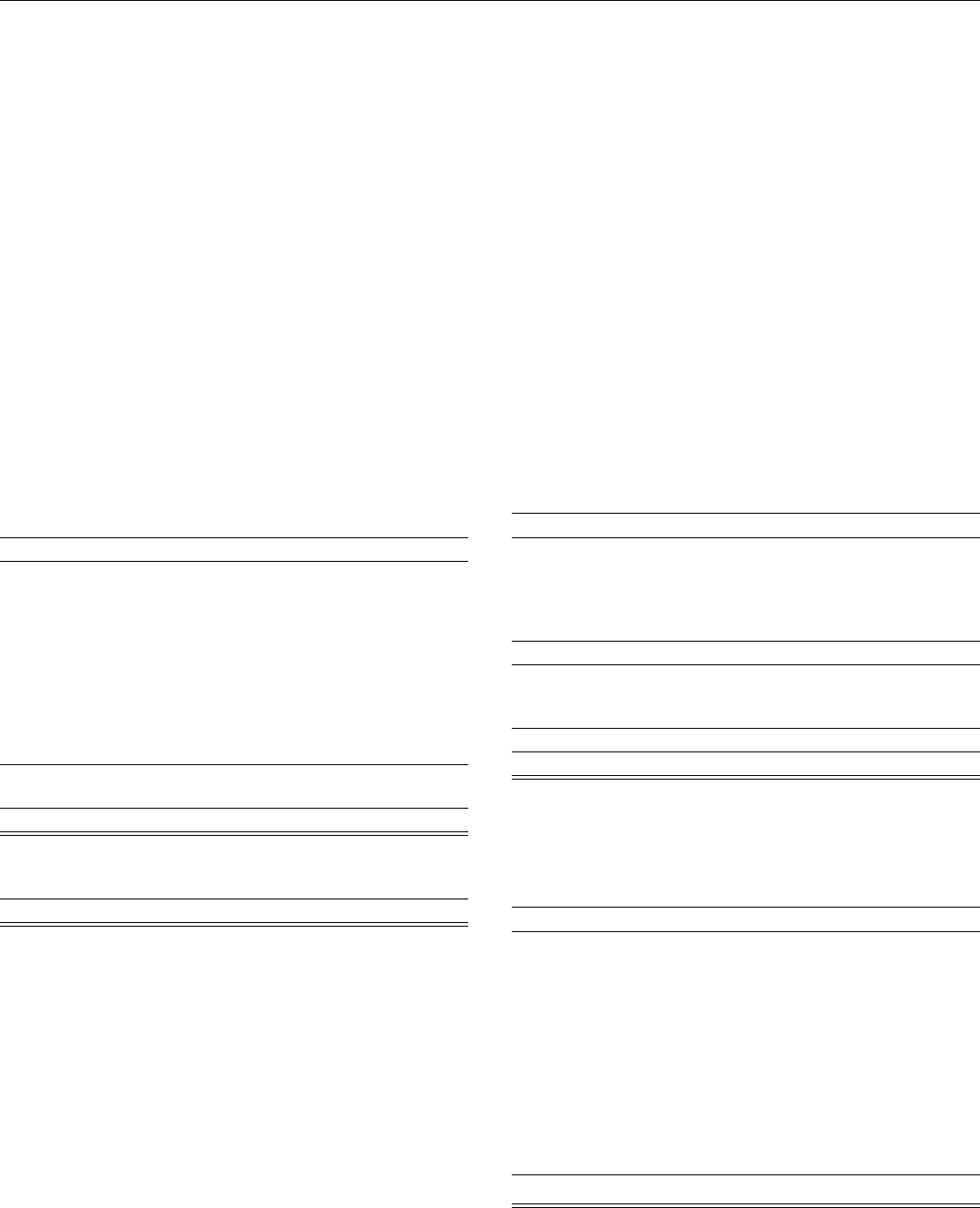

Significant components of our deferred tax liabilities (assets)

are as follows at December 31:

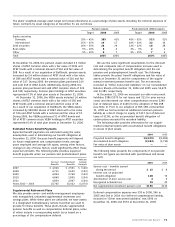

2006 2005

Depreciation and amortization $21,016 $13,921

Intangibles (nonamortizable) 2,271 1,874

Equity in foreign affiliates 515 727

Employee benefits (9,667) (4,897)

