AT&T Wireless 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 : :

2006 AT&T Annual Report

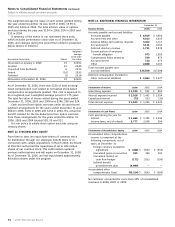

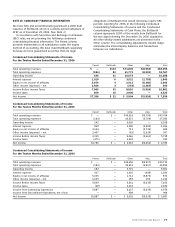

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

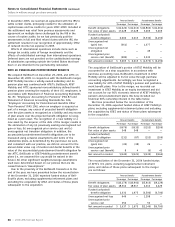

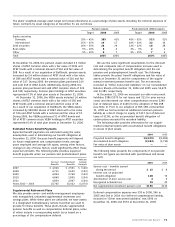

Summarized financial information for the Illinois and

northwest Indiana directory advertising business is as follows:

Year ended December 31, 2006 2005 2004

Operating revenues $ — $ — $311

Operating income — — 132

Income taxes — — 51

Net income from operations — — 81

Gain on disposal, net of tax — — 827

The assets and liabilities of the discontinued operations were

$0 as of December 31, 2006 and 2005.

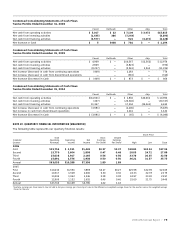

NOTE 16. CONTINGENT LIABILITIES

In addition to issues specifically discussed elsewhere, we are

party to numerous lawsuits, regulatory proceedings and other

matters arising in the ordinary course of business. In accordance

with Statement of Financial Accounting Standards No. 5,

“Accounting for Contingencies,” in evaluating these matters

on an ongoing basis, we take into account amounts already

accrued on the balance sheet. In our opinion, although the

outcomes of these proceedings are uncertain, they should

not have a material adverse effect on our financial position,

results of operations or cash flows.

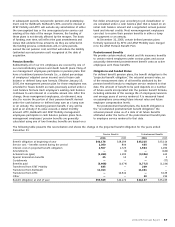

We have contractual obligations to purchase certain goods

or services from various other parties. Our purchase obliga-

tions are expected to be approximately $2,564 in 2007,

$2,100 in total for 2008 and 2009, $802 in total for 2010 and

2011 and $331 in total for years thereafter.

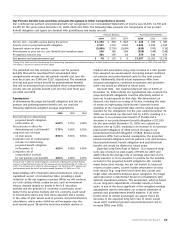

NOTE 17. SUBSEQUENT EVENT

As part of the dissolution of AT&T Mobility’s joint venture

agreement with T-Mobile USA (T-Mobile), both parties were

required to exchange certain spectrum licenses and we

committed to purchase a minimum number of minutes on

T-Mobile’s California/Nevada and New York networks during

a specified transition period. In January 2007, we received

10 MHz of spectrum in the New York market; T-Mobile

received 5 MHz of spectrum in each of nine markets in

California, the largest of which is San Diego. T-Mobile also

notified us of its intent to exercise its option to purchase an

additional 10 MHz of spectrum in the San Diego market, with

the transaction closing expected during the second quarter

of 2007. Concurrent with T-Mobile’s notification to purchase

the San Diego spectrum, T-Mobile communicated to us that

it will not exercise its option to purchase 10 MHz of spectrum

in the Los Angeles market.

We expect to record a net gain in connection on these

transactions, estimated to be between $150 to $250 net of

tax, principally due to the value of the New York spectrum

received. The gain is net of $55 of costs previously deferred,

which related to parts of the dissolution transaction com-

pleted in prior periods. This gain is subject to valuation

revisions of the assets exchanged and the resolution of

remaining business matters governed by the dissolution

agreement.

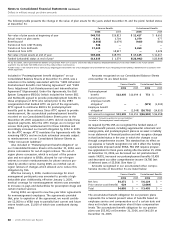

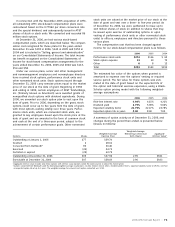

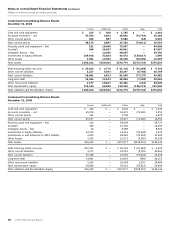

NOTE 14. TRANSACTIONS WITH AT&T MOBILITY

Prior to our December 29, 2006 acquisition of BellSouth (see

Note 2), we and BellSouth, the two owners of AT&T Mobility,

each made a subordinated loan to AT&T Mobility (shareholder

loans). Our shareholder loan to AT&T Mobility totaled $4,108

at December 31, 2005. This loan carried an annual 6.0%

interest rate. We and BellSouth also entered into a revolving

credit agreement with AT&T Mobility to provide short-term

financing for operations. Our share of advances to AT&T

Mobility under the revolving credit agreement was $307 at

December 31, 2005, and is reflected in “Investments in and

Advances to AT&T Mobility” on our Consolidated Balance

Sheet. During 2005, AT&T Mobility repaid $1,747 to reduce the

balance of its shareholder loan in accordance with the terms

of the revolving credit agreement. Following the BellSouth

acquisition, mentioned above, both our shareholder loan and

our revolving credit agreement with AT&T Mobility were

consolidated and do not appear on our Consolidated Balance

Sheet at December 31, 2006. We earned interest income on

our shareholder loan of $246 during 2006, $311 in 2005 and

$354 in 2004.

Prior to our December 29, 2006 acquisition of BellSouth,

we generated revenues of $1,466 in 2006, $869 in 2005 and

$602 in 2004 for services sold to AT&T Mobility. These

revenues were primarily from access and long-distance

services sold to AT&T Mobility on a wholesale basis and

commissions revenue related to customers added through

AT&T sales sources. The offsetting expense amounts were

recorded by AT&T Mobility, and 60% of these expenses were

included in our “Equity in net income of affiliates” line on our

Consolidated Statements of Income when we reported our

60% proportionate share of AT&T Mobility’s results.

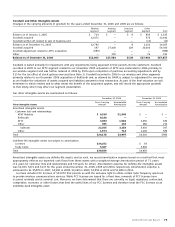

NOTE 15. DISCONTINUED OPERATIONS

In September 2004, we sold our interest in the directory

advertising business in Illinois and northwest Indiana to

Donnelley and received net proceeds of $1,397. As part of

this transaction we recorded a gain of $1,357 ($827 net of

tax) in our 2004 results.

In accordance with Statement of Financial Accounting

Standards No. 144, “Accounting for Impairment or Disposal of

Long-Lived Assets,” we have reclassified the results from our

directory advertising business in Illinois and northwest Indiana

as discontinued operations, restating previously reported

results to reflect the reclassification on a comparable basis.

The operational results and the gain associated with the sale

of this business are presented in the “Income From Discontin-

ued Operations, net of tax” line item on our Consolidated

Statements of Income. Prior to the reclassification, these

results were reported in our directory segment.