AT&T Wireless 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

35

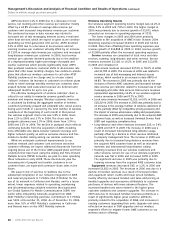

Pension and Postretirement Benefits Our actuarial

estimates of retiree benefit expense and the associated

significant weighted-average assumptions are discussed in

Note 10. One of the most significant of these assumptions is

the return on assets assumption, which was 8.5% for the year

ended December 31, 2006. This assumption will remain

unchanged for 2007. If all other factors were to remain

unchanged, we expect that a 1% decrease in the expected

long-term rate of return would cause 2007 combined pension

and postretirement cost to increase $802 over 2006. The

10-year returns on our pension plan were 10.2% through

2006, including returns in excess of our assumed rate of

return for 2006. Under GAAP, the expected long-term rate

of return is calculated on the market-related value of assets

(MRVA). GAAP requires that actual gains and losses on

pension and postretirement plan assets be recognized in the

MRVA equally over a period of up to five years. We use a

methodology, allowed under GAAP, under which we hold the

MRVA to within 20% of the actual fair value of plan assets,

which can have the effect of accelerating the recognition of

excess actual gains and losses into the MRVA in less than five

years. This methodology did not have a significant additional

effect on our 2006, 2005 or 2004 combined net pension and

postretirement costs. Note 10 also discusses the effects of

certain changes in assumptions related to medical trend rates

on retiree health care costs.

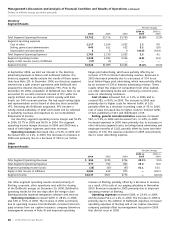

Depreciation Our depreciation of assets, including use of

composite group depreciation and estimates of useful lives, is

described in Notes 1 and 5. We assign useful lives based on

periodic studies of actual asset lives. Changes in those lives

with significant impact on the financial statements must be

disclosed, but no such changes have occurred in the three

years ended December 31, 2006. However, if all other factors

were to remain unchanged, we expect that a one-year

increase in the useful lives of the largest categories of our

plant in service (which accounts for more than three-fourths

of our total plant in service) would result in a decrease of

between approximately $2,180 and $2,610 in our 2007

depreciation expense and that a one-year decrease would

result in an increase of between $2,350 and $2,550 in our

2007 depreciation expense.

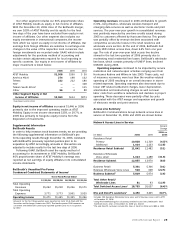

Income Taxes Our estimates of income taxes and the

significant items giving rise to the deferred assets and liabilities

are shown in Note 9 and reflect our assessment of actual

future taxes to be paid on items reflected in the financial

statements, giving consideration to both timing and probability

of these estimates. Actual income taxes could vary from these

estimates due to future changes in income tax law or results

from the final review of our tax returns by federal, state or

foreign tax authorities. We have considered these potential

changes and have provided amounts within our deferred tax

assets and liabilities that reflect our judgment of the probable

outcome of tax contingencies (see Note 9). Unfavorable

settlement of any particular issue could require use of our cash.

Favorable resolution could be recognized as a reduction to our

tax expense and cash refunds. We regularly review the amounts

provided and adjust them in light of changes in facts and

circumstances, such as the progress of a tax audit.

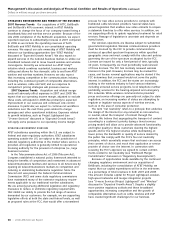

Asset Valuations and Impairments Under Statement of

Financial Accounting Standards No. 141 “Business Combina-

tions” (FAS 141), the assets and liabilities of BellSouth were

recorded at their respective preliminary fair values as of the

December 29, 2006 acquisition date, thereby recording

BellSouth’s 40% interest in AT&T Mobility’s assets and liabilities

at fair value. We obtained preliminary third-party valuations

of property, plant and equipment, intangible assets, debt and

certain other assets and liabilities. Because of the proximity of

this transaction to year-end, the values of certain assets and

liabilities are based on preliminary valuations and are subject

to adjustment as additional information is obtained. Such

additional information includes, but is not limited to, valuations

and physical counts of property, plant and equipment,

valuations of investments and the involuntary separation of

employees. Changes to the valuation of property, plant and

equipment may result in adjustments to the fair value of

certain identifiable intangible assets acquired. When finalized,

material adjustments to goodwill may result including the

segment allocation of goodwill.

The fair values of intangible assets acquired in our acquisi-

tions were based on the expected discounted cash flows of

the identified customer relationships, patents, tradenames and

licenses and are discussed in Note 2. Customer relationships,

which are finite-lived intangible assets, are primarily amortized

using the sum-of-the-months-digits method of amortization

over the period in which those relationships are expected to

contribute to our future cash flows. In determining the future

cash flows we consider demand, competition and other

economic factors. We have established the weighted-average

useful lives of BellSouth customer relationships as 5 years for

consumer customers, 9.6 years for business customers and

7 years for directory customers. Additionally, BellSouth’s

economic ownership of customer relationships acquired and

recorded at AT&T Mobility will be amortized over a weighted-

average period of 6.4 years. Useful lives of customer

relationships acquired in the ATTC acquisition were from

1.5 to 9 years for business customers and 1.5 to 2.5 years

for consumer customers.

The sum-of-the-months-digits method is a process of

allocation, not of valuation and reflects our belief that we

expect greater revenue generation from these customer

relationships during the earlier years of their lives. Alterna-

tively, we could have chosen to amortize customer relation-

ships using the straight-line method, which would allocate the

cost equally over the amortization period. In 2007, for

customer relationships identified in the BellSouth acquisition,

expected amortization using the sum-of-the-months-digits

method is $4,414 and under the straight-line method it would

be $2,693. For customer relationships identified in the ATTC

acquisition we recorded $899 of amortization expense in 2006

using the sum-of-the-months-digits method as opposed to

$579 that would have been recorded under the straight-line

method. Amortization of other intangibles, including patents

and amortizable tradenames, is determined using the straight-

line method of amortization over the expected remaining

useful lives. We do not amortize indefinite-lived intangibles,

such as wireless FCC licenses or certain trade names.