AT&T Wireless 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 : :

2006 AT&T Annual Report

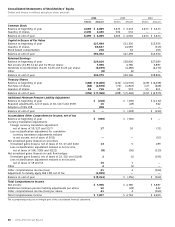

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

Following the acquisition of BellSouth in December 2006,

we agreed:

• To become a co-obligor on the $750 principal amount

7.5% senior notes due May 1, 2007, and on the $2,000

principal amount 8.125% senior notes due May 1, 2012,

originally issued by AWE and on which AT&T Mobility is

also a co-obligor.

• To unconditionally and irrevocably guarantee the payment

of interest and principal for the $1,200 principal amount

of floating rate notes of BellSouth due August 15, 2008.

We do not have plans to materially change the corporate

structures of BellSouth and AT&T Mobility.

• To unconditionally and irrevocably guarantee all obligations

under, including the payment of interest and principal on,

the $1,000 principal amount of annual put reset securities

issued by BellSouth due 2021, which were originally issued

on April 27, 2001 with an annual put option. In addition,

we agreed to assume all of BellSouth’s reporting obliga-

tions under these securities.

In February 2007, we received net proceeds of approxi-

mately $3,150 from the issuance of $1,500 principal amount

of floating-rate notes due in 2010, $1,200 principal amount of

6.375% notes due in 2056 and $500 principal amount of

5.625% notes due in 2016.

Other

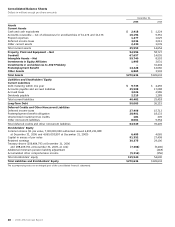

Our total capital consists of debt (long-term debt and debt

maturing within one year) and stockholders’ equity. Our

capital structure does not include debt issued by our interna-

tional equity investees. Total capital increased $90,076 in

2006 compared to $17,791 in 2005. The 2006 total capital

increase was primarily due to the purchase of BellSouth

(see Note 2). For 2006, our common stock outstanding and

capital in excess of par value increased by $60,850 and

our current and long-term debt increased by $29,226. The

increase in total debt was primarily due to acquired debt

from BellSouth and AT&T Mobility of $28,321, an increase

in commercial paper and other short-term borrowings of

$3,649, debt issuances of $1,500, partially offset by debt

repayments of $4,244 during 2006. Stockholders’ equity also

increased due to our net income and was partially offset by

dividend payments and our repurchases of common shares

through our stock repurchase program.

For 2005, our common stock outstanding and capital in

excess of par value increased nearly $14,200 and our current

and long-term debt increased by $3,605. The increase in total

debt of $3,605 was primarily due to acquired debt from

ATTC of $8,293 and debt issuances of $2,000, partially offset

by debt repayments of $6,801 during 2005. Stockholders’

equity also increased due to our net income and was partially

offset by dividend payments and our repurchases of common

shares through our stock repurchase program.

Our debt ratio was 34.1%, 35.9% and 40.0% at December

31, 2006, 2005 and 2004. The debt ratio is affected by the

same factors that affect total capital. The primary factor

contributing to the decline in our 2006 debt ratio was the

acquisition of BellSouth, which increased our stockholders’

equity approximately 105% and our total long-term debt by

96%. The primary factor that impacted our 2005 debt ratio

was the acquisition of ATTC, which increased stockholders’

equity and our total long-term debt.

CON TRACTUA L O BLI GAT IONS, COM MITM ENTS A ND CO NTI N GEN CIES

Current accounting standards require us to disclose our

material obligations and commitments to making future

payments under contracts, such as debt and lease agree-

ments, and under contingent commitments, such as debt

guarantees. We occasionally enter into third-party debt

guarantees, but they are not, nor are they reasonably likely

to become material. We disclose our contractual long-term

debt repayment obligations in Note 7 and our operating

lease payments in Note 5. Our contractual obligations do

not include expected pension and postretirement payments

as we maintain pension funds and Voluntary Employee

Beneficiary Association trusts to fully or partially fund these

benefits (see Note 10). In the ordinary course of business we

routinely enter into commercial commitments for various

aspects of our operations, such as plant additions and office

supplies. However, we do not believe that the commitments

will have a material effect on our financial condition, results

of operations or cash flows.

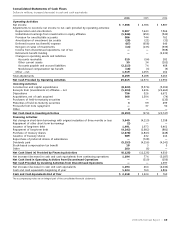

Our contractual obligations as of December 31, 2006, are

in the following table. The purchase obligations that follow

are those for which we have guaranteed funds and will be

funded with cash provided by operations or through incre-

mental borrowings. The minimum commitment for certain

obligations is based on termination penalties that could be

paid to exit the contract. Since termination penalties would

not be paid every year, such penalties are excluded from the

table. Other long-term liabilities were included in the table

based on the year of required payment or an estimate of

the year of payment. Such estimate of payment is based on

a review of past trends for these items, as well as a forecast

of future activities. Certain items were excluded from the

following table as the year of payment is unknown and could

not be reliably estimated since past trends were not deemed

to be an indicator of future payment.

Substantially all of our purchase obligations are in our

wireline and wireless segments. The table does not include

the fair value of our interest rate swaps. Our capital lease

obligations have been excluded from the table due to the

immaterial value at December 31, 2006. Many of our other

noncurrent liabilities have been excluded from the following

table due to the uncertainty of the timing of payments,

combined with the absence of historical trending to be used

as a predictor of such payments. Additionally, certain other

long-term liabilities have been excluded since settlement of

such liabilities will not require the use of cash. However, we

have included in the following table, obligations which

primarily relate to benefit funding and severance due to the

certainty of the timing of these future payments. Our other

long-term liabilities are: deferred income taxes (see Note 9)

of $27,406; postemployment benefit obligations (see Note 10)

of $28,901; unamortized investment tax credits of $181;

and other noncurrent liabilities of $8,061, which included

deferred lease revenue from our agreement with American

Tower of $568 (see Note 5).