AT&T Wireless 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 : :

2006 AT&T Annual Report

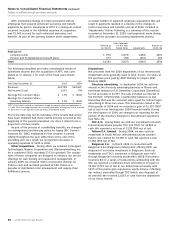

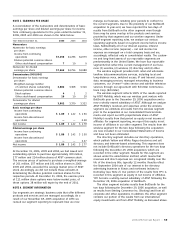

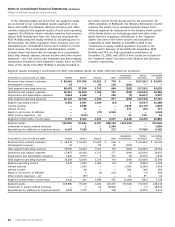

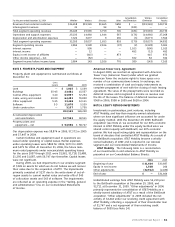

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

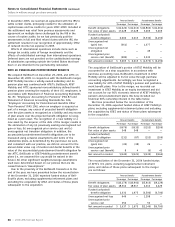

current interest rates. The carrying value of debt with an

original maturity of less than one year approximates market

value.

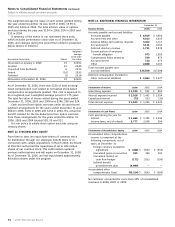

Prior to our December 29, 2006 acquisition of BellSouth

(see Note 2), we and BellSouth, the two owners of AT&T

Mobility, each made a subordinated loan to AT&T Mobility

(shareholder loans). Following the BellSouth acquisition, our

shareholder loan with AT&T Mobility was consolidated and

does not appear on our Consolidated Balance Sheet at

December 31, 2006. At December 31, 2005, our shareholder

loan to AT&T Mobility was recorded at face value, and the

carrying amounts approximate fair values.

The fair value of our EchoStar note receivable was esti-

mated based on a third-party valuation. The carrying amount

of this note was based on the present value of cash and

interest payments, which will be accreted on the note up to

the face value of $500 on a straight-line basis through August

2008.

Our available-for-sale equity securities are carried at fair

value, and realized gains and losses on these equity securities

were included in “Other income (expense) – net” on the

Consolidated Statements of Income. The fair value of our

available-for-sale equity securities was principally determined

based on quoted market prices and the carrying amount of

the remaining securities approximates fair value. Gross

realized gains on our available-for-sale equity securities were

$10 in 2006, $110 in 2005 and $323 in 2004. Gross realized

losses on these securities were $0 in 2006, $1 in 2005 and

$191 in 2004. These gains and losses were determined using

the specific identification method. Our proceeds from the

sales of our available-for-sale equity securities were $10 in

2006, $125 in 2005 and $3,188 in 2004.

Our short-term investments, other short-term and long-

term held-to-maturity investments and customer deposits are

recorded at amortized cost, and the carrying amounts approxi-

mate fair values. We held other short-term held-to-maturity

securities of $477 at December 31, 2006, compared to $3 at

December 31, 2005.

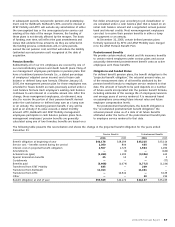

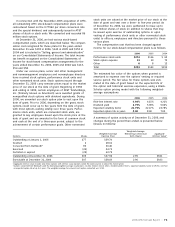

Preferred Stock Issuances In November 2005, we issued

768,391.4 shares of Perpetual Cumulative Preferred Stock

(AT&T preferred stock), par value $1 per share. The AT&T

preferred stock was issued to replace each share of ATTC

preferred stock that was issued and outstanding prior to the

November 18, 2005 acquisition and is held by a subsidiary

of ATTC.

Preferred Stock Issuances by Subsidiaries In 2002, we

restructured our holdings in certain investments, including

Sterling. As part of this restructuring, a newly created

subsidiary issued $43 of preferred stock, which was included

in “Other noncurrent liabilities” on the Consolidated Balance

Sheets. The preferred stock will accumulate dividends at an

annual rate of 5.79% and can be converted, at the option of

the holder, to common stock (but not a controlling interest)

of the subsidiary at any time.

In 2005, we redeemed $350 of an AT&T subsidiary-issued

preferred stock private placement and repaid $378 of

preferred securities previously issued by an AT&T subsidiary,

which was related to an internal restructuring of our owner-

ship in several investments.

Letters of Credit Letters of credit are guarantees we

purchase, which ensure our performance or payment to third

parties in accordance with specified terms and conditions.

Management has determined that our letters of credit do not

create additional risk to us. The notional amounts outstanding

were $478 at December 31, 2006, and $623 at December 31,

2005, and the fair values of the letters of credit, based on the

fees paid to obtain the obligations, for both periods were $1.

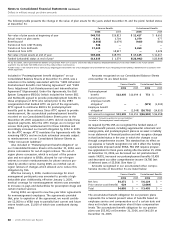

Derivatives We use interest rate swaps, interest rate

forward contracts and foreign currency exchange contracts to

manage our market risk changes in interest rates and foreign

exchange rates. We do not use financial instruments for

trading or speculative purposes. Each swap matches the exact

maturity dates of the underlying debt to which they are

related, allowing for perfectly effective hedges. Each utilized

forward contract matches the interest payments of the

underlying debt to which they are related, allowing for

perfectly effective hedges.

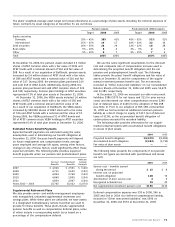

Interest Rate Swaps We had fair value interest rate swaps

with a notional value of $5,050 at December 31, 2006 and

$4,250 at December 31, 2005, with a net carrying and fair

value liability of $80 and $16, respectively. In 2006, we had

$1,000 of swaps mature in 2006 related to our repayment of

the underlying security. The net fair value liability at Decem-

ber 31, 2006, was comprised of a liability of $86 and an asset

of $6. The net fair value liability at December 31, 2005, was

comprised of a liability of $33 and an asset of $17.

Included in the above fair value interest rate swap notional

value for 2006 was interest rate swaps with a notional

amount of $1,800 acquired as a result of our acquisition of

BellSouth on December 29, 2006. These swaps were unwound

in January 2007.

Interest Rate Locks In May 2006, we entered into an

interest rate forward contract with a notional amount of $750

to partially hedge interest expense related to our debt

issuance in 2006. In 2006, we utilized a notional amount of

$600 of this forward contract and incurred settlement gains of

$4. In November 2005, we entered into an interest rate

forward contract with a notional amount of $500 to partially

hedge interest expense related to refinancing a portion of our

debt maturities in 2006. In November 2005, we utilized the

notional amount of this interest rate forward contract and

incurred settlement costs of $2. During 2004, we utilized a

notional amount of $1,500 of interest rate forward contracts

and incurred settlement costs of $302 ($196 net of tax

benefit). During 2007, we expect to reclassify into earnings

between $8 to $9, net of tax, of the previously mentioned

settlement expenses.

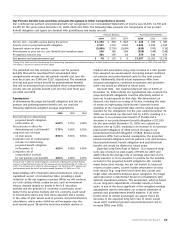

Interest Rate Foreign Currency Swaps We had combined

interest rate foreign currency swap agreements for Euro-

denominated debt, which hedge our risk to both interest

rate and currency movements. In November 2006, we repaid

the notional amount of our foreign currency swap of $636.

Upon repayment we unwound our swap asset of $284.

Additionally, we repaid the collateral associated with the

swap contract of $150, which was received by us over the

term of the swap agreement.