AT&T Wireless 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 : :

2006 AT&T Annual Report

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

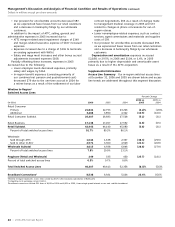

ARPU declined 1.1% in 2006 due to a decrease in local

service, net roaming and other revenue per customer mostly

offset by a 44.8% increase in average data revenue per

customer and increased long-distance revenue per customer.

The continued increase in data revenue was related to

increased use of text messaging, Internet access, e-mail and

other data services, which we expect to grow as we continue

expanding our third-generation (3G) service. ARPU declined

0.1% in 2005 due to a decrease in local service and net

roaming revenue per customer virtually offset by an increase

of 115% in average data revenue per customer and increased

long-distance revenue per customer. In 2006, local service

revenue per customer declined primarily due to the addition

of a disproportionately higher percentage of prepaid and

reseller customers which provide significantly lower ARPU

than postpaid customers; customer shifts to all-inclusive rate

plans that offer lower monthly charges; free mobile-to-mobile

plans that allow our wireless customers to call other AT&T

Mobility customers at no charge and, to a lesser extent,

“rollover” minutes. An increase in customers on rollover plans

tends to lower average monthly revenue per customer, since

unused minutes (and associated revenue) are deferred until

subsequent months for up to one year.

The effective management of wireless customer churn is

critical to our ability to maximize revenue growth and to

maintain and improve margins. Wireless customer churn rate

is calculated by dividing the aggregate number of wireless

customers (primarily prepaid and postpaid) who cancel service

during each month in a period by the total number of wireless

customers at the beginning of each month in that period.

Our wireless segment churn rate was 1.8% in 2006, down

from 2.2% in 2005 and 2.7% in 2004. The churn rate for

postpaid customers was 1.5% in 2006, down from 1.9% in

2005 and 2.3% in 2004. The decline in postpaid churn reflects

continuing benefits from the acquisition of AWE, including

more affordable rate plans, broader network coverage and

higher network quality, as well as exclusive devices and free

mobile-to-mobile calling among our wireless customers.

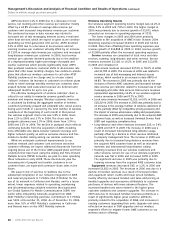

While we anticipate continued improvements to our

wireless network and customer care and more attractive

customer offerings, we expect additional disconnects from the

ongoing phase out of the former AWE prepaid plans and from

customers that have been using the analog and Time Division

Multiple Access (TDMA) networks; we plan to cease operating

these networks in early 2008. These disconnects, plus the

increasing mix of prepaid and reseller customers in our

customer base, are expected to pressure churn rates in the

future.

We expect cost of services to stabilize due to the

substantial completion of our network integration of AWE

and reduced payments to T-Mobile USA (T-Mobile) for the

use of its network in California and Nevada, and to a lesser

extent, lower expenses related to operating, maintaining

and decommissioning outdated networks that duplicated

our Global System for Mobile Communication (GSM) net-

works while integrating networks acquired from AWE.

AT&T Mobility’s remaining purchase commitment to T-Mobile

was $202 at December 31, 2006. As of December 31, 2006,

more than 91% of AT&T Mobility’s customers in California

and Nevada were on the AT&T Mobility network.

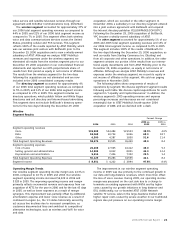

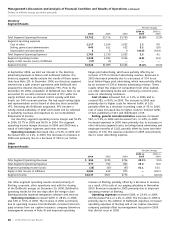

Wireless Operating Results

Our wireless segment operating income margin was 12.2% in

2006, 5.3% in 2005 and 7.8% in 2004. The higher margin in

2006 was primarily due to revenue growth of $3,073, which

exceeded our increase in operating expenses of $330.

The lower margins in 2005 and 2004 were primarily

attributable to the acquisition of AWE in late October 2004.

Operating expenses increased $14,572 in 2005 and $4,714

in 2004. More than offsetting these operating expenses was

revenue growth of $14,868 in 2005. In 2004, revenue growth

of $3,988 partially offset the increased operating expenses.

Service revenues are comprised of local voice and data

services, roaming, long-distance and other revenue. Service

revenues increased $3,118, or 10.2%, in 2006 and $13,036

in 2005 and consisted of:

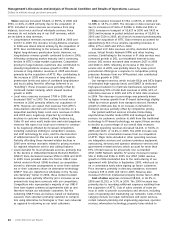

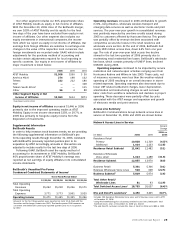

• Data service revenues increased $1,579, or 59.0%, in 2006

and $1,785 in 2005. The increase in 2006 was related to

increased use of text messaging and Internet access

services, which resulted in an increase in data ARPU of

44.8%. The increase in 2005 was primarily due to the

inclusion of former AWE customers and increased average

data revenue per customer related to increased use of text

messaging and other data services. Data service revenues

represented approximately 12.6% of our wireless segment

service revenues in 2006 and 8.7% in 2005.

• Local voice revenues increased $1,515, or 6.0%, in 2006 and

$10,219 in 2005. The increase in 2006 was primarily due to

an increase in the average number of wireless customers of

11.5%, partially offset by competitive pricing pressures and

the impact of various all-inclusive calling and prepaid plans.

The increase in 2005 was primarily due to the acquired AWE

customer base, as well as increased Universal Service Fund

(USF) and regulatory compliance fees.

• Long-distance and other revenues increased $26, or 3.4%,

in 2006 and $377 in 2005. The increase in 2006 was a

result of increased international long-distance usage,

partially offset by a decline in other revenue attributed

to property management fees. The increase in 2005 was

primarily due to increased long-distance revenues from

the acquired AWE customer base as well as increased

domestic and international long-distance calling.

• Roaming revenues from our wireless customers and

other wireless carriers for use of our wireless segment’s

network was flat in 2006 and increased $655 in 2005.

The significant increase in 2005 was primarily due to

roaming revenues from the acquired AWE customer base.

Equipment revenues decreased $45, or 1.2%, in 2006 and

increased $1,832 in 2005. The decrease in 2006 was due to a

decline in handset revenues as a result of increased rebate

and equipment return credits and lower priced handsets,

mostly offset by increased handset unit sales and pricing on

handset upgrades and accessories attributable to customer

purchases of devices with more advanced features. The

increased handset unit sales related to the higher gross

customer additions and customer upgrades. The increase in

2005 was due to increased handset revenues primarily as a

result of significantly higher gross customer additions,

primarily related to the acquisition of AWE, and increases in

existing customers upgrading their units. Upgrade unit sales

reflected an increase in GSM upgrades and our wireless

segment’s efforts to migrate former AWE customers to our

wireless service offerings.