AT&T Wireless 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 : :

2006 AT&T Annual Report

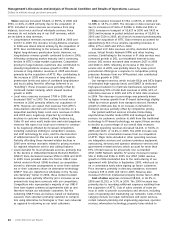

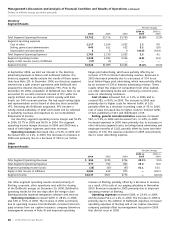

The increase in 2005 operating expense includes a $236

charge to terminate an agreement with WilTel, merger-related

asset impairments of $349 and severance accrual increases of

$283 related to the ATTC acquisition. Partially offsetting these

items were decreases due to expenses incurred in 2004

related to strike preparation and labor-contract settlements

of $263 and to a net decrease of $186 reflecting changes in

postretirement benefits in 2005 and 2004. Our significant

expense changes are discussed in greater detail in our

“Segment Results” sections.

Interest expense increased $387, or 26.6%, in 2006 and

$433, or 42.3%, in 2005. The increase in 2006 was primarily

due to recording a full year of interest expense on ATTC’s

outstanding debt.

The increase in 2005 was primarily due to issuing additional

debt in the fourth quarter of 2004, thus accruing interest

expense for a full 12 months of 2005 in comparison to less

than three months of 2004. In 2004 we issued debt totaling

approximately $8,750 to finance our portion of AT&T Mobility’s

purchase price for AT&T Wireless Services, Inc. (AWE).

Interest income decreased $6, or 1.6%, in 2006 and $109,

or 22.2%, in 2005. The decrease in 2006 was primarily due to

the lower average balance in 2006 on our shareholder loan

to AT&T Mobility, which was partially offset by increased interest

income on advances to AT&T Mobility under the terms of

our revolving credit agreement (see Note 14). Prior to the

December 29, 2006 acquisition of BellSouth, AT&T Mobility

borrowed funds from us under a shareholder loan and

revolving credit agreement. Following the BellSouth acquisi-

tion, AT&T Mobility became a wholly-owned subsidiary and our

consolidated financial statements will no longer include

interest income or interest expense paid from subsidiaries.

The decrease in 2005 was primarily due to lower investment

balances during 2005 as investments held for the majority of

2004 were liquidated and used to fund our portion of AT&T

Mobility’s purchase price for AWE, and less income earned on

our advances to AT&T Mobility resulting from payments during

2005 on a portion of outstanding advances due to us.

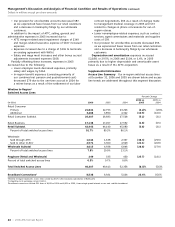

Equity in net income of affiliates increased $1,434 in

2006 and decreased $264, or 30.2%, in 2005. The increase in

2006 was primarily due to our proportionate share of AT&T

Mobility’s improved results of $1,308 in 2006. The 2005

decrease was due to lower results from our international

holdings of $345, partially offset by an increase of $170 in

our proportionate share of AT&T Mobility’s results.

Investments in partnerships, joint ventures and less than

majority-owned subsidiaries where we have significant

influence are accounted for under the equity method. Prior to

the December 29, 2006 BellSouth acquisition (see Note 2), we

accounted for our 60% economic interest in AT&T Mobility

under the equity method since we had been sharing control

equally with BellSouth. We had equal voting rights and

representation on the Board of Directors that controlled

AT&T Mobility. (After the BellSouth acquisition, AT&T Mobility

became a wholly-owned subsidiary of AT&T and wireless

results will be reflected in operating revenues and expenses

on our Consolidated Statements of Income.)

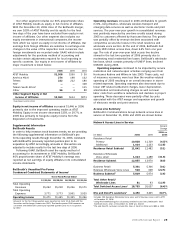

Other income (expense) – net We had other income of

$16 in 2006, $14 in 2005 and $922 in 2004. There were no

individually significant other income or expense transactions

during 2006.

Results for 2005 primarily included a gain of $108 on the

sales of shares of Amdocs Limited (Amdocs), American Tower

Corp. (American Tower) and Yahoo! Inc. (Yahoo) and other

miscellaneous gains. These gains were partially offset by

other expenses of $126 to reflect an increase in value of a

third-party minority holder’s interest in an AT&T subsidiary’s

preferred stock and other miscellaneous expenses.

Results for 2004 primarily included a gain of $832 on the

sale of our investment in Belgacom S.A., gains of $270 on the

sales of shares of Amdocs and Yahoo, and a gain of $57 on

the sales of shares of Teléfonos de México, S.A. de C.V.

(Telmex) and América Móvil S.A. de C.V. (América Móvil).

Included in items that partially offset those gains were losses

of $138 on the sale of all of our shares of TDC and $82 on

the sale of all of our shares of Telkom S.A. Limited.

Income taxes increased $2,593 in 2006 and decreased

$1,254, or 57.4%, in 2005. Our effective tax rate in 2006 was

32.4%, compared to 16.3% in 2005 and 30.5% in 2004. The

increase in income tax expense in 2006 compared to 2005

was primarily due to the higher income before income taxes in

2006 and our agreement in December 2005 with the Internal

Revenue Service (IRS) to settle certain claims principally

related to the utilization of capital losses and tax credits

for tax years 1997-1999. The settlement resulted in our

recognition of $902 of reduced income tax expense in 2005.

The decrease in income taxes and our effective tax rate in

2005 compared to 2004 was due primarily to our agreement

with the IRS, discussed above. (See Note 9)

Income from discontinued operations was $908 in 2004

and represents results from the directory advertising business

in Illinois and northwest Indiana that we sold in 2004.

(See Note 15)

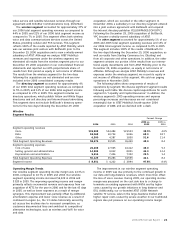

Segment Results

Our segments represent strategic business units that offer

different products and services and are managed accordingly.

As a result of our November 18, 2005 acquisition of ATTC we

revised our segment reporting to represent how we now

manage our business, restating prior periods to conform to

the current segments. Due to the proximity of our December

29, 2006 acquisition of BellSouth to year-end, we have

reported the two days of results from BellSouth in the other

segment. Our operating segment results presented in Note 4

and discussed below for each segment follow our internal

management reporting. We analyze our various operating

segments based on segment income before income taxes (see

Note 4). Each segment’s percentage of total segment operat-

ing revenue calculation is derived from our segment results

table in Note 4 and reflects amounts before eliminations.

Operating income percentage fluctuations were largely due to

improved results in our wireless segment as well as the

inclusion of ATTC in our wireline segment for all of 2006, as

opposed to only 43 days in 2005. We have four reportable

segments: (1) wireline, (2) wireless, (3) directory and (4) other.

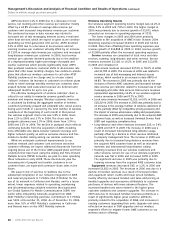

The wireline segment accounted for approximately 58% of

our 2006 total segment operating revenues as compared to

50% in 2005; and 54% of our 2006 total segment income as

compared to 58% in 2005. This segment provides both retail

and wholesale landline telecommunications services, including

local and long-distance voice, switched access, Internet

Protocol (IP) and Internet access data, messaging services,

managed networking to business customers, our U-verseSM

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts