AT&T Wireless 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

71

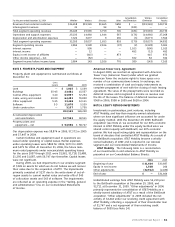

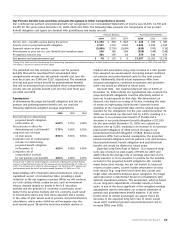

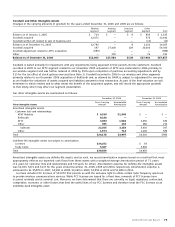

The plans’ weighted-average asset target and actual allocations as a percentage of plan assets, including the notional exposure of

future contracts by asset categories at December 31 are as follows:

Pension Assets Postretirement (VEBA) Assets

Target 2006 2005 Target 2006 2005

Equity securities

Domestic 35% – 45% 38% 41% 45% – 55% 51% 51%

International 15% – 25% 19 17 10% – 20% 22 16

Debt securities 20% – 30% 26 29 12% – 22% 18 28

Real estate 5% – 10% 8 6 3% – 9% 2 1

Other 5% – 10% 9 7 9% – 15% 7 4

Total 100% 100% 100% 100%

At December 31, 2006, the pension assets included 4.3 million

shares of AT&T common stock with a fair value of $152 and

AT&T bonds with a notional amount of $62 and fair value of

$68. As a result of our acquisition of BellSouth, pension assets

increased by 2.4 million shares of AT&T stock with a fair value

of $86 and AT&T bonds with a notional value of $16 and fair

value of $17. During 2006, the pension plans purchased $19

and sold $19 of AT&T bonds. Additionally, during 2006, the

pension plan purchased and sold AT&T common stock of $22

and $38, respectively. Pension plan holdings in AT&T securities

represented 0.3% of total plan assets at December 31, 2006.

At December 31, 2006, the VEBA assets included 1.6 million

shares of AT&T common stock with a fair value of $56 and

AT&T bonds with a notional amount and fair value of $5.

As a result of our acquisition of BellSouth, the VEBA assets

increased by 949,000 shares of AT&T stock with a fair value

of $34 and AT&T bonds with a notional and fair value of $3.

During 2006, the VEBAs purchased $1 of AT&T bonds and

$8 of AT&T common stock. VEBA holdings in AT&T securities

represented 0.4% of total plan assets at December 31, 2006.

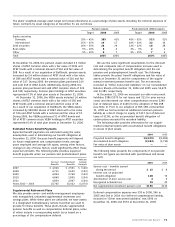

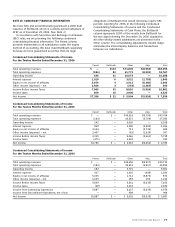

Estimated Future Benefit Payments

Expected benefit payments are estimated using the same

assumptions used in determining our benefit obligation at

December 31, 2006. Because benefit payments will depend

on future employment and compensation levels, average

years employed and average life spans, among other factors,

changes in any of these factors could significantly affect these

expected amounts. The following table provides expected

benefit payments under our pension and postretirement plans:

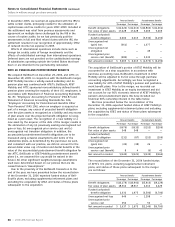

Medicare

Pension Postretirement Subsidy

Benefits Benefits Receipts

2007 $ 4,920 $ 2,531 $ (120)

2008 4,711 2,652 (132)

2009 4,824 2,768 (143)

2010 4,840 2,859 (154)

2011 4,854 2,947 (164)

Years 2012 – 2016 23,705 15,022 (1,074)

Supplemental Retirement Plans

We also provide senior- and middle-management employees

with nonqualified, unfunded supplemental retirement and

savings plans. While these plans are unfunded, we have assets

in a designated nonbankruptcy remote trust that are used to

provide for these benefits. These plans include supplemental

pension benefits as well as compensation deferral plans, some

of which include a corresponding match by us based on a

percentage of the compensation deferral.

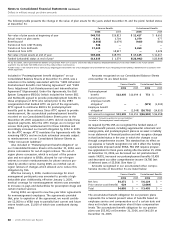

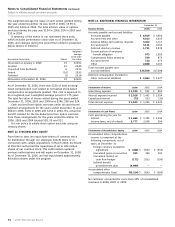

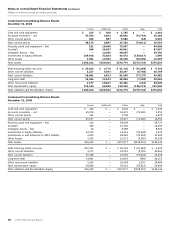

We use the same significant assumptions for the discount

rate and composite rate of compensation increase used in

determining the projected benefit obligation and the net

pension and postemployment benefit cost. The following

tables provide the plans’ benefit obligations and fair value of

assets at December 31 and the components of the supple-

mental retirement pension benefit cost. The net amounts

recorded as “Other noncurrent liabilities” on our Consolidated

Balance Sheets at December 31, 2006 and 2005 were $2,470

and $1,381, respectively.

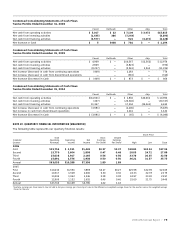

At December 31, 2006 we increased our other noncurrent

liabilities $386 ($375 for net losses and $11 for prior service

costs) and decreased our other comprehensive income $240

(net of deferred taxes of $146) for the adoption of FAS 158

(see Note 1). Prior to our adoption of FAS 158, at December

31, 2005 we had recorded an additional minimum pension

liability as a direct charge to equity of $217 (net of deferred

taxes of $134), as the accumulated benefit obligation of

certain plans exceeded the recorded liability.

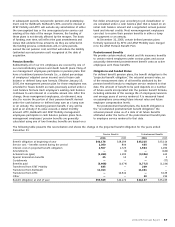

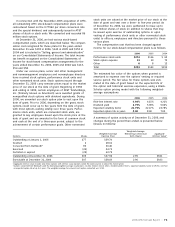

The following table provides information for our supple-

mental retirement plans with accumulated benefit obligations

in excess of plan assets:

2006 2005

Projected benefit obligation $(2,470) $(1,800)

Accumulated benefit obligation (2,353) (1,730)

Fair value of plan assets — —

The following table presents the components of net periodic

benefit cost (gains are denoted with parentheses and losses

are not):

2006 2005

Service cost – benefits earned

during the period $ 15 $ 8

Interest cost on projected

benefit obligation 108 73

Amortization of prior service cost 4 9

Recognized actuarial loss 29 23

Net supplemental retirement pension cost $156 $113

Deferred compensation expense was $39 in 2006, $46 in

2005 and $44 in 2004. Our deferred compensation liability,

included in “Other noncurrent liabilities,” was $996 at

December 31, 2006 and $574 at December 31, 2005.