AT&T Wireless 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 : :

2006 AT&T Annual Report

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

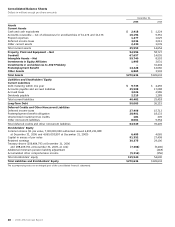

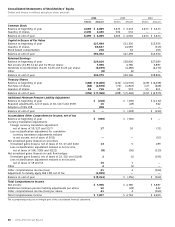

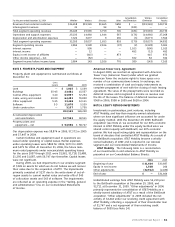

The following table summarizes the preliminary estimated

fair values of the BellSouth assets acquired and liabilities

assumed and related deferred income taxes as of acquisition

date. Included in the liabilities assumed at the acquisition was

$535 for accrued severance.

BellSouth

Assets acquired

Current assets $ 4,875

Property, plant and equipment 18,498

Intangible assets not subject to amortization

Trademark/name 330

Licenses 214

Intangible assets subject to amortization

Customer lists and relationships 9,230

Patents 100

Trademark/name 211

Investment in AT&T Mobility 32,759

Other investments 2,446

Other assets 11,211

Goodwill 26,467

Total assets acquired 106,341

Liabilities assumed

Current liabilities, excluding current

portion of long-term debt 5,288

Long-term debt 15,628

Deferred income taxes 10,318

Postemployment benefit obligation 7,086

Other noncurrent liabilities 1,223

Total liabilities assumed 39,543

Net assets acquired $ 66,798

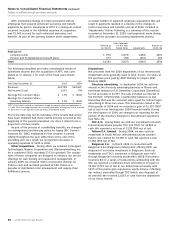

Goodwill of $26,467 resulting from the acquisition of Bell-

South was assigned to the other segment. In addition,

BellSouth’s investment in AT&T Mobility’s and YPC’s goodwill

was recorded as a result of this acquisition. However, as part

of the final valuation of the acquisition, we will determine to

which reporting units and to what extent the benefit of the

acquisition applies, and as required by GAAP, record the

appropriate goodwill to each reporting unit. Goodwill includes

a portion of value for assembled workforce which is not

separately classified from goodwill in accordance with FAS

141. The purchased intangibles and goodwill are not deduct-

ible for tax purposes. However, purchase accounting allows for

the establishment of deferred tax liabilities on purchased

intangibles (other than goodwill), which will be reflected as a

tax benefit on our future Consolidated Statements of Income

in proportion to and over the amortization period of the

related intangible asset.

Substantially all of the licenses acquired have an indefinite

life, and accordingly, are not subject to amortization. The

customer relationship intangible assets will be amortized

over the following weighted periods using the sum-of-the-

months-digits method of amortization: 5 years for consumer

customers, 9.6 years for business customers and 7 years for

directory customers. This sum-of-the-months-digits method of

amortization best reflects the estimated pattern in which the

economic benefits will be consumed.

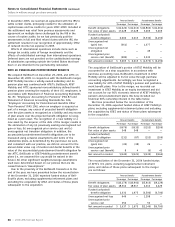

BellSouth’s 40% economic ownership of AT&T Mobility has

been recorded above as “Investment in AT&T Mobility,” and

has been eliminated in our Consolidated Balance Sheets. We

have recorded the consolidation of AT&T Mobility as a step

acquisition, retaining 60% of AT&T Mobility’s prior book value

and adjusting the remaining 40% to fair value as shown below.

AT&T Mobility

60% at 40% at

Book Fair

Value Value Total

Assets acquired

Current assets $ 4,218 $ 2,770 $ 6,988

Property, plant and equipment 14,118 5,569 19,687

Intangible assets not

subject to amortization

Licenses 15,952 18,027 33,979

Intangible assets subject

to amortization

Customer lists and

relationships 1,028 6,555 7,583

Trademark/name 7 336 343

Other 79 97 176

Other assets 439 647 1,086

Goodwill 13,078 14,351 27,429

Total assets acquired 48,919 48,352 97,271

Liabilities assumed

Current liabilities, excluding

current portion of

long-term debt 4,224 2,790 7,014

Intercompany debt 5,504 3,539 9,043

Long-term debt 7,570 4,989 12,559

Deferred income taxes 2,298 3,161 5,459

Postemployment benefit

obligation 163 138 301

Other noncurrent liabilities 1,031 976 2,007

Total liabilities assumed 20,790 15,593 36,383

Net assets acquired $28,129 $32,759 $60,888

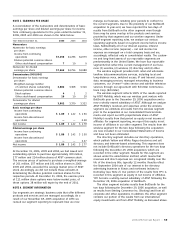

Substantially all of the licenses acquired have an indefinite

life, and accordingly, are not subject to amortization. The

majority of customer relationship intangible assets are being

amortized over a weighted-average period of 6.4 years using

the sum-of-the-months-digits method. This method best

reflects the estimated pattern in which the economic benefits

will be consumed. Other intangible assets and other noncur-

rent liabilities include lease and sublease contracts, which are

amortized over the remaining terms of the underlying leases

and have a weighted-average amortization period of 6.4 years.