AT&T Wireless 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

41

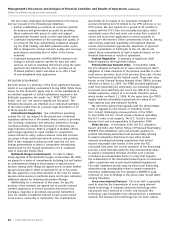

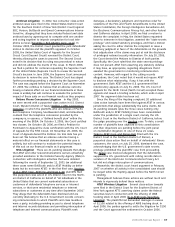

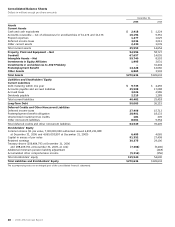

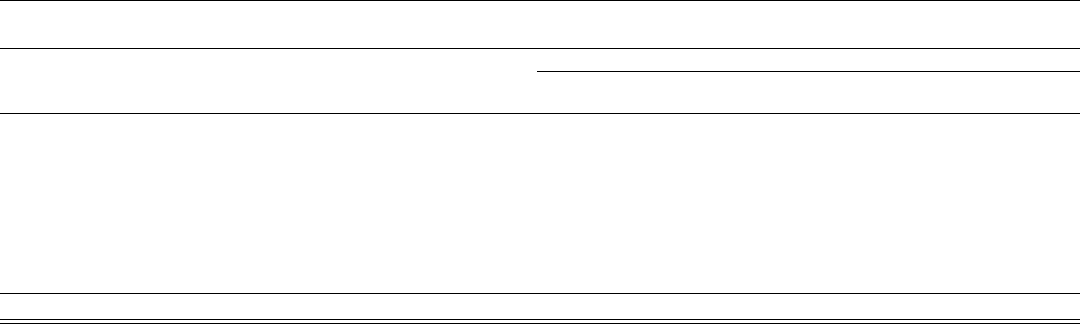

Contractual Obligations

Payments Due By Period

Less than 1-3 3-5 More than

Total 1 Year Years Years 5 Years

Long-term debt obligations1 $51,863 $ 4,400 $ 9,814 $ 9,738 $27,911

Commercial paper obligations 5,214 5,214 — — —

Other short-term borrowings 105 105 — — —

Operating lease obligations 14,296 1,961 3,206 2,382 6,747

Purchase obligations2,3 5,797 2,564 2,100 802 331

Other long-term obligations4 2,865 632 1,181 755 297

Retirement benefit funding obligation 1,000 — 1,000 — —

Severance obligations 980 902 78 — —

Total Contractual Obligations $82,120 $15,778 $17,379 $13,677 $35,286

1 The impact of premiums/discounts and derivative instruments included in debt amounts on the balance sheet are excluded from the table.

2 We have contractual obligations to utilize network facilities from local exchange carriers with terms greater than one year. Since the contracts have no minimum volume require-

ments and are based on an interrelationship of volumes and discounted rates, we assessed our minimum commitment based on penalties to exit the contracts, assuming that

we had exited the contracts on December 31, 2006. At December 31, 2006, the penalties we would have incurred to exit all of these contracts would have been $897. These

termination fees could be $623 in 2007, $413 in the aggregate for 2008 and 2009 and $4 for 2010, assuming that all contracts are exited. These termination fees are excluded

from the above table as the fees would not be paid every year and the timing of such payments, if any, is uncertain.

3 We calculated the minimum obligation for certain agreements to purchase goods or services based on termination fees that can be paid to exit the contract. If we elect to exit

these contracts, termination fees for all such contracts in the year of termination could be approximately $244 in 2007, $336 in the aggregate for 2008 and 2009, $140 in the

aggregate for 2010 and 2011 and $0 in the aggregate, thereafter. Certain termination fees are excluded from the above table as the fees would not be paid every year and the

timing of such payments, if any, is uncertain.

4 Other long-term obligations includes commitments with local exchange carriers for dedicated leased lines.

MARKET R I S K

We are exposed to market risks primarily from changes in

interest rates and foreign currency exchange rates. In manag-

ing exposure to these fluctuations, we may engage in various

hedging transactions that have been authorized according to

documented policies and procedures. On a limited basis, we

use certain derivative financial instruments, including foreign

currency exchange contracts and combined interest rate

foreign currency contracts to manage these risks. We do not

use derivatives for trading purposes, to generate income or to

engage in speculative activity. Our capital costs are directly

linked to financial and business risks. We seek to manage the

potential negative effects from market volatility and market

risk. The majority of our financial instruments are medium-

and long-term fixed rate notes and debentures. Fluctuations in

market interest rates can lead to significant fluctuations in the

fair value of these notes and debentures. It is our policy to

manage our debt structure and foreign exchange exposure in

order to manage capital costs, control financial risks and

maintain financial flexibility over the long term. Where

appropriate, we will take actions to limit the negative effect of

interest and foreign exchange rates, liquidity and counterparty

risks on stockholder value.

We enter into foreign currency contracts to minimize our

exposure to risk of adverse changes in currency exchange

rates. We are subject to foreign exchange risk for foreign

currency-denominated transactions, such as debt issued,

recognized payables and receivables and forecasted

transactions. At December 31, 2006, our foreign currency

exposures were principally Euros, British pound sterling,

Danish krone and Japanese Yen.

QUAN T ITATI V E INFOR MATIO N ABOUT MARK ET RI SK

In order to determine the changes in fair value of our various

financial instruments, we use certain financial modeling

techniques. We apply rate-sensitivity changes directly to our

interest rate swap transactions and forward rate sensitivity to

our foreign currency-forward contracts.

The changes in fair value, as discussed below, assume

the occurrence of certain market conditions, which could

have an adverse financial impact on AT&T and do not

represent projected gains or losses in fair value that we

expect to incur. Future impacts would be based on actual

developments in global financial markets. We do not foresee

any significant changes in the strategies used to manage

interest rate risk, foreign currency rate risk or equity price

risk in the near future.