AT&T Wireless 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

31

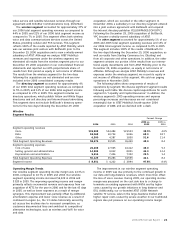

Expected Growth Areas

We expect our primary wireline products and wireless services

to remain the most significant portion of our business and

have also discussed trends affecting the segments in which

we report results for these products (see “Wireline Segment

Results” and “Wireless Segment Results”). Over the next few

years we expect an increasing percentage of our growth to

come from: (1) our wireless service, and (2) data/broadband,

through existing services and new services to be provided by

our Project Lightspeed initiative. We expect that our recent

acquisitions will strengthen the reach and sophistication of

our network facilities, increase our large-business customer

base and enhance the opportunity to market wireless services

to that customer base. Whether, or the extent to which,

growth in these areas will offset declines in other areas of our

business is not known.

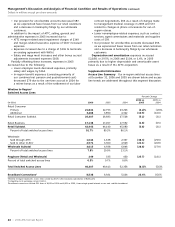

U-verse Services (Project Lightspeed) In June 2004, we

announced key advances in developing a network capable of

delivering a new generation of integrated digital television,

high-speed broadband and VoIP services to our residential

and small-business customers. We have been building out this

network in numerous locations and are now providing AT&T

U-verse services, including U-verse TV (IPTV) video, in limited

parts of 11 markets as of year-end 2006, and we expect to

launch additional markets during 2007. Our deployment

strategy is to enter each market on a limited basis in order to

ensure that all operating and back-office systems are func-

tioning successfully and then expand within each market as

we continue to monitor these systems to ensure customer

satisfaction with our services. In these market expansions, we

expect to continue to use contracted outside labor in addition

to our employees as installers; our rate of expansion will be

slowed if we cannot hire and train an adequate number of

technicians to keep pace with customer demand. During our

launch into these additional markets, we also expect to add

additional features to our IP video service offering. We expect

to have the capability to offer service to approximately

19 million living units by the end of 2008, as part of our initial

deployment, and expect to spend approximately $4,600 in

network-related deployment costs and capital expenditures

from 2006 through 2008, as well as additional customer

activation capital expenditures. We remain on budget for this

overall target and expect to spend approximately $3,100

during 2007 and 2008. These expenditures may increase

slightly if the programming and features of the video offering

expand or if additional network conditioning is required.

With respect to our IP video service, we continue to work

with our vendors to continue to improve, in a timely manner,

the requisite hardware and software technology. Our deploy-

ment plans could be delayed if we do not receive required

equipment and software on schedule. We have completed

most negotiations, and consistent with our profitability

assumptions, with programming owners (e.g., movie studios

and cable networks) to offer existing television programs and

movies and, if applicable, other new interactive services.

Also, as discussed in the “Regulatory Developments” section,

we are supporting legislation at the state level that would

streamline the regulatory process for new video competitors

to enter the market.

We believe that IPTV is subject to federal oversight as a

“video service” under the Federal Communications Act.

However, some cable providers and municipalities have

claimed that certain IP services should be treated as a

traditional cable service and therefore subject to the appli-

cable state and local regulation, which could include the

requirement to pay fees to obtain local franchises for our

IP video service. Certain municipalities have refused us

permission to use our existing right-of-ways to deploy or

activate our U-verse-related services and products, resulting

in litigation. Pending negotiations and current or threatened

litigation involving municipalities could delay our deployment

plans in those areas for 2007 and future years. If the courts

were to decide that state and local regulation were applicable

to our U-verse services, it could have a material adverse effect

on the cost, timing and extent of our deployment plans.

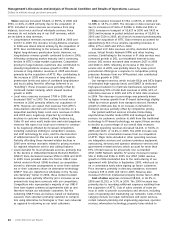

Wireless AT&T Mobility began operations in October

2000 as a joint venture between us and BellSouth. In October

2004, AT&T Mobility completed its acquisition of AWE, which

established AT&T Mobility as the largest provider of mobile

wireless voice and data communications services in the

U.S. in terms of subscribers. Following our December 2006

acquisition of BellSouth, AT&T Mobility became a wholly-

owned subsidiary. At December 31, 2006, we served

approximately 61 million customers and had access to

licenses to provide wireless communications services

covering an aggregate population of 296 million, or

approximately 99% of the U.S. population, including most

of the 100 largest U.S. metropolitan areas.

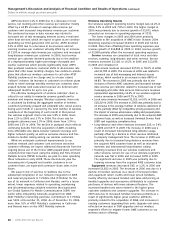

Our wireless networks use equipment with GSM and TDMA

digital transmission technologies. We are transitioning our

subscribers to GSM technology, and over 99% of our total

usage, based on minutes of use, is on our GSM network. We

will decommission our TDMA network in early 2008. Our GSM

networks also contain General Packet Radio Service (GPRS)

and Enhanced Data Rates for Global Evolution (EDGE) technol-

ogy to provide high-speed wireless data services. In the

majority of the U.S. domestic markets we are also completing

deployment of UMTS/HSDPA (or Universal Mobile Telecommu-

nications System/High Speed Downlink Packet Access), a 3G

technology that allows customers to access the Internet from

their wireless devices at superior speeds for data and video

services.

We expect that intense industry competition and market

saturation may cause the wireless industry’s customer growth

rate to moderate in comparison with historical growth rates.

While the wireless telecommunications industry continues to

grow, a high degree of competition exists among four national

carriers, their affiliates and smaller regional carriers. This

competition will continue to put pressure upon pricing and

margins as the carriers compete for potential customers.

However, as wireless Internet connectivity and wireline/

wireless convergence are realized, we expect increased

demand for high-speed wireless and wireless data services.

Future carrier revenue growth is dependent upon the number

of net customer additions a carrier can achieve and the

revenue per customer. The effective management of customer

turnover, or churn, is also important in minimizing customer

acquisition costs and maintaining and improving margins and

customer growth.