AT&T Wireless 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

29

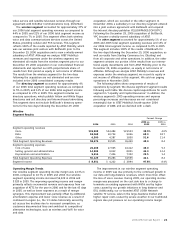

Our other segment includes our 60% proportionate share

of AT&T Mobility results as equity in net income of affiliates.

With the December 29, 2006 close of the BellSouth merger,

we own 100% of AT&T Mobility and its results for the final

two days of the year have been excluded from equity in net

income of affiliates. Our other segment also includes our

equity investments in international companies, the income

from which we report as equity in net income of affiliates. Our

earnings from foreign affiliates are sensitive to exchange-rate

changes in the value of the respective local currencies. Our

foreign investments are recorded under GAAP, which include

adjustments for the purchase method of accounting and

exclude certain adjustments required for local reporting in

specific countries. Our equity in net income of affiliates by

major investment is listed below:

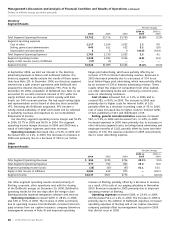

2006 2005 2004

AT&T Mobility $1,508 $200 $ 30

América Móvil 274 198 132

Telmex 222 212 180

TDC1 — — 328

Telkom South Africa1 — — 115

Other 56 4 88

Other Segment Equity in Net

Income of Affiliates $2,060 $614 $873

1Investment sold in 2004.

Equity in net income of affiliates increased $1,446 in 2006

primarily due to the improved operating results at AT&T

Mobility. Equity in net income decreased $259, or 29.7%, in

2005 due primarily to foregone equity income from the

disposition of investments.

Supplemental Information

BellSouth Results

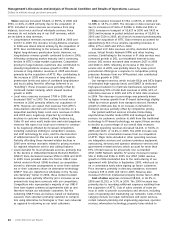

In order to help investors track business trends, we are providing

the following supplemental information on BellSouth’s pro

forma operating results through December 31, 2006, consistent

with BellSouth’s previously reported quarters prior to its

acquisition by AT&T. Accordingly, amounts in this section are

adjusted to include results for the last two days of 2006.

Following GAAP, BellSouth used the equity method of

accounting for its investment in AT&T Mobility. BellSouth’s

40% proportionate share of AT&T Mobility’s earnings was

reported as net earnings of equity affiliates in its consolidated

income statements.

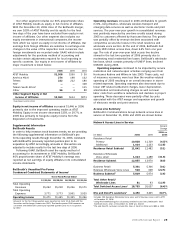

BellSouth’s Unaudited Pro Forma

Condensed Combined Statements of Income1

Three-Month Period Ended

12/31/06 09/30/06 06/30/06 03/31/06

Total Operating

Revenues $5,242 $5,218 $5,206 $5,171

Total Operating

Expenses 3,771 3,773 3,901 3,925

Operating Income $1,471 $1,445 $1,305 $1,246

1

Amounts for the first three quarters were reported on Form 10-Q, filed with the

Securities and Exchange Commission (SEC). The fourth-quarter 2006 amounts are

consistent with BellSouth’s previously reported quarters prior to its acquisition

by AT&T.

Operating revenues increased in 2006 attributable to growth

in DSL, long distance, wholesale wireless transport and

emerging data services as well as electronic media and print

services. The year-over-year growth in consolidated revenues

was positively impacted by one-time credits issued during

2005 to customers affected by Hurricane Katrina. This growth

was partially offset by revenue declines associated with

competitive access line losses in the retail residence and

wholesale voice sectors. At the end of 2006, BellSouth had

nearly 18.8 million access lines, down 6.4% from one year

ago. The rate of year-over-year total access line decline

slowed in the last two quarters of 2006 primarily due to

moderating retail residential line losses. BellSouth’s wholesale

line base, which consists primarily of UNE-P lines, declined

638,000 during 2006.

Operating expenses continued to be impacted by service

restoration and network-repair activities carrying over from

Hurricanes Katrina and Wilma in late 2005. These costs, net

of insurance recoveries, were less than the weather-related

spending of 2005 resulting in an overall decrease in storm-

related expenses. Operating expenses also decreased due to

lower USF related settlement charges, lower depreciation,

amortization and restructuring charges as well as lower

labor costs from workforce reductions and declines in project

spending. These decreases were partially offset by costs

associated with the AT&T merger and expansion and growth

of electronic media and print services.

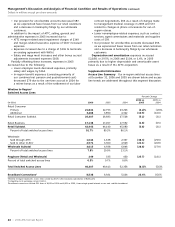

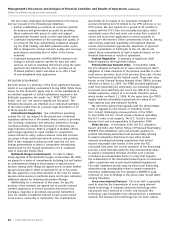

Access Line Summary

BellSouth’s Communications Group network access lines in

service at December 31, 2006 and 2005 are shown below:

Network Access Lines in Service

Percent

Change

2006 vs.

(In 000s) 2006 2005 2005

Residence Retail

Primary 10,828 11,319 (4.3)%

Additional 1,014 1,163 (12.8)

Residence Retail Subtotal 11,842 12,482 (5.1)

Residence Wholesale

Voice Lines1 1,013 1,488 (31.9)

Residence Subtotal 12,855 13,970 (8.0)

Business Retail 5,301 5,306 (0.1)

Business Wholesale Voice Lines 518 668 (22.5)

Business Subtotal1 5,819 5,974 (2.6)

Total Other Retail/

Wholesale Lines 81 93 (12.9)

Total Switched Access Lines2 18,755 20,037 (6.4)%

DSL and DirecTV customers3 4,450 3,405 30.7%

1 Includes 205 Residence Wholesale Voice Lines and 57 Business Lines sold to ATTC

at December 31, 2006.

2 Using AT&T methodology for calculating switched access lines, BellSouth’s Total

Switched Access Lines at December 31, 2006 was 20,163.

3 DSL and DirecTV customers include DSL lines of 3,632 in 2006 and 2,882 in 2005.