AT&T Wireless 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

73

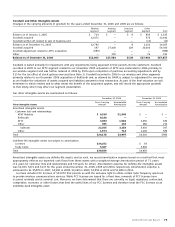

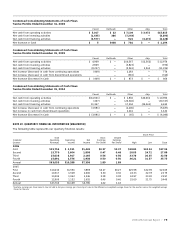

In connection with the November 2005 acquisition of ATTC,

all outstanding ATTC stock-based compensation plans were

restructured based on the 0.77942 per share conversion rate

and the special dividend, and subsequently issued in AT&T

shares of stock or stock units. We converted and recorded 86

million stock options.

At December 31, 2006, we had various stock-based

compensation plans, which are described below. The compen-

sation cost recognized for those plans for the years ended

December 31 was $293 in 2006, $143 in 2005 and $153 in

2004 and is included in “Selling, general and administrative”

on our Consolidated Statements of Income. The total income

tax benefit recognized on the Consolidated Statements of

Income for stock-based compensation arrangements for the

years ended December 31, 2006, 2005 and 2004 was $113,

$54 and $58.

Under our various plans, senior and other management

and nonmanagement employees and nonemployee directors

have received stock options, performance stock units and

other nonvested stock units. Stock options issued through

December 31, 2006 carry exercise prices equal to the market

price of our stock at the date of grant. Beginning in 1994

and ending in 1999, certain employees of AT&T Teleholdings,

Inc. (formerly known as Ameritech) were awarded grants of

nonqualified stock options with dividend equivalents. During

2006, we amended our stock option plan to vest upon the

date of grant. Prior to 2006, depending on the grant, stock

options could occur up to five years from the date of grant,

with most options vesting ratably over three years. Perfor-

mance stock units, which are nonvested stock units, are

granted to key employees based upon the stock price at the

date of grant and are awarded in the form of common stock

and cash at the end of a three-year period, subject to the

achievement of certain performance goals. Other nonvested

stock units are valued at the market price of our stock at the

date of grant and vest over a three- to five-year period. As

of December 31, 2006, we were authorized to issue up to

143 million shares of stock (in addition to shares that may

be issued upon exercise of outstanding options or upon

vesting of performance stock units or other nonvested stock

units) to officers, employees and directors pursuant to these

various plans.

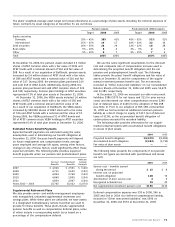

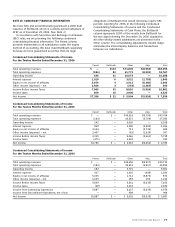

The compensation cost that has been charged against

income for our stock-based compensation plans is as follows:

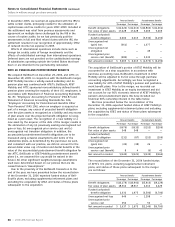

2006 2005 2004

Performance stock units $274 $116 $ 65

Stock option expense 13 19 75

Other 6 8 13

Total $293 $143 $153

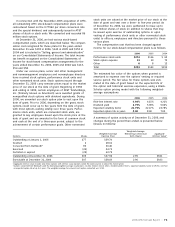

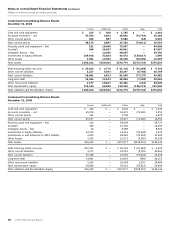

The estimated fair value of the options when granted is

amortized to expense over the options’ vesting or required

service period. The fair value for these options was esti-

mated at the date of grant based on the expected life of

the option and historical exercise experience, using a Black-

Scholes option pricing model with the following weighted-

average assumptions:

2006 2005 2004

Risk-free interest rate 4.94% 4.15% 4.21%

Dividend yield 4.75% 5.38% 5.00%

Expected volatility factor 21.79% 22.47% 23.78%

Expected option life in years 8.00 8.00 7.00

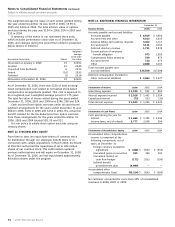

A summary of option activity as of December 31, 2006, and

changes during the period then ended, is presented below

(shares in millions):

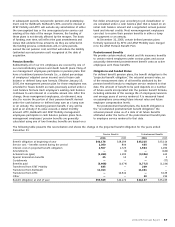

Weighted-Average

Weighted-Average Remaining Contractual Aggregate

Options Shares Exercise Price Term (Years) Intrinsic Value1

Outstanding at January 1, 2006 277 $39.74

Granted 2 28.01

Converted from BellSouth2 83 30.40

Exercised (24) 24.73

Forfeited or expired (29) 42.79

Outstanding at December 31, 2006 309 $37.96 2.95 $941

Exercisable at December 31, 2006 307 $38.03 2.90 $923

1 Aggregate intrinsic value includes only those options with intrinsic value (options where the exercise price is below the market price).

2 Options converted from BellSouth used the following weighted-average assumptions: risk-free interest rate of 4.84%, dividend yield of 5.20%, expected volatility factor of 19.05% and had

an expected option life of up to 4 years. The weighted-average fair value of each option converted was $2.02.