AT&T Wireless 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

55

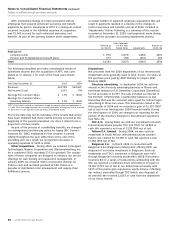

We and BellSouth jointly owned AT&T Mobility and the

Internet-based publisher YELLOWPAGES.COM (YPC). In the

AT&T Mobility joint venture, we held a 60% economic interest

and BellSouth held a 40% economic interest and in the YPC

joint venture we held a 66% economic interest and BellSouth

held a 34% economic interest. For each joint venture, control

was shared equally. We and BellSouth each accounted for the

joint ventures under the equity method of accounting,

recording the proportional share of AT&T Mobility’s and YPC’s

income as equity in net income of affiliates on the respective

consolidated statements of income and reporting the owner-

ship percentage of AT&T Mobility’s net assets as “Investments

in and Advances to AT&T Mobility” and the ownership percent-

age of YPC’s net assets as “Investments in Equity Affiliates”

on the respective consolidated balance sheets. After the

BellSouth acquisition, BellSouth, AT&T Mobility and YPC

became wholly-owned subsidiaries of AT&T.

We paid a premium (i.e., goodwill) over the fair value of the

net tangible and identified intangible assets acquired for a

number of reasons, including the following:

AT&T Mobility

• Ownership of 100% of AT&T Mobility will permit us to

better integrate AT&T Mobility offerings with our other

communication offerings. We expect that this will create

enhanced marketing opportunities, significant network

synergies resulting from the combination of multiple

Internet Protocol (IP) networks and the ability to more

rapidly develop and make available advanced products

and services. The ownership change in AT&T Mobility will

also improve the speed and focus of decision making,

which should help to develop and deliver more quickly

the new products and services customers desire.

Network Integration

• The merger will allow for the ability to integrate IP

networks of AT&T, BellSouth and AT&T Mobility into a

single fully-integrated wireless and wireline IP network

and will not only offer substantial cost-saving opportuni-

ties, but should also allow us to offer the desired

products and services demanded by customers.

• The addition of the BellSouth wireline network, which

already includes a substantial build-out of fiber-optic

cable to points near end-users, will complement our

existing plans to deploy IPTV to existing wireline service

areas and to increase the number of potential customers

for our IPTV product.

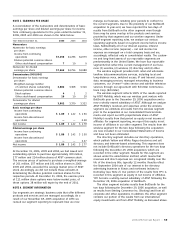

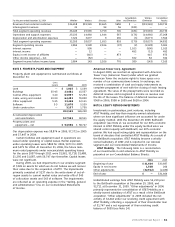

The application of purchase accounting under FAS 141,

requires that the total purchase price be allocated to the fair

value of assets acquired and liabilities assumed based on

their fair values at the acquisition date, with amounts

exceeding the fair values being recorded as goodwill. The

acquisition of BellSouth’s portion of AT&T Mobility has been

accounted for as a step acquisition. In accordance with

purchase accounting rules, BellSouth’s investment in AT&T

Mobility has been adjusted to its fair value through purchase

accounting adjustments.

The assets and liabilities of BellSouth and AT&T Mobility

have been appraised, based on third-party valuations, for

inclusion in the balance sheet, adjusting 100% of BellSouth’s

and 40% of AT&T Mobility’s values. Long-lived assets such as

property, plant and equipment will reflect a value of replacing

the assets, which takes into account changes in technology,

usage, and relative obsolescence and depreciation of the

assets, sometimes referred to as a “Greenfield approach.” This

approach often results in differences, sometimes material,

from recorded book values even if, absent the acquisition, the

assets would not be impaired. In addition, assets and liabilities

that would not normally be recorded in ordinary operations

will be recorded at their acquisition values (i.e., customer

relationships that were developed by the acquired company).

Debt instruments and investments are valued in relation to

current market conditions and other assets and liabilities are

valued based on the acquiring company’s estimates. After all

values have been assigned to assets and liabilities, the

remainder of the purchase price is recorded as goodwill.

These values are subject to adjustment for one year after the

close of the transaction as additional information is obtained.

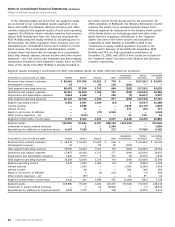

The allocation process requires an analysis of acquired

fixed assets, contracts, customer lists and relationships,

contractual commitments, legal contingencies and brand

value to identify and record the fair value of all assets

acquired and liabilities assumed. In valuing acquired assets

and assumed liabilities, fair values were based on, but not

limited to: future expected discounted cash flows for cus-

tomer relationships; current replacement cost for similar

capacity and obsolescence for certain fixed assets; compa-

rable market rates for contractual obligations and certain

investments, real estate and liabilities, including pension and

postretirement benefits; expected settlement amounts for

litigation and contingencies; and appropriate discount rates

and growth rates.

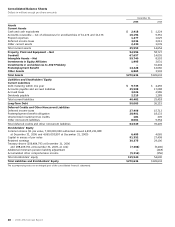

The assets and liabilities of BellSouth were recorded at

their respective fair values as of the date of the acquisition,

December 29, 2006. Additionally, we recorded BellSouth’s

ownership percentage, or 40%, of AT&T Mobility’s assets and

liabilities at their respective fair values and our ownership

percentage, or 60%, of AT&T Mobility’s assets and liabilities at

their historical, or book value. We recorded goodwill of

$54,024 as a result of the BellSouth acquisition. We have

obtained preliminary third-party valuations; however, because

of the proximity of this transaction to year-end, the values

of certain assets and liabilities are based on preliminary

valuations and are subject to adjustment as additional

information is obtained. Such additional information includes,

but is not limited to: valuations and physical counts of

property, plant and equipment, valuation of investments and

the involuntary separation of employees. We will have

12 months from the closing of the acquisition to finalize our

valuations. Changes to the valuation of property, plant and

equipment may result in adjustments to the fair value of

certain identifiable intangible assets acquired. When finalized,

material adjustments to goodwill may result.

We have not identified any material unrecorded pre-

acquisition contingencies where the related asset, liability or

impairment is probable and the amount can be reasonably

estimated. Prior to the end of the one-year purchase price

allocation period, if information becomes available that

would indicate it is probable that such events had occurred

and the amounts can be reasonably estimated, such items will

be included in the final purchase price allocation and may

adjust goodwill.