AT&T Wireless 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 : :

2006 AT&T Annual Report

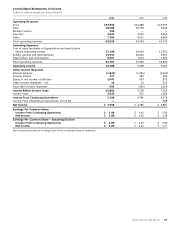

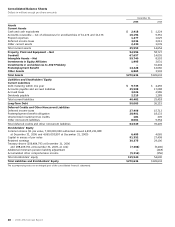

Consolidated Balance Sheets

Dollars in millions except per share amounts

December 31,

2006 2005

Assets

Current Assets

Cash and cash equivalents $ 2,418 $ 1,224

Accounts receivable – net of allowances for uncollectibles of $1,276 and $1,176 16,194 9,351

Prepaid expenses 1,477 1,029

Deferred income taxes 3,034 2,011

Other current assets 2,430 1,039

Total current assets 25,553 14,654

Property, Plant and Equipment – Net 94,596 58,727

Goodwill 67,657 14,055

Intangible Assets – Net 59,740 8,503

Investments in Equity Affiliates 1,995 2,031

Investments in and Advances to AT&T Mobility — 31,404

Postemployment Benefit 14,228 12,666

Other Assets 6,865 3,592

Total Assets $270,634 $145,632

Liabilities and Stockholders’ Equity

Current Liabilities

Debt maturing within one year $ 9,733 $ 4,455

Accounts payable and accrued liabilities 25,508 17,088

Accrued taxes 3,026 2,586

Dividends payable 2,215 1,289

Total current liabilities 40,482 25,418

Long-Term Debt 50,063 26,115

Deferred Credits and Other Noncurrent Liabilities

Deferred income taxes 27,406 15,713

Postemployment benefit obligation 28,901 18,133

Unamortized investment tax credits 181 209

Other noncurrent liabilities 8,061 5,354

Total deferred credits and other noncurrent liabilities 64,549 39,409

Stockholders’ Equity

Common shares ($1 par value, 7,000,000,000 authorized: issued 6,495,231,088

at December 31, 2006 and 4,065,093,907 at December 31, 2005) 6,495 4,065

Capital in excess of par value 91,352 27,499

Retained earnings 30,375 29,106

Treasury shares (256,484,793 at December 31, 2006

and 188,209,761 at December 31, 2005, at cost) (7,368) (5,406)

Additional minimum pension liability adjustment — (218)

Accumulated other comprehensive income (5,314) (356)

Total stockholders’ equity 115,540 54,690

Total Liabilities and Stockholders’ Equity $270,634 $145,632

The accompanying notes are an integral part of the consolidated financial statements.