AT&T Wireless 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

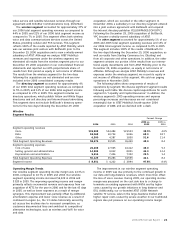

30 : :

2006 AT&T Annual Report

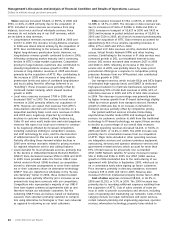

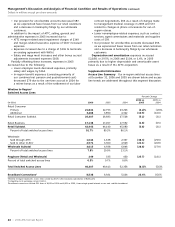

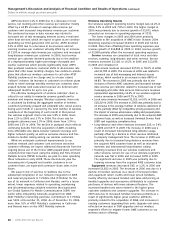

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

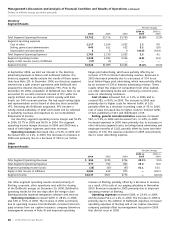

Dollars in millions except per share amounts

OPERATI N G ENVIRO N M E N T AND T R E N D S OF T H E BUSINESS

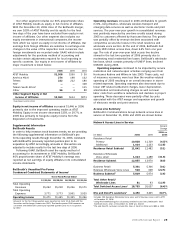

2007 Revenue Trends Our acquisitions of ATTC, BellSouth

and BellSouth’s 40% economic interest in AT&T Mobility

continue to change the focus of our company toward being a

broadband/data and wireless service provider. Because of the

late 2006 completion of the BellSouth acquisition, we expect

reported revenues to substantially increase in 2007 compared

to 2006 as we include the operating revenues of both

BellSouth and AT&T Mobility in our consolidated operating

revenues. We expect our sole ownership of AT&T Mobility will

enhance our bundling opportunities (see “AT&T Mobility”

discussed in “Expected Growth Areas”). We also expect to

expand services in the national business market, to utilize our

broadband network and to move toward wireless and wireline

convergence. Recently we announced our AT&T UnitySM

initiative which combines residential, business and wireless

calling and allows for free domestic calls to and from AT&T

wireline and wireless numbers. However, we also expect

that increasing competition in the communications industry,

including the continued growth of comparable alternatives,

such as wireless, cable and VoIP, and our response to

competitors’ pricing strategies will pressure revenue.

2007 Expense Trends Acquisition and related merger

costs will adversely affect expenses in 2007 and 2008. We

expect that our operating income margin, adjusted to exclude

these costs, will expand in 2008 due primarily to expected

improvement in our revenues and continued cost-control

measures. In particular, we expect to continue net workforce

reductions over the next three years related to merger

synergies and other operational initiatives. Expenses related

to growth initiatives, such as Project Lightspeed (see

“U-verse Services” discussed in “Expected Growth Areas”)

will apply some pressure to our operating income margin.

OPE RATIN G ENVI RO NME N T OVE R VIE W

AT&T subsidiaries operating within the U.S. are subject to

federal and state regulatory authorities. AT&T subsidiaries

operating outside the U.S. are subject to the jurisdiction of

national regulatory authorities in the market where service is

provided, and regulation is generally limited to operational

licensing authority for the provision of enterprise (i.e., large

business) services.

In the Telecommunications Act of 1996 (Telecom Act),

Congress established a national policy framework intended to

bring the benefits of competition and investment in advanced

telecommunications facilities and services to all Americans by

opening all telecommunications markets to competition and

reducing or eliminating burdensome regulation. Since the

Telecom Act was passed, the Federal Communications

Commission (FCC) and some state regulatory commissions

have maintained many of the extensive regulatory require-

ments applicable to our traditional wireline subsidiaries.

We are actively pursuing additional legislative and regulatory

measures to reduce or eliminate regulatory requirements

that inhibit our ability to provide the full range of services

demanded by our customers. For example, we are supporting

legislative efforts at both the state and federal levels, as well

as proposed rules at the FCC, that would offer a streamlined

process for new video service providers to compete with

traditional cable television providers. Several states have

passed legislation that enables new video entrants to acquire

a statewide franchise to offer video services. In addition, we

are supporting efforts to update regulatory treatment for retail

services. Passage of legislation is uncertain and depends on

many factors.

Our wireless operations are likewise subject to substantial

governmental regulation. Wireless communications providers

must be licensed by the FCC to provide communications

services at specified spectrum frequencies within specified

geographic areas and must comply with the rules and policies

governing the use of the spectrum as adopted by the FCC.

Licenses are issued for only a fixed period of time, typically

10 years. Consequently, we must periodically seek renewal

of those licenses. The FCC has routinely renewed wireless

licenses in the past. However, licenses may be revoked for

cause, and license renewal applications may be denied if the

FCC determines that a renewal would not serve the public

interest. In addition, the FCC and the states are increasingly

looking to the wireless industry to fund various initiatives,

including universal service programs, local telephone number

portability, services for the hearing-impaired and emergency

911 networks. While wireless communications providers’

prices and service offerings are generally not subject to state

regulation, an increasing number of states are attempting to

regulate or legislate various aspects of wireless services,

such as in the area of consumer protection.

The term “net neutrality” refers to a principle that underlies

the design of the Internet (or any network) as non-selective,

or neutral, about the transport of content through the

network. We believe that segregating the transport of content

according to a customer’s priority (using a tiered services

pricing model) will allow us to provide advanced functionality

and higher quality to those customers desiring the highest

speeds and/or the highest volumes while maintaining, at

lower prices, the bandwidth or quality of service desired by

the public. We comply with the FCC’s four net neutrality

principles, which essentially ensure that end-users can access

their content of choice, and reach their application or service

provider of choice over the Internet. In connection with

receiving the FCC’s approval, we agreed to certain commit-

ments related to net neutrality (see “BellSouth Merger

Commitments” discussion in “Regulatory Developments”).

Because of opportunities made available by the continued

changing regulatory environment and our acquisition of

BellSouth, including the consolidation of AT&T Mobility, we

expect that our capital expenditures will be in the mid-teens

as a percentage of total revenues in both 2007 and 2008.

This amount includes capital for Project Lightspeed, wireless

high-speed networks and merger-integration projects

(see “U-verse Services (Project Lightspeed)” and “Wireless”

discussed in “Expected Growth Areas”). Despite a slightly

more positive regulatory outlook and these broadband

opportunities, increasing competition and the growth of

comparable alternatives such as cable, wireless and VoIP

have created significant challenges for our business.