AT&T Wireless 2006 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

21

video service and satellite television services through our

agreement with EchoStar Communications Corp. (EchoStar).

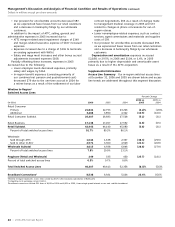

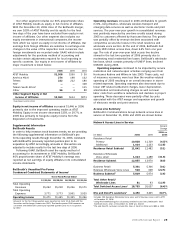

The wireless segment accounted for approximately 37% of

our 2006 total segment operating revenues as compared to

44% in 2005; and 21% of our 2006 total segment income as

compared to 7% in 2005. This segment offers both wireless

voice and data communications services across the United

States, providing cellular and PCS services. This segment

reflects 100% of the results reported by AT&T Mobility, which

was our wireless joint venture with BellSouth prior to the

December 29, 2006 acquisition and is now a wholly-owned

subsidiary of AT&T. Although we analyze AT&T Mobility’s

revenues and expenses under the wireless segment, we

eliminated all results from the wireless segment prior to our

December 29, 2006 acquisition in our consolidated financial

statements and reported our 60% proportionate share of

results from that period as equity in net income of affiliates.

The results from the wireless segment for the two days

following the acquisition are not eliminated and are now

included in the 2006 consolidated company results.

The directory segment accounted for approximately 4%

of our 2006 total segment operating revenues as compared

to 5% in 2005; and 12% of our 2006 total segment income

as compared to 27% in 2005. This segment includes our

directory operations, which publish Yellow and White Pages

directories and sell directory and Internet-based advertising.

This segment does not include BellSouth’s directory opera-

tions for the two days following the December 29, 2006

acquisition, which are recorded in the other segment. In

November 2004, a subsidiary in our directory segment entered

into a joint venture agreement with BellSouth and acquired

the Internet directory publisher YELLOWPAGES.COM (YPC).

Following the December 29, 2006 acquisition of BellSouth,

YPC became a wholly-owned subsidiary of AT&T.

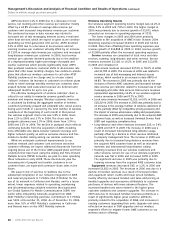

The other segment accounted for approximately 1% of our

2006 and 2005 total segment operating revenues and 13% of

our 2006 total segment income, as compared to 8% in 2005.

This segment includes 100% of the results of BellSouth for

the two days following the December 29, 2006 acquisition, as

well as results from Sterling Commerce Inc. (Sterling) and

from all corporate and other operations. In addition, the other

segment contains our portion of the results from our interna-

tional equity investments and from AT&T Mobility, prior to the

December 29, 2006 acquisition, as equity in net income of

affiliates. Although we analyze AT&T Mobility’s revenues and

expenses under the wireless segment, we record its equity in

net income of affiliates in this segment. We sold our paging

operations in November 2005.

The following tables show components of results of

operations by segment. We discuss significant segment results

following each table. We discuss capital expenditures for each

segment in “Liquidity and Capital Resources.” In addition, the

wireless segment’s 2005 operating revenue and expense

percentage increases and decreases are not considered

meaningful due to AT&T Mobility’s fourth-quarter 2004

acquisition of AWE, and are denoted with a dash.

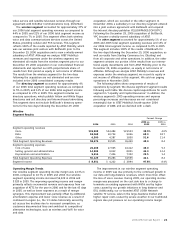

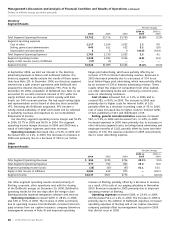

Wireline

Segment Results

Percent Change

2006 vs. 2005 vs.

2006 2005 2004 2005 2004

Segment operating revenues

Voice $33,908 $24,484 $23,553 38.5% 4.0%

Data 18,068 10,734 9,046 68.3 18.7

Other 6,500 4,287 3,850 51.6 11.4

Total Segment Operating Revenues 58,476 39,505 36,449 48.0 8.4

Segment operating expenses

Cost of sales 26,206 17,945 16,412 46.0 9.3

Selling, general and administrative 14,305 9,912 8,821 44.3 12.4

Depreciation and amortization 9,614 7,426 7,322 29.5 1.4

Total Segment Operating Expenses 50,125 35,283 32,555 42.1 8.4

Segment Income $ 8,351 $ 4,222 $ 3,894 97.8% 8.4%

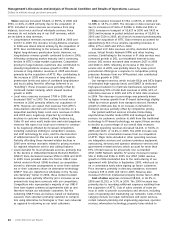

Operating Margin Trends

Our wireline segment operating income margin was 14.3% in

2006, compared to 10.7% in 2005 and 2004. Our wireline

segment operating income increased $4,129 in 2006 and

$328 in 2005. The improving operating income and margin

primarily reflects incremental revenue and expenses from our

acquisition of ATTC for the year in 2006 and for the last 43 days

in 2005, as well as lower expenses as a result of merger

synergies. This improvement was partially offset by additional

amortization expense and lower voice revenue as a result of

continued in-region (i.e., the 13 states historically served by

us) access line declines due to increased competition, as

customers disconnected lines and switched to competitors’

alternative technologies, such as wireless and VoIP, for voice

and data.

The improvement in our wireline segment operating

income in 2005 was due primarily to the continued growth in

our data and long-distance revenues, which more than offset

the loss of voice revenue. During 2005, our operating income

margin was pressured on the cost side due to a charge to

terminate an existing agreement with WilTel and by higher

costs caused by our growth initiatives in long distance and

DSL. Additionally, our co-branded AT&T | DISH Network

satellite TV service, sales in the large-business market and

higher repair costs caused by severe weather in our traditional

regions also put pressure on our operating income margin.