AT&T Wireless 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

43

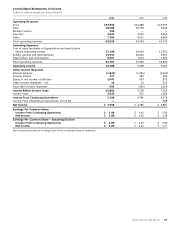

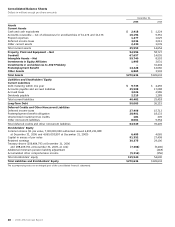

Total Number of

Shares Purchased as Maximum Number of

Part of Publicly Shares that May Yet

Total Number of Average Price Announced Plans Be Purchased Under

Purchase Period Shares Purchased Paid per Share1 or Programs the Plans or Programs

October 2, 2006 – October 31, 2006 12,600,000 $33.05 12,600,000 342,430,000

November 1, 2006 – November 30, 2006 13,832,816 $33.28 13,832,816 328,597,184

December 1, 2006 – December 20, 2006 12,765,068 $34.64 12,765,068 315,832,116

Total 39,197,884 $33.65 39,197,884 315,832,116

1Average Price Paid per Share excludes transaction costs.

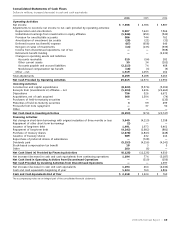

The comparison above assumes $100 invested on December

31, 2001, in AT&T common stock, Standard & Poor’s 500 Index

(S&P 500), Standard & Poor’s 500 Integrated Telecom Index

(Telecom Index) and a Peer Group of other large U.S. telecommu-

nications companies (BellSouth and Verizon). The index of

telecommunications companies (Peer Group) is weighted

according to the market capitalization of its component

companies at the beginning of each period. As a result of the

acquisition of BellSouth on December 29, 2006, the Peer Group

will no longer represent multiple independent companies, so

we have adopted the Telecom Index to represent comparable

companies. Total return equals stock price appreciation plus

reinvestment of dividends on a quarterly basis.

CERTIFICATI O N BY T H E CHIEF E X ECUTIVE O F F I C E R

As required under the rules of the New York Stock Exchange

(NYSE), our chief executive officer has timely submitted to

the NYSE his annual certification that he is not aware of any

violation by the company of NYSE corporate governance

standards. Also as required under the rules of the NYSE,

readers are advised that the certifications required under

Section 302 of the Sarbanes-Oxley Act of 2002 are not

included in this report but instead are included as exhibits

to our Annual Report on Form 10-K for 2006.

RISK FACTORS

In addition to the other information set forth in this document,

including the matters contained under the caption “Cautionary

Language Concerning Forward-Looking Statements,” you

should carefully read the matters described below. We believe

that each of these matters could materially affect our

business. We recognize that most of these factors are beyond

our ability to control and therefore to predict an outcome.

Accordingly, we have organized them by first addressing

general factors, then industry factors and, finally, items

specifically applicable to us.

140

130

120

110

100

90

80

70

60

72

70

78

79

69

73 76

79

91

111 117

135

100

75

76

77

117

116

113

12/01 12/02 12/03 12/04 12/05 12/06

80

S&P 500 Integrated

Telecom Index

AT&T Inc. Peer Group S&P 500 Index

STO C K PERFO R M A N C E GRAPH

Comparison of Five Year Cumulative Total Return

AT&T Inc., S&P 500 Index, Peer Group, and S&P 500 Integrated Telecom Index

Issuer Equity Repurchases

On March 4, 2006, our Board of Directors authorized the

repurchase of up to 400 million shares of AT&T common

stock; this authorization expires at the end of 2008. During

the fourth quarter of 2006, we repurchased 39.2 million

shares at a cost of $1,319. Under this repurchase plan, we

repurchased $2,678 in shares during 2006. We expect our

combined buyback for 2006 and 2007 to total $10,000 at

the end of 2007. We have repurchased, and intend to

continue to repurchase, shares pursuant to plans that comply

with the requirements of Rule 10b5-1(c) under the Securities

Exchange Act of 1934. We will fund our share repurchases

through a combination of cash from operations, borrowings,

dependent upon market conditions, and cash from the

disposition of certain non-strategic investments.