AT&T Wireless 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

61

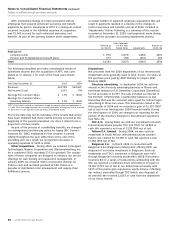

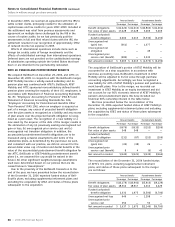

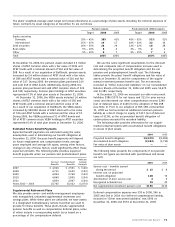

Consolidation Wireless Consolidated

For the year ended December 31, 2004 Wireline Wireless Directory Other and Elimination Elimination Results

Revenues from external customers $36,418 $19,565 $3,665 $650 $ — $(19,565) $40,733

Intersegment revenues 31 — 94 56 (181) — —

Total segment operating revenues 36,449 19,565 3,759 706 (181) (19,565) 40,733

Operations and support expenses 25,233 14,960 1,644 567 (176) (14,960) 27,268

Depreciation and amortization expenses 7,322 3,077 9 236 (3) (3,077) 7,564

Total segment operating expenses 32,555 18,037 1,653 803 (179) (18,037) 34,832

Segment operating income 3,894 1,528 2,106 (97) (2) (1,528) 5,901

Interest expense — 900 — — 1,023 (900) 1,023

Interest income — 12 — — 492 (12) 492

Equity in net income of affiliates — (415) — 873 — 415 873

Other income (expense) – net — (82) — — 922 82 922

Segment income before income taxes 3,894 143 2,106 776 389 (143) 7,165

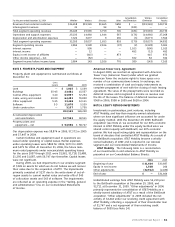

American Tower Corp. Agreement

In August 2000, we reached an agreement with American

Tower Corp. (American Tower) under which we granted

American Tower the exclusive rights to lease space on a

number of our communications towers. In exchange, we

received a combination of cash and equity instruments as

complete prepayment of rent with the closing of each leasing

agreement. The value of the prepayments were recorded as

deferred revenue and recognized in income as revenue over

the life of the leases. The balance of deferred revenue was

$568 in 2006, $598 in 2005 and $628 in 2004.

NOTE 6. EQUITY METHOD INVESTMENTS

Investments in partnerships, joint ventures, including

AT&T Mobility, and less-than majority-owned subsidiaries

where we have significant influence are accounted for under

the equity method. Until the December 29, 2006 BellSouth

acquisition (see Note 2), we accounted for our 60% economic

interest in AT&T Mobility under the equity method since we

shared control equally with BellSouth, our 40% economic

partner. We had equal voting rights and representation on the

board of directors that controlled AT&T Mobility. As a result of

the BellSouth acquisition, AT&T Mobility became a wholly-

owned subsidiary of AT&T and is reported in our wireless

segment and our Consolidated Statements of Income.

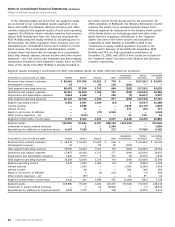

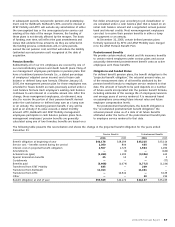

AT&T Mobility The following table is a reconciliation

of our investments in and advances to AT&T Mobility as

presented on our Consolidated Balance Sheets:

2006 2005

Beginning of year $ 31,404 $33,687

Equity in net income 1,508 200

Other adjustments (32,912) (2,483)

End of year $ — $31,404

Undistributed earnings from AT&T Mobility were $4,219 prior

to the BellSouth acquisition at December 29, 2006, and

$2,711 at December 31, 2005. “Other adjustments” in 2006

primarily represents the consolidation of AT&T Mobility as a

wholly-owned subsidiary of AT&T as a result of the BellSouth

acquisition. “Other adjustments” in 2005 included the net

activity of $2,442 under our revolving credit agreement with

AT&T Mobility, reflecting a repayment of their shareholder loan

of $1,747 and a net repayment of their revolving credit

balance of $695 (see Note 14).

