AT&T Wireless 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

51

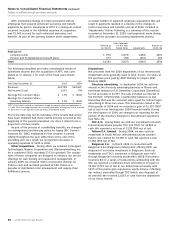

Notes to Consolidated Financial Statements

Dollars in millions except per share amounts

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation Throughout this document, AT&T Inc.

is referred to as “AT&T,” “we” or the “Company.” The consoli-

dated financial statements include the accounts of the

Company and our majority-owned subsidiaries and affiliates.

Our subsidiaries and affiliates operate in the communications

services industry both domestically and internationally

providing wireline and wireless telecommunications services

and equipment as well as directory advertising and publishing

services. On December 29, 2006, we acquired 100% of the

outstanding common shares of BellSouth Corporation

(BellSouth). BellSouth is a wholly-owned subsidiary of the

Company and the results of BellSouth’s operations have

been included in our consolidated financial statements after

the December 29, 2006 acquisition date. For a detailed

discussion of our acquisition, see Note 2.

All significant intercompany transactions are eliminated in

the consolidation process. Investments in partnerships, joint

ventures, including AT&T Mobility LLC (AT&T Mobility), formerly

Cingular Wireless LLC (Cingular), and less than majority-owned

subsidiaries where we have significant influence are

accounted for under the equity method. Until the BellSouth

acquisition, we accounted for our 60% economic interest in

AT&T Mobility under the equity method since we shared

control equally with BellSouth, our 40% economic partner.

We had equal voting rights and representation on the board

of directors that controlled AT&T Mobility. After the BellSouth

acquisition, AT&T Mobility became a wholly-owned subsidiary

of AT&T. Earnings from certain foreign equity investments

accounted for using the equity method are included for

periods ended within up to one month of our year end

(see Note 6).

The preparation of financial statements in conformity with

U.S. generally accepted accounting principles (GAAP) requires

management to make estimates and assumptions that affect

the amounts reported in the financial statements and accom-

panying notes, including estimates of probable losses and

expenses. Actual results could differ from those estimates.

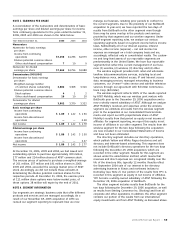

FIN 48 In June 2006, the Financial Accounting Standards

Board (FASB) issued FASB Interpretation No. 48, “Accounting

for Uncertainty in Income Taxes” (FIN 48), an interpretation

of Statement of Financial Accounting Standards No. 109,

“Accounting for Income Taxes.” FIN 48 changes the accounting

for uncertainty in income taxes by prescribing a recognition

threshold for tax positions taken or expected

to be taken in a tax return. FIN 48 is effective for fiscal years

beginning after December 15, 2006. Our evaluation of the

impact FIN 48 will have on our financial position and results

of operations is ongoing. See Note 9 for further discussion.

EITF 06-3 In June 2006, the Emerging Issues Task Force

(EITF) ratified the consensus on EITF 06-3, “How Taxes

Collected from Customers and Remitted to Governmental

Authorities Should Be Presented in the Income Statement”

(EITF 06-3). EITF 06-3 provides that taxes imposed by a

governmental authority on a revenue producing transaction

between a seller and a customer should be shown in the

income statement on either a gross or a net basis, based on

the entity’s accounting policy, which should be disclosed

pursuant to Accounting Principles Board Opinion No. 22,

“Disclosure of Accounting Policies.” Amounts that are allowed

to be charged to customers as an offset to taxes owed by a

company are not considered taxes collected and remitted.

If such taxes are significant, and are presented on a gross basis,

the amounts of those taxes should be disclosed. EITF 06-3 will

be effective for interim and annual reporting periods beginning

after December 15, 2006. We are currently evaluating the

impact EITF 06-3 will have, but do not expect a material impact

on our financial position and results of operations.

FAS 157 In September 2006, the FASB issued Statement

of Financial Accounting Standard No. 157, “Fair Value

Measurements” (FAS 157). FAS 157 defines fair value,

establishes a framework for measuring fair value and expands

disclosures about fair value measurements. FAS 157 applies

under other accounting pronouncements that require or

permit fair value measurement. FAS 157 does not require

any new fair value measurements and we do not expect the

application of this standard to change our current practice.

FAS 157 requires prospective application for fiscal years

ending after November 15, 2007.

FAS 158 In September 2006, the FASB issued Statement

of Financial Accounting Standard No. 158, “Employers’

Accounting for Defined Benefit Pension and Other Postretire-

ment Plans, an amendment of FASB Statements No. 87, 88,

106 and 132(R)” (FAS 158). FAS 158 required us to recognize

the funded status of defined benefit pension, including

supplemental retirement and savings plans, and postemploy-

ment plans as an asset or liability in our statement of financial

position and to recognize changes in that funded status in the

year in which the changes occur through comprehensive

income. This standard has no effect on our expense or benefit

recognition, nor will it affect the funding requirements imposed

under the Employee Retirement Income Security Act of 1974,

as amended (ERISA). FAS 158 requires prospective application

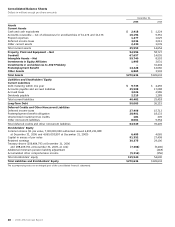

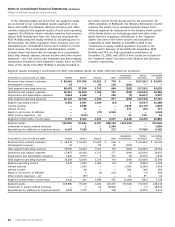

for fiscal years ending after December 15, 2006. The table

below illustrates the incremental impact on our Consolidated

Balance Sheet of applying FAS 158 at December 31, 2006.

Before After

Application Application

of FAS 158 Adjustments of FAS 158

Postemployment Benefit $ 19,118 $(4,890) $ 14,228

Other Assets 7,003 (138) 6,865

Postretirement benefit

obligation 25,485 3,416 28,901

Noncurrent deferred

income taxes 31,100 (3,694) 27,406

Other noncurrent liabilities 8,020 41 8,061

Additional minimum pension

liability adjustment –

net of tax (208) 208 —

Accumulated other

comprehensive income –

net of tax (315) (4,999) (5,314)

Total Stockholders’ Equity 120,331 (4,791) 115,540

Reclassifications We have reclassified certain amounts in

prior-period financial statements to conform to the current

period’s presentation. Included among these, as a result of

integration activities following our November 2005 acquisition

of AT&T Corp. (ATTC), we revised our segment reporting in

2006 (see Note 4). In addition, we revised the product

categories reported in operating revenue as follows: long

distance is now reported in voice revenue; the majority of

customer premises equipment and integration services