AT&T Wireless 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

59

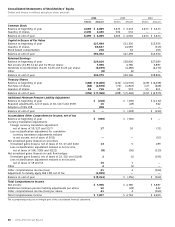

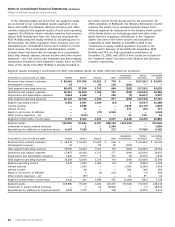

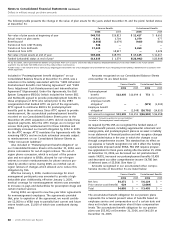

NOTE 3. EARNINGS PER SHARE

A reconciliation of the numerators and denominators of basic

earnings per share and diluted earnings per share for income

from continuing operations for the years ended December 31,

2006, 2005 and 2004 are shown in the table below:

Year Ended December 31, 2006 2005 2004

Numerators

Numerator for basic earnings

per share:

Income from continuing

operations $7,356 $4,786 $4,979

Dilutive potential common shares:

Other stock-based compensation 7 10 9

Numerator for diluted

earnings per share $7,363 $4,796 $4,988

Denominators (000,000)

Denominator for basic earnings

per share:

Weighted average number

of common shares outstanding 3,882 3,368 3,310

Dilutive potential common shares:

Stock options 4 1 2

Other stock-based compensation 16 10 10

Denominator for diluted

earnings per share 3,902 3,379 3,322

Basic earnings per share

Income from continuing

operations $ 1.89 $ 1.42 $ 1.50

Income from discontinued

operations — — 0.28

Net income $ 1.89 $ 1.42 $ 1.78

Diluted earnings per share

Income from continuing

operations $ 1.89 $ 1.42 $ 1.50

Income from discontinued

operations — — 0.27

Net income $ 1.89 $ 1.42 $ 1.77

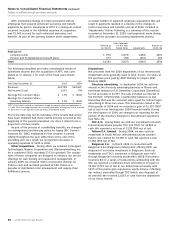

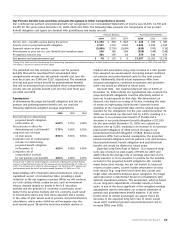

At December 31, 2006, 2005 and 2004, we had issued and

outstanding options to purchase approximately 309 million,

277 million and 214 million shares of AT&T common stock.

The exercise prices of options to purchase a weighted-average

of 201 million, 257 million and 191 million shares in 2006,

2005 and 2004, exceeded the average market price of AT&T

stock. Accordingly, we did not include these amounts in

determining the dilutive potential common shares for the

respective periods. At December 31, 2006, the exercise price

of 111 million share options were below market price; of

these options, 38 million will expire by the end of 2011.

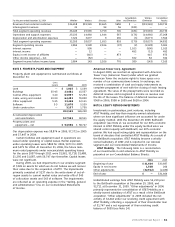

NOTE 4. SEGMENT INFORMATION

Our segments are strategic business units that offer different

products and services and are managed accordingly. As a

result of our November 18, 2005 acquisition of ATTC we

revised our segment reporting to represent how we now

manage our business, restating prior periods to conform to

the current segments. Due to the proximity of our BellSouth

acquisition to year-end, we have reported the two days of

results from BellSouth in the other segment even though

there may be some overlap in the products and services

provided by that segment and our wireline segment. Under

GAAP segment reporting rules, we analyze our various

operating segments based on segment income before income

taxes. Substantially all of our interest expense, interest

income, other income (expense) – net and income tax

expense are managed on a total company basis and are,

accordingly, reflected only in consolidated results. The custom-

ers and long-lived assets of our reportable segments are

predominantly in the United States. We have four reportable

segments that reflect the current management of our busi-

ness: (1) wireline, (2) wireless, (3) directory and (4) other.

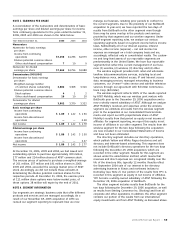

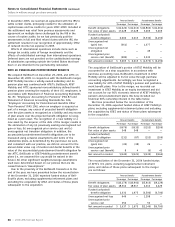

The wireline segment provides both retail and wholesale

landline telecommunications services, including local and

long-distance voice, switched access, IP and Internet access

data, messaging services, managed networking to business

customers, our U-verseSM video service and satellite television

services through our agreement with EchoStar Communica-

tions Corp. (EchoStar).

The wireless segment reflects 100% of the results reported

by AT&T Mobility, which was our wireless joint venture with

BellSouth prior to the December 29, 2006 acquisition and is

now a wholly-owned subsidiary of AT&T. Although we analyze

AT&T Mobility’s revenues and expenses under the wireless

segment, we eliminate all results from the wireless segment

prior to the acquisition in our consolidated financial state-

ments and report our 60% proportionate share of AT&T

Mobility’s results from that period as equity in net income of

affiliates. For segment reporting, we report this equity in net

income of affiliates in our other segment. The results from the

wireless segment for the two days following the acquisition

are now included in our Consolidated Statements of Income

and have not been eliminated.

The directory segment includes our directory operations,

which publish Yellow and White Pages directories and sell

directory and Internet-based advertising. This segment does

not include BellSouth’s directory operations for the two days

following the December 29, 2006 acquisition, which are

recorded in the other segment. Results for this segment are

shown under the amortization method, which means that

revenues and direct expenses are recognized ratably over the

life of the directory title, typically 12 months. Results reflect

the September 2004 sale of our interest in the directory

advertising business in Illinois and northwest Indiana to

Donnelley (see Note 2). Our portion of the results from YPC is

recorded in this segment as equity in net income of affiliates.

YPC became a wholly-owned subsidiary of AT&T following the

December 29, 2006 acquisition of BellSouth.

The other segment includes results from BellSouth for the

two days following the December 29, 2006 acquisition, as well

as results from Sterling Commerce Inc. (Sterling) and from all

corporate and other operations. In addition, the other segment

contains our portion of the results from our international

equity investments and from AT&T Mobility, as discussed above.