AT&T Wireless 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

57

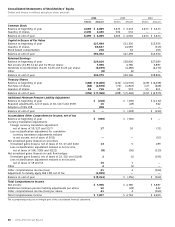

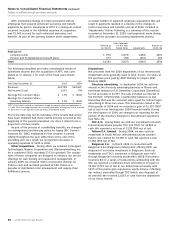

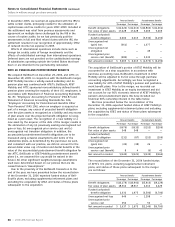

The following unaudited pro forma consolidated results of

operations assume that the acquisition of BellSouth was

completed as of January 1 for each of the fiscal years shown

below.

Year Ended December 31, 2006 2005

Revenues $116,300 $116,144

Net Income (Loss) 9,226 7,687

Earnings Per Common Share $ 1.46 $ 1.22

Earnings Per Common Share –

Assuming Dilution $ 1.46 $ 1.22

Pro forma data may not be indicative of the results that would

have been obtained had these events actually occurred at the

beginning of the periods presented, nor does it intend to be a

projection of future results.

AT&T Corp. In November 2005, we acquired ATTC in a

transaction accounted for under FAS 141, issuing 632 million

shares. ATTC was one of the nation’s largest business service

communications providers, offering a variety of global com-

munications services, including large domestic and multina-

tional businesses, small and medium-sized businesses and

government agencies, and operated one of the largest

telecommunications networks in the U.S. ATTC also provided

domestic and international long-distance and usage-based-

communications services to consumer customers. ATTC is now

a wholly-owned subsidiary of AT&T and the results of ATTC’s

operations have been included in our consolidated financial

statements after the November 18, 2005 acquisition date.

Under the purchase method of accounting, the transaction

was valued, for accounting purposes, at $15,517 and the

assets and liabilities of ATTC were recorded at their respective

fair values as of the date of the acquisition. At the time of the

acquisition, we obtained preliminary third-party valuations of

property, plant and equipment, intangible assets (including the

AT&T trade name), debt and certain other assets and liabilities.

Because of the proximity of this transaction to year-end, the

values of certain assets and liabilities at December 31, 2005

were based on preliminary valuations and were subject to

adjustment as additional information was obtained. Such

additional information included, but was not limited to:

valuations and physical counts of property, plant and equip-

ment, valuation of investments and the involuntary termina-

tion of employees.

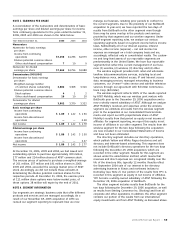

The following table summarizes the preliminary estimated

fair values of the ATTC assets acquired and liabilities assumed

and related deferred income taxes as of the acquisition date

and adjustments made thereto.

Purchase Price Allocation

As of As of

12/31/05 Adjs. 11/18/06

Assets acquired

Current assets $ 6,295 $ 358 $ 6,653

Property, plant and equipment 10,921 (489) 10,432

Intangible assets not subject

to amortization:

Trade name 4,900 — 4,900

Licenses 40 — 40

Intangible assets subject

to amortization:

Customer lists and

relationships 3,050 — 3,050

Patents 150 — 150

Brand licensing agreements 70 — 70

Investments in

unconsolidated subsidiaries 160 (90) 70

Other assets 4,247 167 4,414

Goodwill 12,343 (976) 11,367

Total assets acquired 42,176 (1,030) 41,146

Liabilities assumed

Current liabilities, excluding

current portion of

long-term debt 6,740 (176) 6,564

Long-term debt 8,293 — 8,293

Deferred income taxes 531 (173) 358

Postemployment

benefit obligation 8,807 (520) 8,287

Other noncurrent liabilities 2,288 (161) 2,127

Total liabilities assumed 26,659 (1,030) 25,629

Net assets acquired $15,517 $ — $15,517

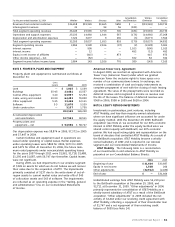

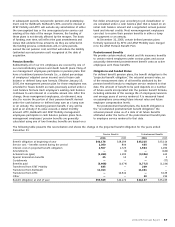

Adjustments were primarily related to property, plant and

equipment, head-count assumptions associated with payments

for involuntary employee separations, pension asset valuations

and the adjustment for certain tax items. Reductions in the

value of property, plant and equipment primarily reflect the

reduction of estimated real estate values of property in use

as well as a more comprehensive look at our fixed asset

portfolio. In addition to the deferred tax impacts associated

with valuation adjustments, a net reduction in deferred

taxes was recorded as a result of modifications to various

pre-merger tax estimates and the resolution of an ATTC IRS

audit (an adjustment of $385 for the years 1997-2001).

As ATTC stock options that were converted at the time of

the merger are exercised, the tax effect on those options may

further reduce goodwill. As of December 31, 2006, we had

recorded $13 in related reductions.