AT&T Wireless 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 : :

2006 AT&T Annual Report

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

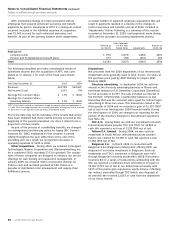

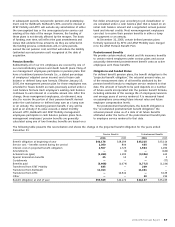

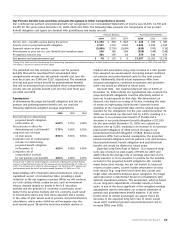

In the following tables, we show how our segment results

are reconciled to our consolidated results reported in accor-

dance with GAAP. The Wireline, Wireless, Directory and Other

columns represent the segment results of each such operating

segment. The Wireline column includes revenues from services

sold to AT&T Mobility (see Note 14). Since we accounted for

AT&T Mobility using the equity method of accounting prior to

the December 29, 2006 acquisition, these revenues were not

eliminated upon consolidation and as such, remain in consoli-

dated revenue. The Consolidation and Elimination column

includes those line items that we manage on a consolidated

basis only: interest expense, interest income and other income

(expense) – net. This column also eliminates any intercompany

transactions included in each segment’s results. Since our 60%

share of the results from AT&T Mobility is already included in

the Other column for the period prior to the December 29,

2006 acquisition of BellSouth, the Wireless Elimination column

removes the results of our wireless business shown in the

Wireless segment for that period. In the balance sheet section

of the tables below, we included goodwill and other intan-

gibles from the acquisition of BellSouth in the “Segment

assets” line item in the Other column and included our

investment in AT&T Mobility of $26,989 in 2005 in the

“Investment in equity method investees” line item in the

Other column. Because of the BellSouth acquisition, AT&T

Mobility and YPC are fully consolidated subsidiaries at

December 31, 2006, and 100% of their assets are included in

the “Segment assets” line item in the Wireless and Directory

columns, respectively.

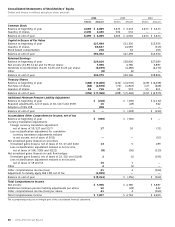

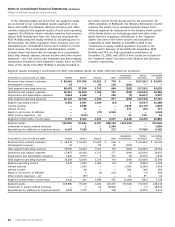

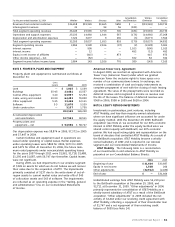

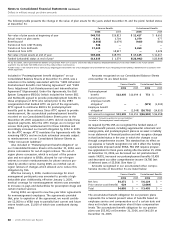

Segment results, including a reconciliation to AT&T consolidated results, for 2006, 2005 and 2004 are as follows:

Consolidation Wireless Consolidated

At December 31, 2006 or for the year ended Wireline Wireless Directory Other and Elimination Elimination Results

Revenues from external customers $ 58,441 $37,506 $3,621 $ 778 $ — $(37,291) $ 63,055

Intersegment revenues 35 — 81 176 (292) — —

Total segment operating revenues 58,476 37,506 3,702 954 (292) (37,291) 63,055

Operations and support expenses 40,511 26,503 1,760 721 (292) (26,343) 42,860

Depreciation and amortization expenses 9,614 6,436 3 256 (1) (6,401) 9,907

Total segment operating expenses 50,125 32,939 1,763 977 (293) (32,744) 52,767

Segment operating income 8,351 4,567 1,939 (23) 1 (4,547) 10,288

Interest expense — 1,186 — — 1,836 (1,179) 1,843

Interest income — 20 — — 377 (20) 377

Equity in net income of affiliates — — (17) 2,060 — — 2,043

Other income (expense) – net — (159) — — 16 159 16

Segment income before income taxes 8,351 3,242 1,922 2,037 (1,442) (3,229) 10,881

Segment assets 102,891 97,634 4,107 288,103 (222,101) — 270,634

Investment in equity method investees — 1 — 1,994 — — 1,995

Expenditures for additions to long-lived assets 8,147 7,039 2 171 — (7,039) 8,320

