AT&T Wireless 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

25

Wireless

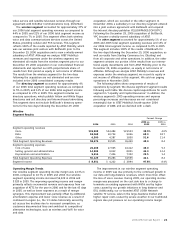

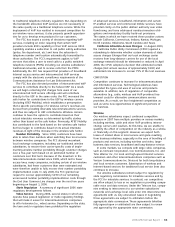

Segment Results

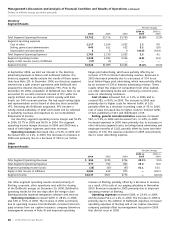

Percent Change1

2006 vs. 2005 vs.

2006 2005 2004 2005 2004

Segment operating revenues

Service $33,756 $30,638 $17,602 10.2% —

Equipment 3,750 3,795 1,963 (1.2) —

Total Segment Operating Revenues 37,506 34,433 19,565 8.9 —

Segment operating expenses

Cost of services and equipment sales 15,056 14,387 7,611 4.7 —

Selling, general and administrative 11,447 11,647 7,349 (1.7) —

Depreciation and amortization 6,436 6,575 3,077 (2.1) —

Total Segment Operating Expenses 32,939 32,609 18,037 1.0 —

Segment Operating Income 4,567 1,824 1,528 — 19.4

Interest Expense 1,186 1,260 900 (5.9) 40.0

Equity in Net Income (Loss) of Affiliates — 5 (415) — —

Other – net (139) (38) (70) — 45.7

Segment Income $ 3,242 $ 531 $ 143 — —

1

AT&T Mobility’s 2005 operating revenue and expense percentage increases and decreases are not considered meaningful due to AT&T Mobility’s fourth-quarter 2004 acquisition

of AWE and are denoted with a dash.

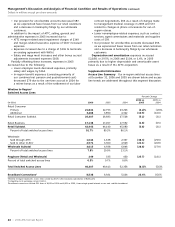

Wireless Customer and Operating Trends

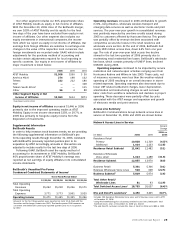

As of December 31, 2006, we served 61.0 million wireless

customers, compared to 54.1 million at December 31, 2005

and 49.1 million at December 31, 2004. Wireless customer

net additions increased 37.7% in 2006 and 50.0% in 2005

with 54% of the 2006 net additions coming from postpaid

customers, 28% from resellers and 18% from prepaid

customers. Postpaid customer growth was driven by lower

churn, which benefited from network and customer service

improvements and continued high levels of advertising over

the past year. Also contributing to the increase in net

additions was a significant increase in prepaid gross additions.

Gross customer additions were 19.2 million in 2006 and

18.5 million in 2005. Postpaid customer gross additions

declined due to the streamlining of operations, such as the

reduction of retail stores and agents, and fewer customers

switching to AT&T Mobility from other providers related to

lower industry churn.

Competition, lower industry churn and increased wireless

penetration as the wireless market matures will continue to

impact wireless gross additions, revenue growth, expenses

and put pressure on margins. We expect that future revenue

growth will become increasingly dependent on minimizing

customer turnover (customer churn) and on increasing service

average revenue per user/customer (ARPU).

Our wireless segment ARPU has weakened slightly over

the past several years, as we have offered a broader array of

plans to expand our customer base, including increased

growth among lower-ARPU prepaid and reseller customers.

We have also responded to increasing competition, resulting

in pricing reductions. Additionally, the increase in prepaid and

reseller customers over the past year has contributed to the

decline in ARPU. We expect continued pressure on ARPU,

despite our increasing revenue from data services.

Accounting for AT&T Mobility

The wireless segment reflects 100% of the results reported by

AT&T Mobility (formerly Cingular), which was our wireless joint

venture with BellSouth prior to the December 29, 2006

acquisition and became a wholly-owned subsidiary of AT&T.

Prior to the acquisition of BellSouth, we accounted for our

60% economic interest in our AT&T Mobility joint venture

under the equity method of accounting in our consolidated

financial statements. This means that for periods prior to the

acquisition, our consolidated results included AT&T Mobility’s

results in the “Equity in net income of affiliates” line. Once the

acquisition closed and AT&T Mobility became a wholly-owned

subsidiary, GAAP requires that results from the wireless

segment be included as operating revenues and expenses

in our consolidated results. Accordingly, results from this

segment for the last two days of 2006 were included as

operating revenues and expenses and not in the “Equity in

net income of affiliates” line.

When analyzing our segment results, we evaluate AT&T

Mobility’s results on a stand-alone basis using information

provided by AT&T Mobility during the year. For periods before

the acquisition, including 100% of AT&T Mobility’s results in

our wireless segment operations (rather than 60% in equity

in net income of affiliates) affected the presentation of this

segment’s revenues, expenses, operating income, nonoperating

items and segment income but did not affect our consolidated

net income.

Acquisition of AT&T Wireless Services, Inc. (AWE)

On October 26, 2004, AT&T Mobility acquired AWE for approxi-

mately $41,000 in cash. We and BellSouth funded, by means

of an equity contribution to AT&T Mobility, a significant portion

of the acquisition’s purchase price. Based on our 60% equity

ownership of AT&T Mobility, and after taking into account cash

on hand at AWE, we provided approximately $21,600 to fund

the purchase price.