AT&T Wireless 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

39

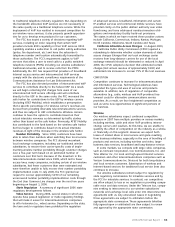

in a number of markets. We expect to fund 2007 capital

expenditures for our wireless segment using cash from

operations and incremental borrowings, depending on interest

rate levels and overall market conditions.

The other segment capital expenditures were less than

2.0% of total capital expenditures in 2006. Included in the

other segment are equity investments, which should be self-

funding as they are not direct AT&T operations; as well as

corporate and Sterling operations, which we expect to fund

using cash from operations. We expect to fund any directory

segment capital expenditures using cash from operations.

Cash Used in or Provided by Financing Activities

We plan to fund our 2007 financing activities primarily through

cash from operations. We will continue to examine opportuni-

ties to fund our activities by issuing debt at favorable rates in

order to refinance some of our debt maturities and with cash

from the disposition of certain other non-strategic investments.

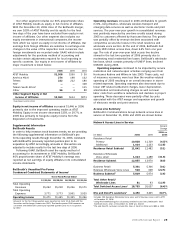

We paid dividends of $5,153 in 2006, $4,256 in 2005 and

$4,141 in 2004, reflecting the issuance of additional shares

for the ATTC acquisition and dividend increases. Dividends

declared by our Board of Directors totaled $1.35 per share in

2006, $1.30 per share in 2005 and $1.26 per share in 2004.

In December 2006, our Board of Directors approved a 6.8%

increase in the regular quarterly dividend to $0.355 per share.

Our dividend policy considers both the expectations and

requirements of stockholders, internal requirements of AT&T

and long-term growth opportunities. It is our intent to provide

the financial flexibility to allow our Board of Directors the

opportunity to continue our historical approach to dividend

growth. All dividends remain subject to approval by our

Board of Directors.

Our Board of Directors has authorized the repurchase of up

to 400 million shares of AT&T common stock; this authoriza-

tion expires at the end of 2008. During 2006, we repurchased

84 million shares at a cost of $2,678. We expect our 2007

share repurchase to total approximately $7,300. We have

repurchased, and intend to continue to repurchase, shares

pursuant to plans that comply with the requirements of

Rule 10b5-1(c) under the Securities Exchange Act of 1934.

In February 2007, we issued approximately $3,200 in long-

term debt, part of the proceeds of which we intend to use

to repurchase shares. We will fund our additional share

repurchases through a combination of cash from operations,

borrowings, dependent upon market conditions, and cash

from the disposition of certain non-strategic investments.

See our “Issuer Equity Repurchases” table for share

repurchase details in the fourth quarter of 2006.

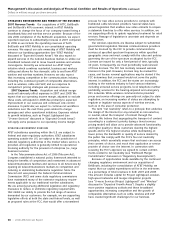

At December 31, 2006, we had $9,733 of debt maturing

within one year, which included $5,214 of commercial paper

borrowings, $4,414 of long-term debt maturities and $105 of

bank borrowings. All of our commercial paper borrowings are

due within 90 days. The availability of bank borrowings is

contingent on the level of cash held by some of our foreign

subsidiaries. We continue to examine our mix of short- and

long-term debt in light of interest rate trends.

During 2006, debt repayments totaled $4,244 and

consisted of:

• $4,040 related to debt repayments with interest rates

ranging from 5.75% to 9.50%, which included $284

associated with unwinding an interest rate foreign

currency swap on our Euro-denominated debt

(see Note 8).

• $148 related to called and put debt with interest rates

ranging from 6.35% to 9.5%.

• $56 related to scheduled principal payments on other

debt and repayments of other borrowings.

In May 2006, we received net proceeds of $1,491 from the

issuance of $1,500 of long-term debt consisting of $900 of

two-year floating rate notes and $600 of 6.80%, 30-year

bonds maturing in 2036.

We received net proceeds of $134 due to the unwinding

of our interest rate foreign currency swap related to the

repayment of our Euro-denominated debt, mentioned

previously. (See Note 8)

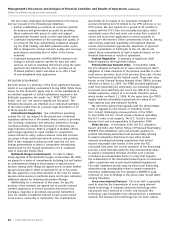

In July 2006, we replaced our three-year $6,000 credit

agreement with a five-year $6,000 credit agreement with a

syndicate of investment and commercial banks. The current

agreement will expire in July 2011. The available credit

under this agreement increased by an additional $4,000

when we completed our acquisition of BellSouth. This

incremental available credit is intended to replace BellSouth’s

$3,000 credit facility, which was terminated in January 2007.

We have the right to request the lenders to further increase

their commitments (i.e., raise the available credit) up to an

additional $2,000 provided no event of default under the

credit agreement has occurred. We also have the right to

terminate, in whole or in part, amounts committed by the

lenders under this agreement in excess of any outstanding

advances; however, any such terminated commitments may

not be reinstated. Advances under this agreement may be

used for general corporate purposes, including support of

commercial paper borrowings and other short-term borrow-

ings. There is no material adverse change provision governing

the drawdown of advances under this credit agreement.

This agreement contains a negative pledge covenant, which

requires that, if at any time we or a subsidiary pledge assets

or otherwise permits a lien on its properties, advances under

this agreement will be ratably secured, subject to specified

exceptions. We must maintain a debt-to-EBITDA (earnings

before interest, income taxes, depreciation and amortization,

and other modifications described in the agreement) financial

ratio covenant of not more than three-to-one as of the last

day of each fiscal quarter for the four quarters then ended.

We are in compliance with all covenants under the agree-

ment. At December 31, 2006, we had no borrowings out-

standing under this agreement. (See Note 7)