AT&T Wireless 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

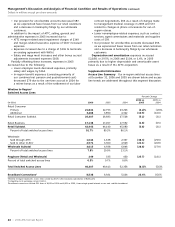

22 : :

2006 AT&T Annual Report

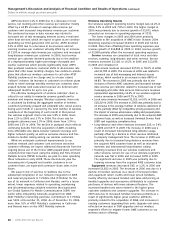

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

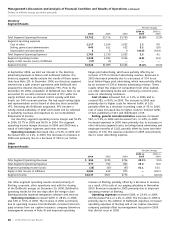

Dollars in millions except per share amounts

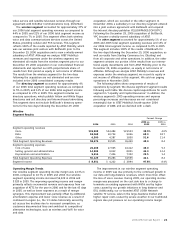

Voice revenues increased $9,424, or 38.5%, in 2006 and

$931, or 4.0%, in 2005 primarily due to the acquisition of

ATTC. Included in voice revenues are revenues from long

distance, local voice and local wholesale services. Voice

revenues do not include any of our VoIP revenues, which

are included in data revenues.

• Long-distance revenues increased $9,268 in 2006 and

$1,673 in 2005. The increase in long-distance revenues

in 2006 was driven almost entirely by the acquisition of

ATTC. Also contributing to the increase in 2006 were

higher long-distance penetration levels. However, our

long-distance revenue growth continued to slow in 2006,

reflecting continuing market maturity and a continuing

decline in ATTC’s mass-market customers. Competitive

pricing for large-business customers also contributed to

slowing long-distance revenue growth in 2006. The

increase in long-distance revenues in 2005 was driven

primarily by the acquisition of ATTC. Also contributing to

the increase in 2005 were increases in long-distance

penetration levels and sales of combined long-distance

and local calling fixed-fee offerings (referred to as

“bundling”). These increases were partially offset by

continued market maturity, which slowed revenue

growth in 2005.

• Local voice revenues increased $708 in 2006 and

decreased $607 in 2005. The increase in local voice

revenues in 2006 primarily reflects our acquisition of

ATTC. However, we expect that revenues from ATTC’s

mass-market customers will continue to decline on a

sequential quarterly basis. Local voice revenues in 2006

and 2005 were negatively impacted by continued

declines in customer demand, calling features (e.g.,

Caller ID and voice mail), inside wire and retail payphone

revenues. We expect our local voice revenue to continue

to be negatively affected by increased competition,

including customers shifting to competitors’ wireless

and VoIP technology for voice, and the disconnection

of additional lines for DSL service and other reasons.

Partially offsetting these demand-related declines in

2006 were revenue increases related to pricing increases

for regional telephone service and calling features.

• Lower demand for local wholesale services, primarily due

to the decline in Unbundled Network Element-Platform

(UNE-P) lines, decreased revenue $552 in 2006 and $135

in 2005. Lines provided under the former UNE-P rules

(which ended in March 2006) declined, as competitors

moved to alternate arrangements to serve their custom-

ers or their customers chose an alternative technology.

(UNE-P lines are classified as wholesale in the “Access

Line Summary” table.) In 2006, these demand-related

decreases were partially offset by price increases as we

entered into long-term contracts with our competitors.

Competitors who represented a majority of our UNE-P

lines have signed commercial agreements with us and

therefore remain our wholesale customers. For the

remaining UNE-P lines, we believe, based on marketing

research, that customers primarily switched to competi-

tors using alternative technologies or their own networks

as opposed to returning as our retail customers.

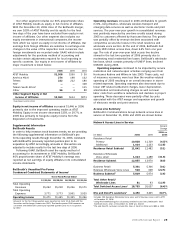

Data revenues increased $7,334, or 68.3%, in 2006 and

$1,688, or 18.7%, in 2005. The increase in data revenues was

due to increases in IP data of $2,846 in 2006 and $931 in

2005, increases in transport of $2,427 in 2006 and $433 in

2005 and increases in packet switched services of $2,061 in

2006 and $324 in 2005, all of which increased predominantly

due to the acquisition of ATTC. Data revenues accounted for

approximately 31% of our wireline operating revenues in

2006, 27% in 2005 and 25% in 2004.

Included in IP data revenues are DSL, dedicated Internet

access, Virtual Private Network (VPN) and other hosting

services. Contributing to the increase in IP data services was

continued growth in DSL, our broadband Internet-access

service. DSL service increased data revenues $427 in 2006

and $444 in 2005, reflecting an increase in DSL lines in

service and, in 2005, was partially driven by lower-priced

promotional offerings as a response to competitive pricing

pressures. Revenue from our VPN product also contributed

to IP data growth in 2006.

Our transport services, which include DS1s and DS3s (types

of dedicated high-capacity lines), and SONET (a dedicated

high-speed solution for multi-site businesses), represented

approximately 50% of total data revenues in 2006, 61% of

total data revenues in 2005 and 67% of total data revenues

in 2004. This decrease in percentage was primarily driven

by higher revenue growth from IP-based technology, slightly

offset by revenue growth from transport services. Revenue

growth in 2006 was due to an increase in demand for

transport services partially offset by competitive pricing.

Our packet switched services includes Frame Relay,

asynchronous transfer mode (ATM) and managed packet

services. As customers continue to shift from this traditional

technology to IP-based technology, we expect these services

to decline as a percentage of our overall data revenues.

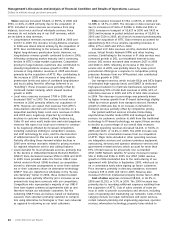

Other operating revenues increased $2,213, or 51.6%, in

2006 and $437, or 11.4%, in 2005. The 2006 increase was

primarily due to incremental revenue from our acquisition

of ATTC. Major items included in other operating revenues

are integration services and customer premises equipment,

outsourcing, directory and operator assistance services and

government-related services, which account for more than

67% of total revenue for all periods. Our co-branded

AT&T | DISH Network satellite TV service increased revenue

$36 in 2006 and $196 in 2005. Our AT&T | DISH revenue

growth in 2006 moderated due to the restructuring of our

agreement with EchoStar in September 2005, which put us

on a commission basis when signing up future customers.

Price increases, primarily in directory assistance, increased

revenues $35 in 2006 and $23 in 2005. Revenue also

increased $70 from intellectual property license fees in 2006.

Cost of sales expenses increased $8,261, or 46.0%, in

2006 and $1,533, or 9.3%, in 2005. The 2006 increase was

primarily due to recording additional expenses resulting from

the acquisition of ATTC. Cost of sales consists of costs we

incur in order to provide our products and services, including

costs of operating and maintaining our networks. Costs in this

category include our repair technicians and repair services,

certain network planning and engineering expenses, operator

services, information technology, property taxes related to