AT&T Wireless 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 : :

2006 AT&T Annual Report

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

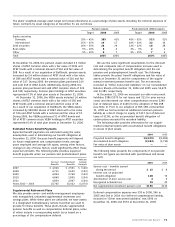

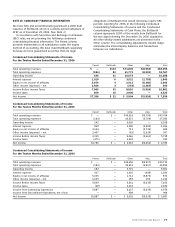

The weighted-average fair value of each option granted during

the year ended December 31 was $4.78 in 2006, $3.39 in

2005 and $4.06 in 2004. The total intrinsic value of options

exercised during the year was $134 in 2006, $24 in 2005 and

$33 in 2004.

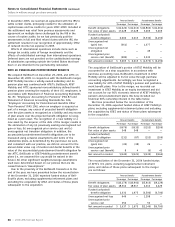

A summary of the status of our nonvested stock units,

which includes performance stock units as of December 31,

2006, and changes during the period then ended is presented

below (shares in millions):

Weighted-

Average

Grant-Date

Nonvested Stock Units Shares Fair Value

Nonvested at January 1, 2006 15 $24.91

Granted 15 25.45

Converted from BellSouth 6 21.54

Vested (10) 25.95

Forfeited (1) 25.18

Nonvested at December 31, 2006 25 $24.03

As of December 31, 2006, there was $230 of total unrecog-

nized compensation cost related to nonvested stock-based

compensation arrangements granted. That cost is expected to

be recognized over a weighted-average period of 1.75 years.

The total fair value of shares vested during the years ended

December 31, 2006, 2005 and 2004 was $246, $38 and $24.

Cash received from option exercises under all stock-based

payment arrangements for the years ended December 31 was

$614 in 2006, $192 in 2005 and $234 in 2004. The actual tax

benefit realized for the tax deductions from option exercises

from these arrangements for the years ended December 31,

2006, 2005 and 2004 totaled $28, $9 and $12.

It is our policy to satisfy share option exercises using our

treasury shares.

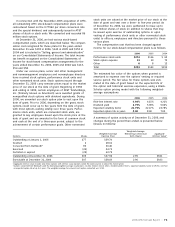

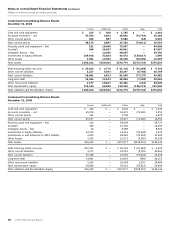

NOTE 12. STOCKHOLDERS’ EQUITY

From time to time, we repurchase shares of common stock

for distribution through our employee benefit plans or in

connection with certain acquisitions. In March 2006, the Board

of Directors authorized the repurchase of up to 400 million

shares of our common stock. This authorization replaced

previous authorizations and will expire on December 31, 2008.

As of December 31, 2006, we had repurchased approximately

84 million shares under the program.

NOTE 13. ADDITIONAL FINANCIAL INFORMATION

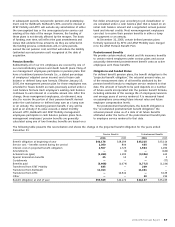

December 31,

Balance Sheets 2006 2005

Accounts payable and accrued liabilities:

Accounts payable $ 6,919 $ 4,466

Accrued rents and other 5,013 1,015

Advance billing and customer deposits 3,402 1,717

Accrued payroll 3,111 2,104

Deferred directory revenue 1,721 1,832

Current portion of employee

benefit obligation 973 1,505

Compensated future absences 759 875

Accrued interest 722 473

Other 2,888 3,101

Total accounts payable and

accrued liabilities $25,508 $17,088

Deferred compensation (included in

Other noncurrent liabilities) $ 2,064 $ 1,127

Statements of Income 2006 2005 2004

Advertising expense $ 1,530 $ 812 $ 862

Interest expense incurred $ 1,916 $ 1,492 $ 1,054

Capitalized interest (73) (36) (31)

Total interest expense $ 1,843 $ 1,456 $ 1,023

Statements of Cash Flows 2006 2005 2004

Cash paid during the year for:

Interest $ 1,666 $ 1,395 $ 1,043

Income taxes, net of refunds 2,777 2,038 506

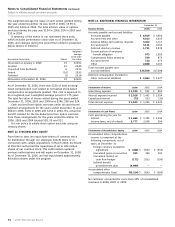

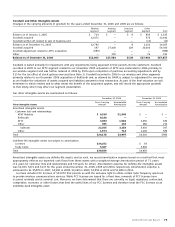

Statements of Stockholders’ Equity 2006 2005 2004

Accumulated other comprehensive

income is comprised of the

following components, net of

taxes, at December 31:

Foreign currency translation

adjustment $ (488) $ (505) $ (555)

Unrealized gains on securities 345 340 391

Unrealized (losses) on

cash flow hedges (172) (191) (196)

Defined benefit

postretirement plan (4,999) — —

Accumulated other

comprehensive (loss) $(5,314) $ (356) $ (360)

No customer accounted for more than 10% of consolidated

revenues in 2006, 2005 or 2004.