Currency translation adjustments (261) (272)

Allowance for uncollectibles (385) (351)

Unamortized investment tax credits (68) (79)

Net operating loss and other carryforwards (2,981) (838)

Investment in wireless partnership 12,580 2,597

Other – net 368 387

Subtotal 23,388 13,069

Deferred tax assets valuation allowance 984 627

Net deferred tax liabilities $24,372 $13,696

Net long-term deferred tax liabilities $27,406 $15,713

Less: Net current deferred tax assets (3,034) (2,011)

Less: Other assets — (6)

Net deferred tax liabilities $24,372 $13,696

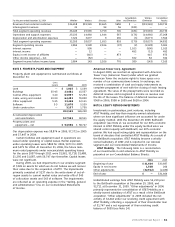

At December 31, 2006 and 2005, net deferred tax liabilities

include a deferred tax asset of $456 and $542 relating to

compensation expense under Statement of Financial Account-

ing Standards No. 123(R) “Share-Based Payment” (FAS 123(R)).

Full realization of this deferred tax asset requires stock

options to be exercised at a price equaling or exceeding the

sum of the strike price plus the fair value of the option at the

grant date. The provisions of FAS 123(R), however, do not

allow a valuation allowance to be recorded unless the

company’s future taxable income is expected to be insufficient

to recover the asset. Accordingly, there can be no assurance

that the stock price of AT&T common shares will rise to levels

sufficient to realize the entire tax benefit currently reflected in

our balance sheet.

At December 31, 2006, we had net operating and capital

loss carryforwards (tax effected) for federal, state and foreign

income tax purposes of $1,507, $1,138 and $13 respectively

expiring through 2025. The federal net operating loss carry-

forward primarily relates to AT&T Mobility’s acquisition of

AWE in 2004. Additionally, we had federal and state credit

carryforwards of $71 and $252 respectively expiring primarily

through 2024.

The change in the valuation allowance for 2006 is primarily

the result of the acquisition of ATTC, BellSouth and AT&T

Mobility. Other changes are the result of an evaluation of the

uncertainty associated with the realization of certain deferred

tax assets unrelated to FAS 123(R). Future adjustments to the

valuation allowance attributable to the ATTC, BellSouth and

AT&T Mobility opening balance sheet items may be required to

be allocated to goodwill and other purchased intangibles.

In June 2006, the FASB issued FIN 48, which changes the

accounting for uncertainty in income taxes by prescribing a

recognition threshold for tax positions taken or expected to

be taken in a tax return. FIN 48 is effective for fiscal years

beginning after December 15, 2006. Our evaluation of the

impact FIN 48 will have on our financial position and results

of operations is ongoing.

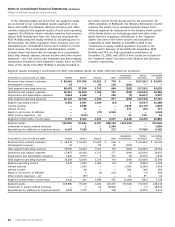

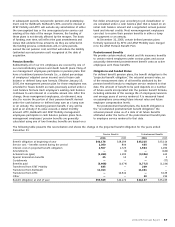

The components of income tax expense are as follows:

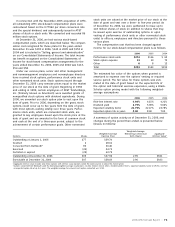

2006 2005 2004

Federal:

Current $3,344 $1,385 $1,145

Deferred – net (139) (681) 843

Amortization of investment

tax credits (28) (21) (32)

3,177 683 1,956

State, local and foreign:

Current 295 226 427

Deferred – net 53 23 (197)

348 249 230

Total $3,525 $ 932 $2,186

A reconciliation of income tax expense and the amount

computed by applying the statutory federal income tax rate

(35%) to income before income taxes, income from discontin-

ued operations, extraordinary items and cumulative effect of

accounting changes is as follows:

2006 2005 2004

Taxes computed at federal

statutory rate $3,809 $2,001 $2,508

Increases (decreases) in

income taxes resulting from:

State and local income

taxes – net of federal

income tax benefit 234 176 213

Effects of international operations (200) (70) (222)

Medicare reimbursements (123) (95) (89)

Equity in net income of affiliates (218) (35) —

Tax settlements — (902) (65)

Other – net 23 (143) (159)

Total $3,525 $ 932 $2,186