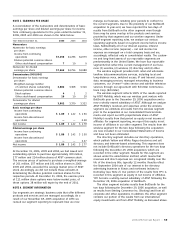

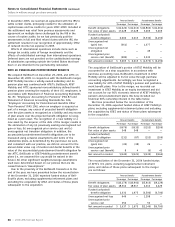

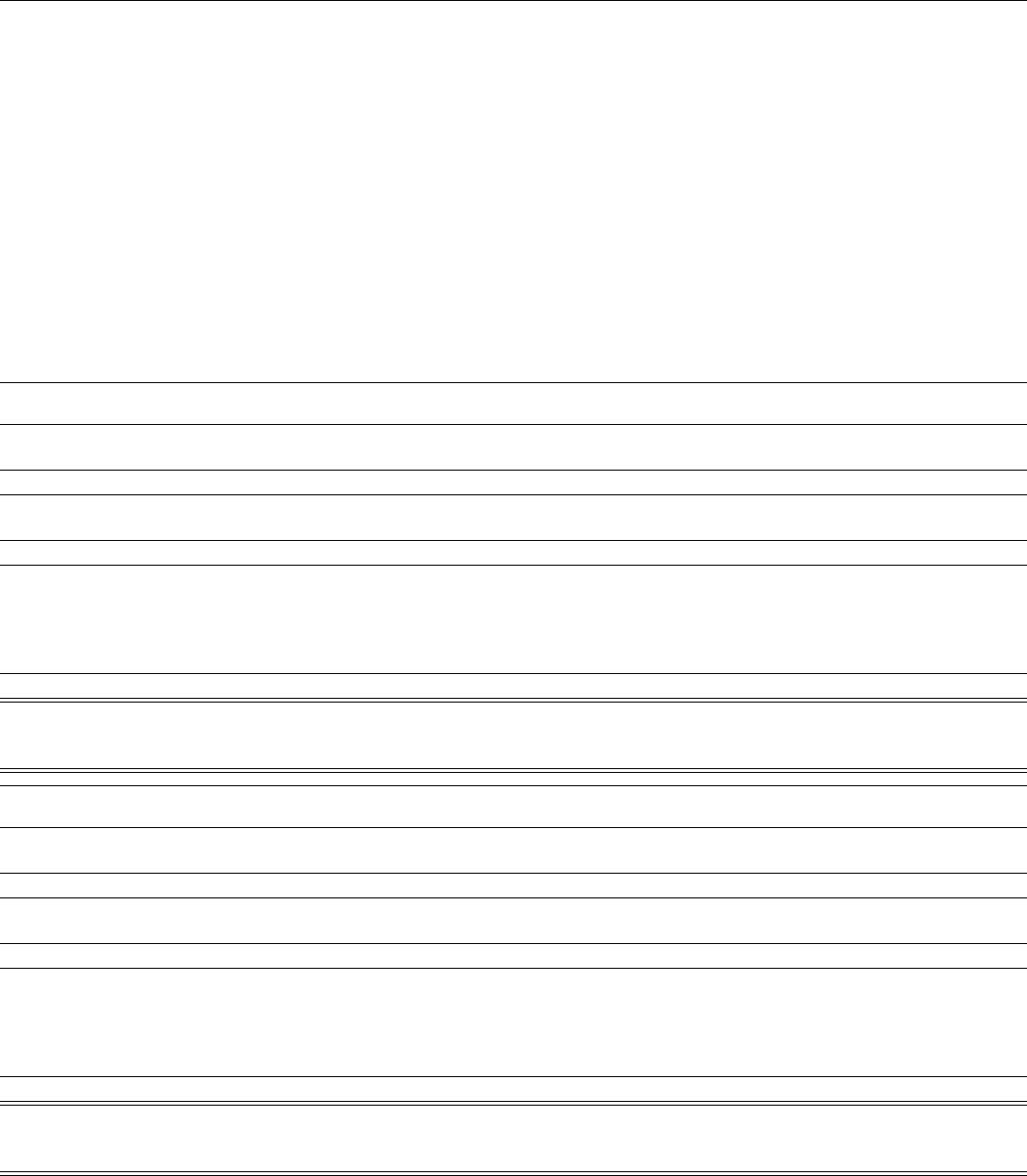

Consolidation Wireless Consolidated

At December 31, 2005 or for the year ended Wireline Wireless Directory Other and Elimination Elimination Results

Revenues from external customers $ 39,475 $ 34,433 $ 3,625 $ 664 $ — $ (34,433) $ 43,764

Intersegment revenues 30 — 89 81 (200) — —

Total segment operating revenues 39,505 34,433 3,714 745 (200) (34,433) 43,764

Operations and support expenses 27,857 26,034 1,715 577 (196) (26,034) 29,953

Depreciation and amortization expenses 7,426 6,575 5 215 (3) (6,575) 7,643

Total segment operating expenses 35,283 32,609 1,720 792 (199) (32,609) 37,596

Segment operating income 4,222 1,824 1,994 (47) (1) (1,824) 6,168

Interest expense — 1,260 — — 1,456 (1,260) 1,456

Interest income — 49 — — 383 (49) 383

Equity in net income of affiliates — 5 (5) 614 — (5) 609

Other income (expense) – net — (87) — — 14 87 14

Segment income before income taxes 4,222 531 1,989 567 (1,060) (531) 5,718

Segment assets 105,880 79,319 4,041 129,257 (93,546) (79,319) 145,632

Investment in equity method investees — 7 64 28,956 — (7) 29,020

Expenditures for additions to long-lived assets 5,418 7,475 2 156 — (7,475) 5,576