AT&T Wireless 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 : :

2006 AT&T Annual Report

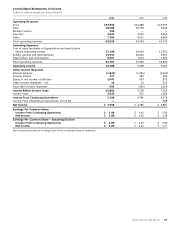

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

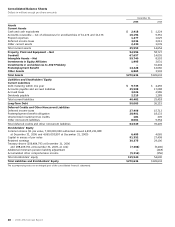

Dollars in millions except per share amounts

LIQ UIDI T Y AND C APITA L R ESO URCES

We had $2,418 in cash and cash equivalents available at

December 31, 2006. Cash and cash equivalents included cash

of $1,324, money market funds of $357 and other cash

equivalents of $737. The increase in cash and cash equivalents

of nearly $1,200 since December 31, 2005 was primarily

provided by cash receipts from operations and the net cash

received upon our acquisition of BellSouth and cash received

from the sale of non-strategic real estate and other assets.

These inflows were partially offset by cash used to meet the

needs of the business including, but not limited to, payment

of operating expenses, funding capital expenditures, dividends

to stockholders, repayment of debt, repurchase of treasury

shares, net cash provided to AT&T Mobility and increased

cash tax payments. We discuss many of these factors in

detail below.

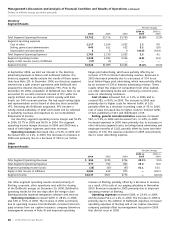

Cash Provided by or Used in Operating Activities

During 2006, our primary source of funds was cash from

operating activities of $15,615 compared to $12,974 in 2005.

Operating cash flows increased primarily due to an increase in

net income of more than $2,500 and additional cash provided

by the ATTC acquisition, partially offset by increased tax

payments of $739 in 2006. Tax payments were higher primarily

due to increased income before income taxes. Tax payments in

2006 include a refund from the completion of the ATTC federal

income tax audit covering 1997-2001. The 2006 tax payments

include amounts related to prior-year accrued liabilities. The

timing of cash payments for income taxes, which is governed

by the IRS and other taxing jurisdictions, will differ from the

timing of recording tax expense and deferred income taxes,

which are reported in accordance with GAAP.

During 2005, our primary source of funds was cash from

operating activities of $12,974 compared to $10,950 in 2004.

Operating cash flows increased in 2005 compared to 2004

primarily due to retirement benefit funding of $2,232 in 2004,

partially offset by increased tax payments in 2005 of $1,224.

The 2005 increased tax payments were mainly related to

prior-year accrued liabilities. We also made advance tax

payments, which we consider to be a refundable deposit,

to a certain state jurisdiction.

Cash Used in or Provided by Investing Activities

During 2006, cash used for investing activities consisted of:

• $8,320 in construction and capital expenditures.

• $1,089 of net funding for AT&T Mobility’s capital and

operating requirements in accordance with the terms

of our agreement with AT&T Mobility and BellSouth.

• $285 related to the acquisition of USinternetworking,

Inc., which provides managed enterprise software and

on-demand services, net of cash received.

• $130 related to the acquisition of Comergent, Inc., which

provides Internet-based services related to services

offered by our Sterling subsidiary.

• $62 related to an investment in 2Wire Inc., a privately

held company that provides services related to Project

Lightspeed.

• $50 related to the acquisition of Nistevo Corporation,

which provides Internet-based services for our Sterling

subsidiary.

During 2006, cash provided by our investing activities

primarily consisted of:

• $898 in cash received upon closing our acquisition of

BellSouth, net of merger acquisition costs.

• $567 of proceeds from real estate sale-leaseback

transactions.

• $189 related to the sale of securities and other assets.

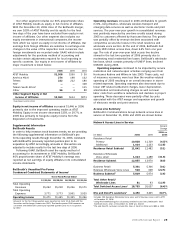

To provide high-quality communications services to our

customers, we must make significant investments in property,

plant and equipment. The amount of capital investment is

influenced by demand for services and products, continued

growth and regulatory considerations. Our capital expendi-

tures totaled $8,320 for 2006, $5,576 for 2005 and $5,099

for 2004. Capital expenditures in the wireline segment, which

represented substantially all of our capital expenditures,

increased 50.4% in 2006, reflecting the acquisition of ATTC,

and 5.9% in 2005. Our capital expenditures are primarily for

our wireline subsidiaries’ networks, Project Lightspeed,

merger-integration projects and support systems for our

long-distance service.

Because of opportunities made available by the continued

changing regulatory environment and our acquisition of ATTC

and BellSouth, we expect that our capital expenditures for the

next two years, which include wireless network expansion and

Project Lightspeed, will be in the mid-teens as a percentage

of consolidated revenue. We continue to expect spending to

be approximately $4,600 on our Project Lightspeed initiative

for network-related deployment costs and capital expenditures

from 2006 through 2008, as well as additional customer

activation capital expenditures. During 2006 we spent

approximately $1,500 on our Project Lightspeed initiative.

We remain on budget for this overall target and expect to

spend approximately $3,100 during 2007 and 2008. These

expenditures may increase slightly if the programming and

features of the video offering expand or if additional network

conditioning is required. We expect that the business

opportunities made available, specifically in the data/broad-

band area, will allow us to expand our products and services

(see “U-verse Services (Project Lightspeed)” discussed in

“Expected Growth Areas”).

We expect to fund 2007 capital expenditures for our wireline

segment, which includes international operations, using cash

from operations and incremental borrowings, depending on

interest rate levels and overall market conditions.

As of December 31, 2006, our wireless segment (AT&T

Mobility) spent $7,039 primarily for GSM/GPRS/EDGE network

upgrades with their cash from operations, dispositions and, as

needed, advances under the revolving credit agreement with

us and BellSouth (see Note 14). During 2006, we made net

advances to AT&T Mobility of $1,089 under the revolving

credit agreement. Additionally, in November 2006, AT&T

Mobility completed its purchase of 48 licenses of wireless

spectrum from the FCC for $1,335. The upgrade, integration

and expansion of our wireless networks will continue to

require substantial amounts of capital over the next several

years, although we expect these spending levels to decline

since we have completed most of our capital expenditures

for our UMTS/HSDPA upgrade and the integration of our

California network. In 2007, our wireless capital expenditures

should be in the lower double-digit range as a percent of our

wireless revenues for the integration and expansion of its

networks and the installation of UMTS/HSDPA technology