AT&T Wireless 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 : :

2006 AT&T Annual Report

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

In accordance with Statement of Financial Accounting

Standards No. 144, “Accounting for the Impairment or Disposal

of Long-Lived Assets,” we review these types of assets for

impairment either annually or whenever events or circum-

stances indicate that the carrying amount may not be

recoverable over the remaining life of the asset or asset group.

In order to determine that the asset is recoverable, we verify

that the expected future cash flows directly related to that

asset exceed its fair value, which is based on the discounted

cash flows. The discounted cash flow calculation uses various

assumptions and estimates regarding future revenue, expense

and cash flow projections over the estimated remaining

useful life of the asset.

Cost investments are evaluated to determine whether

mark-to-market declines are temporary and reflected in other

comprehensive income, or other than temporary and recorded

as an expense in the income statement. This evaluation is

based on the length of time and the severity of decline in

the investment’s value.

New Accounting Standards

FIN 48 In June 2006, the Financial Accounting Standards

Board (FASB) issued FASB Interpretation No. 48, “Accounting

for Uncertainty in Income Taxes” (FIN 48), an interpretation

of Statement of Financial Accounting Standards No. 109,

“Accounting for Income Taxes.” FIN 48 changes the accounting

for uncertainty in income taxes by prescribing a recognition

threshold for tax positions taken or expected to be taken in a

tax return. FIN 48 is effective for fiscal years beginning after

December 15, 2006. We are currently evaluating the impact

FIN 48 will have on our financial position and results of

operations.

EITF 06-3 In June 2006, the Emerging Issues Task Force

(EITF) ratified the consensus on EITF 06-3, “How Taxes

Collected from Customers and Remitted to Governmental

Authorities Should Be Presented in the Income Statement”

(EITF 06-3). EITF 06-3 provides that taxes imposed by a

governmental authority on a revenue producing transaction

between a seller and a customer should be shown in the

income statement on either a gross or a net basis, based on

the seller’s accounting policy, which should be disclosed

pursuant to Accounting Principles Board Opinion No. 22,

“Disclosure of Accounting Policies.” Amounts that are allowed

to be charged to customers as an offset to taxes owed by a

company are not considered taxes collected and remitted.

If such taxes are significant and are presented on a gross

basis, the amounts of those taxes should be disclosed.

EITF 06-3 will be effective for interim and annual reporting

periods beginning after December 15, 2006. We are currently

evaluating the impact EITF 06-3 will have, but we do not

expect a material impact on our financial position and

results of operations.

FAS 157 In September 2006, the FASB issued Statement

of Financial Accounting Standards No. 157, “Fair Value

Measurements” (FAS 157). FAS 157 defines fair value, estab-

lishes a framework for measuring fair value and expands

disclosures about fair value measurements. FAS 157 applies

under other accounting pronouncements that require or

permit fair value measurement. FAS 157 does not require any

new fair value measurements and we do not expect the

application of this standard to change our current practice.

FAS 157 requires prospective application for fiscal years

ending after November 15, 2007.

FAS 158 In September 2006, the FASB issued Statement

of Financial Accounting Standards No. 158, “Employers’

Accounting for Defined Benefit Pension and Other Post-

retirement Plans” (FAS 158), an amendment of FASB State-

ments No. 87, 88, 106 and 132(R). FAS 158 requires us to

recognize the funded status of defined benefit pension and

postretirement plans as an asset or liability in our statement

of financial position and to recognize changes in that funded

status in the year in which the changes occur through

comprehensive income. This standard will have no effect

on our expense or benefit recognition, nor will it affect the

funding requirements imposed under the Employee Retire-

ment Income Security Act of 1974, as amended (ERISA).

FAS 158 requires prospective application for fiscal years

ending after December 15, 2006. At December 31, 2006

we decreased our postretirement and other assets $5,028,

increased our postemployment benefits and other noncurrent

liabilities $3,457 and decreased our other stockholders’ equity

$4,791 (net of deferred taxes of $3,694).

OTH ER BU SIN E SS MATTE RS

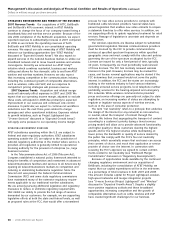

Acquisition of BellSouth On December 29, 2006, we

acquired BellSouth for approximately $66,798 including

capitalized merger-transaction costs and other items, using

shares of our common stock. The transaction was approved

by the Board of Directors and stockholders of each company.

The U.S. Department of Justice completed its review of the

transaction without imposing any conditions. The FCC and

numerous state and international regulatory bodies also

approved the acquisition. The FCC’s decision adopted on

December 29, 2006, imposes conditions on us that relate,

among other things, to: accessibility of our broadband

services, net neutrality, special access rates and intercon-

nection agreements, divestiture of spectrum and the

repatriation of 3,000 jobs to the U.S. In particular, we agreed

not to offer to provide service, for a period of two years or

until federal net neutrality legislation is enacted if sooner,

that charges a premium for transporting data from websites.

We also agreed to offer broadband Internet access service to

all residential living units within our 22-state service territory

by December 31, 2007. We will provide this access to at least

85% of these living units using wireline technologies and will

use alternative technologies and operating arrangements to

provide access to the remaining 15%. We do not expect the

above-mentioned conditions will have a material impact on

our financial statements.