AT&T Wireless 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 : :

2006 AT&T Annual Report

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

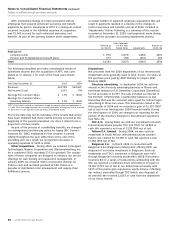

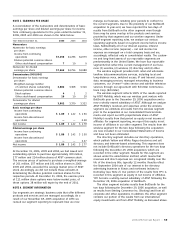

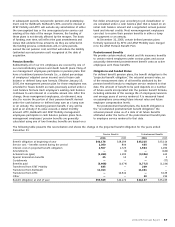

ATTC maintained change-in-control provisions with its

employees that required enhanced severance and benefit

payments be paid to employees of ATTC if a change-in-control

occurred. Included in the liabilities assumed at acquisition,

was $1,543 accrued for such enhanced severance and

benefits. As part of the opening balance sheet adjustments,

a revised number of expected employee separations that will

result in payments resulted in a decline in the change-in-

control severance and benefits accrual of $616, included in

“Adjustments” below. Following is a summary of the accrual

recorded at December 31, 2005, cash payments made during

2006 and the purchase accounting adjustments thereto.

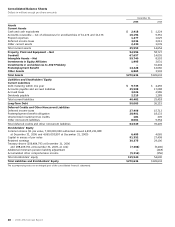

Cash Payments

Balance at for the Year Balance at

12/31/05 Ended 2006 Adjustments 12/31/06

Paid out of:

Company funds $ 870 $(279) $(184) $407

Pension and Postemployment benefit plans 673 (58) (432) 183

Total $1,543 $(337) $(616) $590

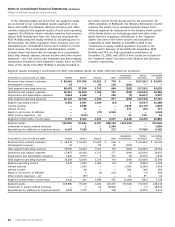

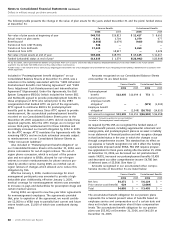

The following unaudited pro forma consolidated results of

operations assume that the acquisition of ATTC was com-

pleted as of January 1 for each of the fiscal years shown

below.

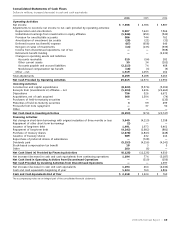

Year Ended December 31, 2005 20041

Revenues $65,789 $69,165

Net Income (Loss) 6,167 (74)

Earnings Per Common Share $ 1.59 $ (0.02)

Earnings Per Common Share –

Assuming Dilution $ 1.59 $ (0.02)

1

ATTC’s 2004 results include an impairment charge on property, plant and equipment of

$11,400. Since the triggering event for assessing impairment of long-lived assets occurred

in July 2004, it is not adjusted in the pro forma consolidated results.

Pro forma data may not be indicative of the results that would

have been obtained had these events actually occurred at the

beginning of the periods presented, nor does it intend to be a

projection of future results.

As part of the process of coordinating benefits, we changed

our management vacation-pay policy for legacy SBC Commu-

nications Inc. (SBC) employees so that vacation is earned

ratably throughout the year rather than at the end of the

preceding year. As a result, we recognized a decrease in

operating expenses of $330 in 2006.

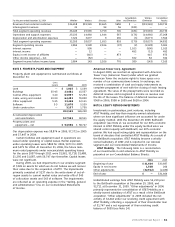

Other Acquisitions During 2006, we acquired Comergent

Technologies, Nistevo Corporation and USinternetworking, Inc.,

for a combined $500, recording $333 in goodwill. The acquisi-

tions of these companies are designed to enhance our service

offerings for web hosting and application management. In

January 2005, we acquired Yantra Corporation (Yantra) for

$169 in cash and recorded goodwill of $98. Yantra is a

provider of distributed order management and supply-chain

fulfillment services.

Dispositions

Net proceeds from the 2004 dispositions of our international

investments were generally used to fund, in part, our share of

the purchase price paid by AT&T Mobility to acquire AT&T

Wireless (AWE).

Directory advertising In September 2004, we sold our

interest in the directory advertising business in Illinois and

northwest Indiana to R.H. Donnelley Corporation (Donnelley)

for net proceeds of $1,397. The sale included our interest in

the DonTech II Partnership, a partnership between us and

Donnelley that was the exclusive sales agent for Yellow Pages

advertising in those two areas. This transaction closed in the

third quarter of 2004 and we recorded a gain of $1,357 ($827

net of tax) in our third-quarter 2004 financial results. During

the third quarter of 2004, we changed our reporting for this

portion of the directory business to discontinued operations

(see Note 15).

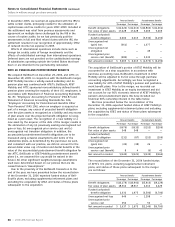

TDC A/S During 2004, we sold our investment in Danish

telecommunications provider TDC A/S (TDC) for $2,864 in

cash. We reported a net loss of $138 ($66 net of tax).

Telkom S.A. Limited During 2004, we also sold our

investment in South African telecommunications provider

Telkom S.A. Limited for $1,186 in cash. We reported a loss

of $82 ($55 net of tax).

Belgacom S.A. In March 2004, in connection with

Belgacom S.A.’s (Belgacom) initial public offering (IPO), we

disposed of our entire investment in Belgacom. Both our

investment and TDC’s investment in Belgacom were held

through Belgacom’s minority stockholder, ADSB Telecommu-

nications B.V. In a series of transactions culminating with the

IPO, we reported a combined direct and indirect net gain of

$1,067 ($715 net of tax) in our 2004 financial results, with

$235 of this pretax gain reported as equity income, reflecting

our indirect ownership though TDC (which also disposed of

its interest). We received $2,063 in cash from the disposition

of our direct interest.