AT&T Wireless 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 : :

2006 AT&T Annual Report

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

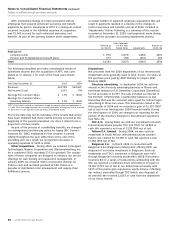

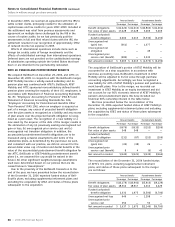

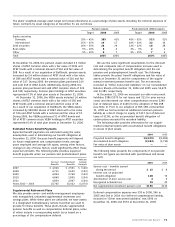

The following table presents summarized financial information

for AT&T Mobility at December 31 or for the year then ended:

2006 2005 2004

Income Statements

Operating revenues $37,506 $34,433 $19,565

Operating income 4,567 1,824 1,528

Net income 2,523 333 201

Balance Sheets

Current assets $ 7,196 $ 6,049

Noncurrent assets 90,438 73,270

Current liabilities 10,317 10,008

Noncurrent liabilities 26,318 24,333

Other Equity Method Investments Our investments in

equity affiliates include primarily international investments.

As of December 31, 2006, our investments in equity affiliates

included an 8.9% interest in Teléfonos de México, S.A. de C.V.

(Telmex), Mexico’s national telecommunications company, and

an 8.0% interest in América Móvil S.A. de C.V. (América Móvil),

primarily a wireless provider in Mexico, with telecommunica-

tions investments in the United States and Latin America. We

are a member of a consortium that holds all of the class AA

shares of Telmex stock, representing voting control of the

company. Another member of the consortium, Carso Global

Telecom, S.A. de C.V., has the right to appoint a majority of the

directors of Telmex. We also are a member of a consortium

that holds all of the class AA shares of América Móvil stock,

representing voting control of the company. Another member

of the consortium, Americas Telecom S.A. de C. V., has the

right to appoint a majority of the directors of América Móvil.

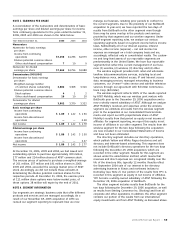

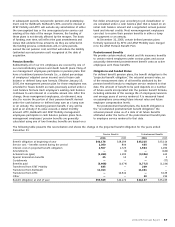

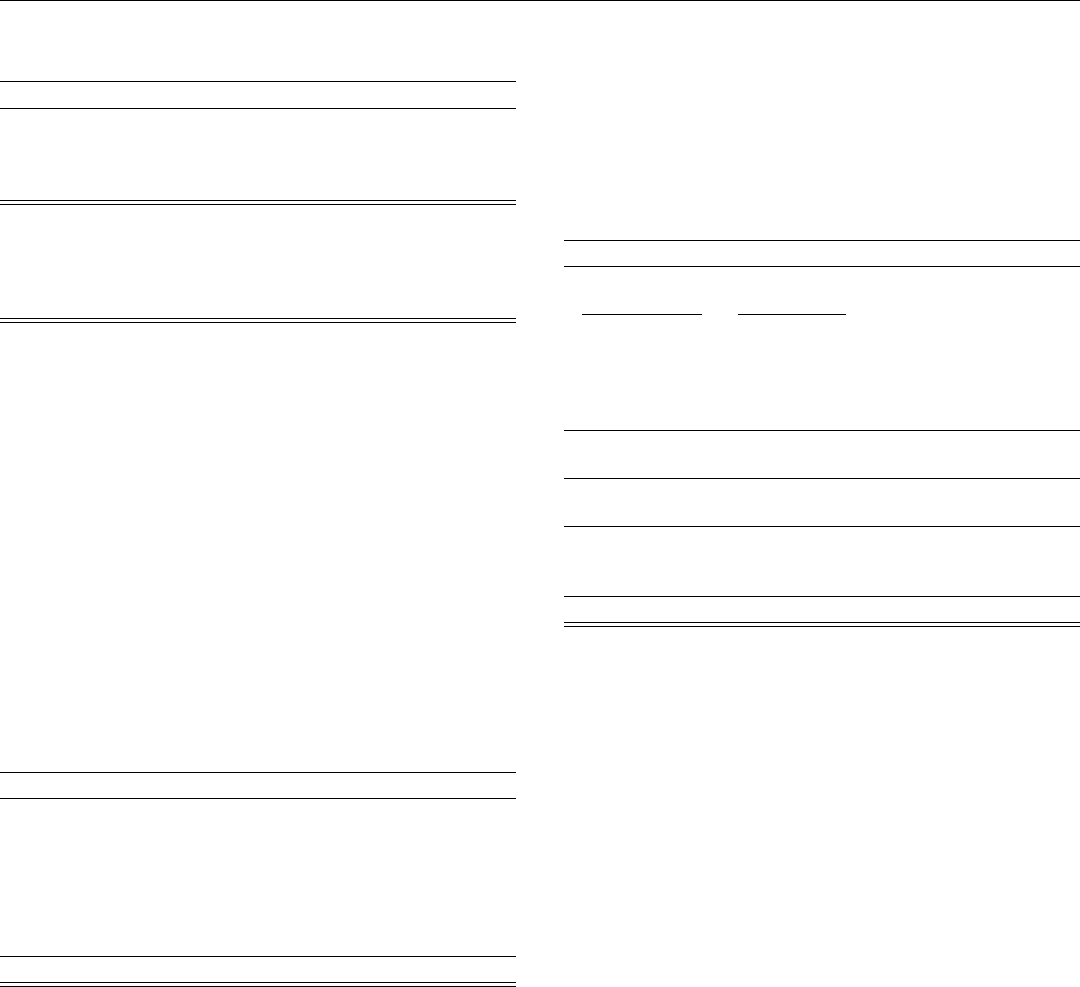

The following table is a reconciliation of our investments in

equity affiliates as presented on our Consolidated Balance Sheets:

