AT&T Wireless 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

23

elements of our network and payphone operations. Pension

and postretirement costs, net of amounts capitalized as part

of construction labor, are also included to the extent that they

are allocated to our network labor force and other employees

who perform the functions listed in this paragraph.

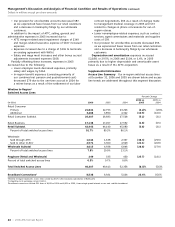

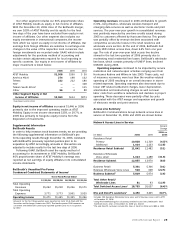

In addition to the impact of the ATTC acquisition, cost of

sales in 2006 increased due to the following:

• Higher nonemployee-related expenses such as contract

services, agent commissions and materials and supplies

costs, of $163.

• Higher in-region benefit expenses, consisting primarily

of our combined net pension and postretirement cost,

increased expense $159, primarily due to changes in our

actuarial assumptions, which included the reduction of

our discount rate from 6.00% to 5.75% (which increases

expense), and amortization of net losses on plan assets

in prior years.

• Higher traffic compensation expenses (for access to

another carrier’s network) of $109 primarily due to

increased volume of local traffic (telephone calls)

terminating on competitor networks and wireless

customers.

• Salary and wage merit increases and other bonus accrual

adjustments of $48.

Partially offsetting these increases, cost of sales in 2006

decreased due to:

• Equipment sales and related network integration services

decreased $418 primarily due to lower demand and as

a result of the September 2005 amendment of our

agreement for our co-branded AT&T | DISH Network

satellite TV service. Prior to restructuring our relationship

with EchoStar in September 2005, we had been record-

ing both revenue and expenses for AT&T | DISH Network

satellite TV customers, resulting in relatively high initial

customer acquisition costs. Costs associated with

equipment for large-business customers (as well as DSL

and, previously, satellite video) typically are greater than

costs associated with services that are provided over

multiple years.

• Lower employee levels, primarily salary and wages,

decreased expenses $296.

• A change made during 2006 in our policy regarding the

timing for earning vacation days decreased expenses

$225.

• Merger severance expenses in the prior year were higher

than in the current year by $176.

• In-region weather-related repair costs incurred in 2005

decreased expenses $100 in 2006.

• Severance expenses in the prior year were higher than

in the current year by $73.

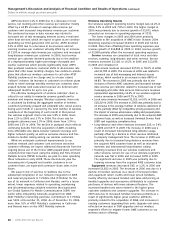

In addition to the impact of ATTC, cost of sales in 2005

increased due to the following:

• Higher traffic compensation expenses of $330 primarily

due to growth in our long-distance service.

• Higher equipment sales and related network integration

services of $195 reflecting our emphasis on growth in

DSL and sales in the large-business market and video.

• Merger severance accruals in 2005 of $176.

• Salary and wage merit increases and other bonus

accrual adjustments of $170.

• Repair costs related to severe weather increased

expenses $100.

Partially offsetting these increases, cost of sales in 2005

decreased due to:

• Lower employee levels decreased expenses, primarily

salary and wages, by $322.

• In-region benefit expenses (consisting primarily of our

combined net pension and postretirement cost)

decreased $154 due to the one-time accrual in 2004

for a retiree bonus as a result of the settlement of our

labor-contract negotiations, $12 as a result of changes

made in 2005 to medical coverage for most managers

and $20 related to changes in phone concessions for

out-of-region retirees.

• Nonemployee-related expenses such as contract services,

agent commissions and materials and supplies costs

decreased $100.

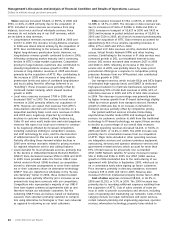

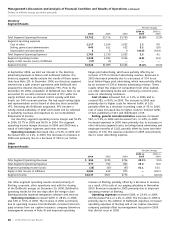

Selling, general and administrative expenses increased

$4,393, or 44.3%, in 2006 and $1,091, or 12.4%, in 2005. The

2006 increase was primarily related to recording increased

expenses due to the acquisition of ATTC. Selling, general and

administrative expenses consist of our provision for uncollect-

ible accounts; advertising costs; sales and marketing functions,

including our retail and wholesale customer service centers;

centrally managed real estate costs, including maintenance

and utilities on all owned and leased buildings; credit and

collection functions; and corporate overhead costs, such as

finance, legal, human resources and external affairs. Pension

and postretirement costs are also included to the extent that

they relate to employees who perform the functions listed in

this paragraph.

In addition to the impact of the ATTC acquisition, selling,

general and administrative expenses in 2006 also increased

due to the following:

• Other in-region wireline segment costs of $809 primarily

due to advertising costs related to promotion of the AT&T

brand name. In addition, other advertising expenses

increased $117.

• Higher nonemployee-related expenses, such as contract

services, agent commissions and materials and supplies

costs of $103.

• Higher in-region benefit expenses, consisting primarily

of our combined net pension and postretirement cost,

increased expense $73, primarily due to changes in our

actuarial assumptions, which included the reduction of

our discount rate from 6.00% to 5.75% (which increases

expense) and net losses on plan assets in prior years.

Partially offsetting these increases, selling, general and

administrative expenses in 2006 decreased due to:

• ATTC merger-related asset impairment charges of $349

and merger-related severance expense of $107 in the

prior year resulted in lower expenses in 2006.

• Lower employee levels, primarily salary and wages,

decreased expenses by $239.

• Expenses decreased in 2006 due to a charge of $236 in

2005 to terminate existing agreements with WilTel, which

will continue to provide transitional and out-of-market

long-distance services under a new agreement, which

commenced in November 2005 as a result of our

acquisition of ATTC.

• A change made during 2006 in our policy regarding

the timing for earning vacation days decreased

expenses $96.