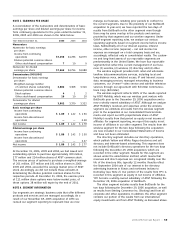

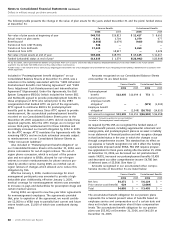

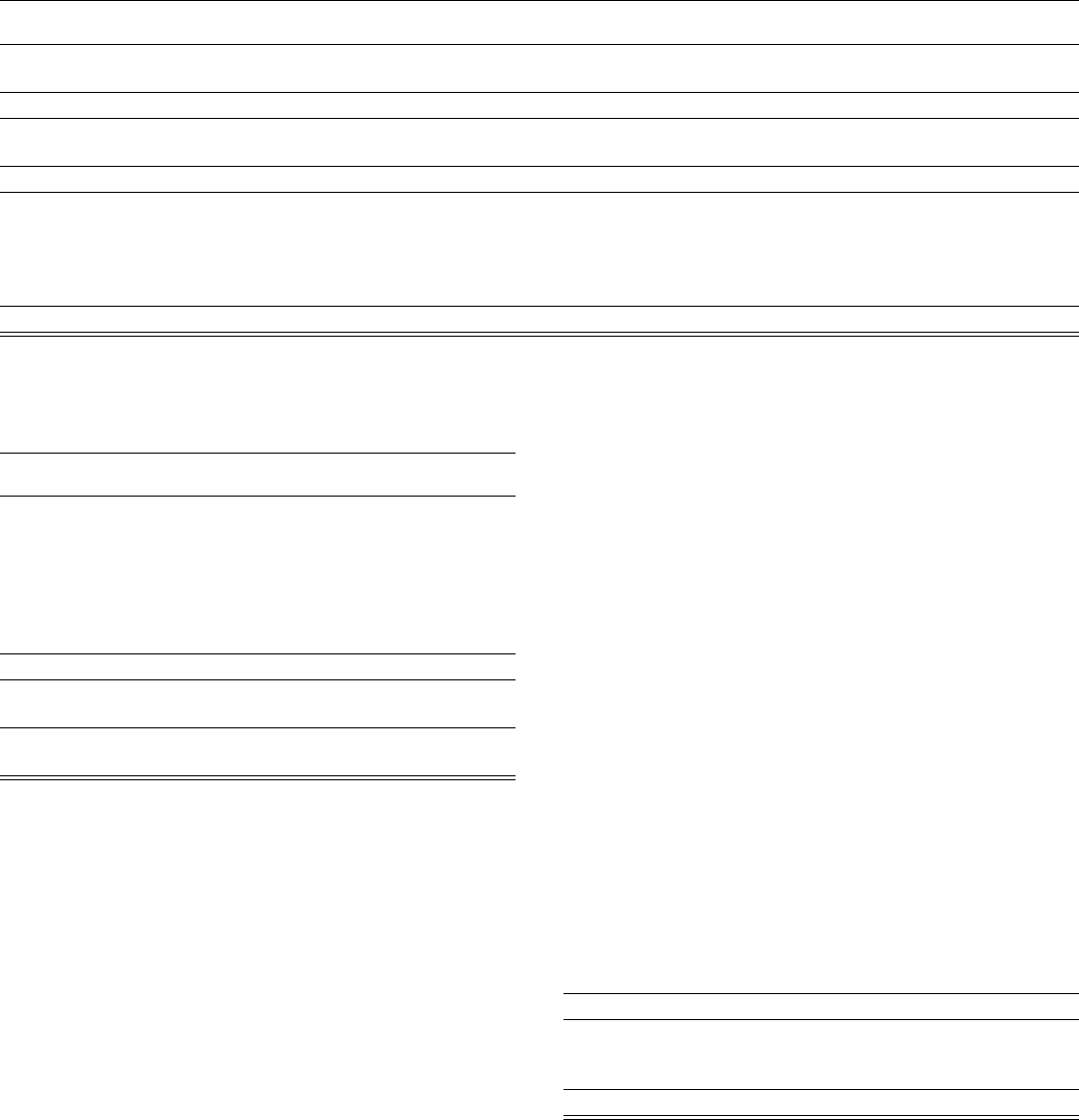

NOTE 5. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment is summarized as follows at

December 31:

Lives

(years) 2006 2005

Land — $ 1,925 $ 1,169

Buildings 35-45 23,481 15,557

Central office equipment 3-10 63,997 57,254

Cable, wiring and conduit 10-50 64,483 55,858

Other equipment 5-15 33,448 12,111

Software 3-5 11,678 5,539

Under construction — 3,137 1,750

202,149 149,238

Accumulated depreciation

and amortization 107,553 90,511

Property, plant and

equipment – net $ 94,596 $ 58,727

Our depreciation expense was $8,874 in 2006, $7,372 in 2005

and $7,447 in 2004.

Certain facilities and equipment used in operations are

leased under operating or capital leases. Rental expenses

under operating leases were $869 for 2006, $473 for 2005

and $479 for 2004. At December 31, 2006, the future mini-

mum rental payments under noncancelable operating leases

for the years 2007 through 2011 were $1,961, $1,718, $1,488,

$1,295 and $1,087, with $6,747 due thereafter. Capital leases

were not significant.

During 2005, we had impairments in our wireline segment

of $349 on assets for which we do not believe we will recover

their value due to the acquisition of ATTC. The impairments

primarily consisted of $237 due to the write-down of out-of-

region assets to current market value and write-offs of $45

of collocation assets and $43 of software. The impairments

are reflected as an operating expense in the “Selling, general

and administrative” line on our Consolidated Statements

of Income.