2006 2005

Beginning of year $2,031 $1,798

Additional investments 5 6

Equity in net income of affiliates 535 409

Dividends received (97) (158)

Currency translation adjustments (22) 66

Dispositions — (228)

Other adjustments (457) 138

End of year $1,995 $2,031

Undistributed earnings from equity affiliates were $2,038 and

$1,615 at December 31, 2006 and 2005. The currency

translation adjustment for 2006 and 2005 primarily reflects

the effect of exchange rate fluctuations on our investments in

Telmex and América Móvil. “Other adjustments” for 2006

consisted primarily of $375 representing the consolidation of

the Cellular Communications of Puerto Rico, YPC and other

domestic wireless investments as wholly-owned subsidiaries

of AT&T as a result of the BellSouth acquisition and $75

representing purchase accounting revaluation of equity

investments in ATTC.

Dispositions for 2005 primarily reflect the dissolution of a

wireless partnership. “Other adjustments” for 2005 include

equity investment balances at December 31, 2005, acquired

as part of our acquisition of ATTC totaling $135, which

includes our 49% economic interest in Alestra S. de R.L. de

C.V., a telecommunications company in Mexico.

The fair value of our investment in Telmex, based on the

equivalent value of Telmex L shares at December 31, 2006,

was $2,543. The fair value of our investment in América Móvil,

based on the equivalent value of América Móvil L shares at

December 31, 2006, was $6,488.

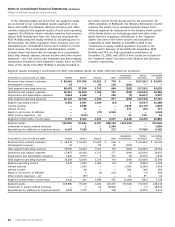

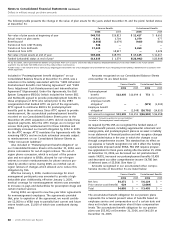

NOTE 7. DEBT

Long-term debt of AT&T and its subsidiaries, including interest

rates and maturities, is summarized as follows at December 31:

2006 2005

Notes and debentures

Interest Rates Maturities

4.13% – 5.98% 2006 – 2054 $18,571 $12,284

6.00% – 7.88% 2006 – 2097 24,685 12,700

8.13% – 9.75% 2006 – 2031 8,626 4,417

Other 141 3

Fair value of interest rate swaps (80) (16)

51,943 29,388

Unamortized premium, net of discount 2,323 639

Total notes and debentures 54,266 30,027

Capitalized leases 211 115

Total long-term debt, including

current maturities 54,477 30,142

Current maturities of long-term debt (4,414) (4,027)

Total long-term debt $50,063 $26,115

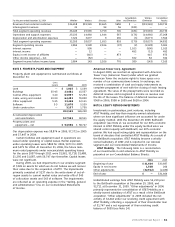

On December 29, 2006, we assumed $28,321 in long-term

debt and capital leases related to our acquisition of BellSouth

(see Note 2). The debt of AT&T Mobility was included in the

amount assumed now that it is a subsidiary of AT&T. BellSouth’s

and AT&T Mobility’s long-term debt included both fixed and

floating interest rates with a weighted-average rate of 6.7%

(ranging from 4.2% to 8.8%) and had maturities ranging from

2007 to 2097. Included in our “Total notes and debentures”

balance in the table above was the face value of acquired debt

from BellSouth and AT&T Mobility of $25,234, which had a

carrying amount of $26,968 at December 31, 2006.

Included in the table above at December 31, 2006, was

$1,734 representing the remaining excess of the fair value over

the recorded value of debt in connection with the acquisition

of BellSouth and AT&T Mobility. The excess is amortized over

the remaining lives of the underlying debt obligations.

We have debt instruments that may require us to repur-

chase the debt or which may alter the interest rate associated

with that debt. We have two issues of $1,000 Puttable Reset

Securities (PURS) at 4.2% maturing in 2021 with an annual put

option by the holder. If the holders of our PURS do not require

us to repurchase the securities, the interest rate will be reset

based on current market conditions. Since these securities can

be put to us annually, the balance is included in current

maturities of long-term debt in our balance sheet.

On November 18, 2005, we consolidated $8,293 in long-

term debt, including capital leases, related to our acquisition

of ATTC. ATTC’s debt included both fixed and floating interest

rates with a weighted-average rate of 8.6% (ranging from

3.87% to 9.75%) and had maturities ranging from 2006 to

2054. Included in our “Total notes and debentures” balance

in the table above was the face value of acquired debt from

ATTC of $6,910, which had a carrying amount of $7,694 at

December 31, 2005.