AT&T Wireless 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 : :

2006 AT&T Annual Report

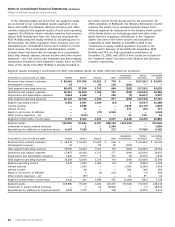

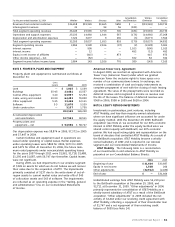

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

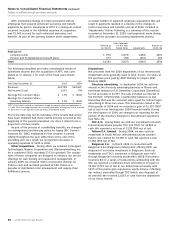

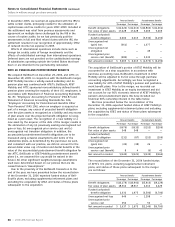

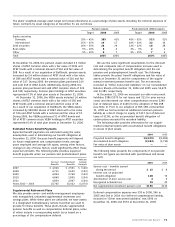

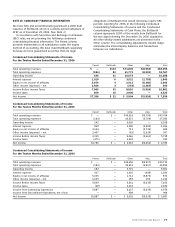

The following table presents the change in the value of plan assets for the years ended December 31 and the plans’ funded status

at December 31:

Pension Benefits Postretirement Benefits

2006 2005 2006 2005

Fair value of plan assets at beginning of year $48,755 $29,813 $ 11,417 $ 8,692

Actual return on plan assets 6,311 2,704 1,379 677

Benefits paid1 (3,958) (2,679) (920) (381)

Transferred from AT&T Mobility 548 — — —

Transferred from BellSouth 17,628 — 5,269 —

Transferred from ATTC — 18,917 — 2,429

Fair value of plan assets at end of year $69,284 $48,755 $ 17,145 $ 11,417

Funded (unfunded) status at end of year2 $13,335 $ 2,579 $(26,992) $(23,808)

1 At our discretion, certain postretirement benefits are paid from AT&T cash accounts and do not reduce Voluntary Employee Beneficiary Association (VEBA) assets. Future benefit

payments may be made from VEBA trusts and thus reduce those asset balances.

2 Funded status is not indicative of our ability to pay ongoing pension benefits nor of our obligation to fund retirement trusts. Required pension funding is determined in accordance with

ERISA regulations.

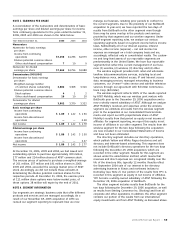

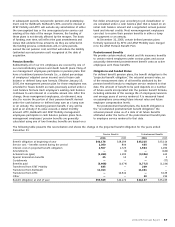

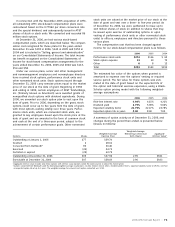

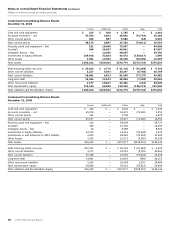

Amounts recognized on our Consolidated Balance Sheets

at December 31 are listed below:

Pension Benefits Postretirement Benefits

2006 2005 2006 2005

Postemployment

benefit $13,335 $12,699 $ 772 $ —

Current portion

employee benefit

obligation1 — — (973) (1,505)

Employee benefit

obligation2 — (1,548) (26,791) (14,953)

Net amount recognized $13,335 $11,151 $(26,992) $(16,458)

1Included in “Accounts payable and accrued liabilities.”

2Included in “Postemployment benefit obligation.”

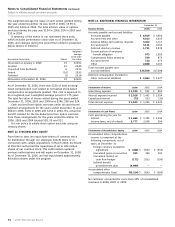

As required by FAS 158, we recognized the funded status of

defined benefit pension, including supplemental retirement and

savings plans, and postemployment plans as an asset or liability

in our statement of financial position and will recognize changes

in that funded status in the year in which the changes occur

through comprehensive income. This standard has no effect on

our expense or benefit recognition nor will it affect the funding

requirements imposed under ERISA. FAS 158 requires prospec-

tive application for fiscal years ending after December 15, 2006.

At December 31, 2006, we decreased our net postretirement

assets $4,891, increased our postemployment benefits $3,459

and decreased our other comprehensive income $4,786 (net

of deferred taxes of $3,564). (See Note 1)

Amounts recognized in our accumulated other compre-

hensive income at December 31 are listed below:

Pension Benefits Postretirement Benefits

2006 2005 2006 2005

Net loss $4,271 $ — $ 6,124 $ —

Prior service cost (benefit) 624 — (2,669) —

Total $4,895 $ — $ 3,455 $ —

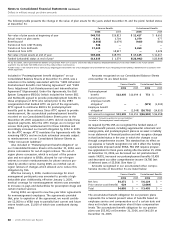

The accumulated benefit obligation for our pension plans

represents the actuarial present value of benefits based on

employee service and compensation as of a certain date and

does not include an assumption about future compensation

levels. The accumulated benefit obligation for our pension

plans was $53,662 at December 31, 2006, and $44,139 at

December 31, 2005.

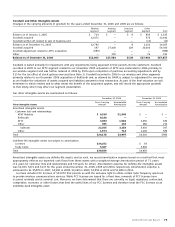

Included in “Postemployment benefit obligation” on our

Consolidated Balance Sheets at December 31, 2004, was a

reduction in the liability associated with the “1983 Unfunded

Postretirement Benefits Cost Sharing Agreement” and “1983

Force Adjustment Cost-Reimbursement and Indemnification

Agreement” (Agreements). Under the Agreements, the Bell

System Companies (RBOCs) (which included the former SBC

and BellSouth) agreed to provide postemployment benefits to

those employees of ATTC who retired prior to the 1983

reorganization that divided ATTC. As part of the Agreements,

ATTC agreed to reimburse RBOCs for postemployment

benefits paid to these retirees. Since ATTC agreed to provide

reimbursement, the accumulated postemployment benefits

recorded on our Consolidated Balance Sheets prior to the

November 18, 2005 acquisition of ATTC did not include these

expected payments. After the ATTC merger, we no longer will

receive third-party reimbursement for these liabilities and

accordingly increased our benefit obligation by $234 in 2005

for the ATTC merger. ATTC maintains the Agreements with the

remaining RBOCs and we include estimated amounts subject

to reimbursement on our Consolidated Balance Sheets as

“Other noncurrent liabilities.”

Also included in “Postemployment benefit obligation” on

our Consolidated Balance Sheets at December 31, 2004, were

phone concessions for out-of-region retirees. The out-of-

region phone concession, which is not part of the pension

plan and not subject to ERISA, allowed for out-of-region

retirees to receive reimbursements for phone services pro-

vided by another carrier. During 2005, we notified out-of-

region retirees of changes which allowed us to reduce this

obligation by $96.

Effective January 1, 2006, medical coverage for most

management participants was amended to provide a high-

deductible plan. Additionally, effective January 1, 2005,

medical coverage for nonmanagement retirees was amended

to increase co-pays and deductibles for prescription drugs and

certain medical services.

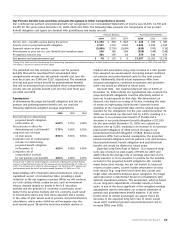

During 2004, we agreed to new five-year labor agreements

for nonmanagement employees. The agreements provided

that, prior to expiration of the agreement, we would contrib-

ute $2,000 to a VEBA trust to partially fund current and future

retiree health care, $1,000 of which was contributed during

2004.