AT&T Wireless 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

27

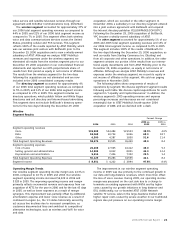

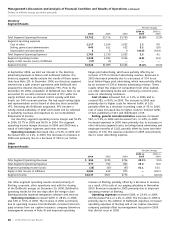

Cost of services and equipment sales expenses increased

$669, or 4.7%, in 2006 and $6,776 in 2005. The increase in

2006 was primarily due to increases in network usage and

associated network system expansion. The increase in 2005

was primarily due to increased cost of services resulting from

the acquired AWE network. Cost of services includes integra-

tion costs, primarily for network integration, of $229 in 2006

compared to $195 in 2005. Cost of services in 2005 also

includes $97 in hurricane-related costs.

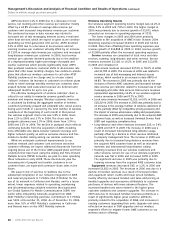

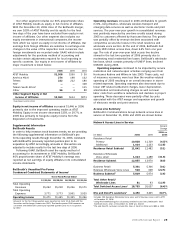

Cost of services increased $491, or 5.3%, in 2006 and $4,581

in 2005. Cost of services increased due to the following:

• Increases in network usage with a total system minutes-

of-use (MOU) increase of 20.6% in 2006 and more than

110% in 2005 related to the increase in customers.

Additionally, average MOU’s per customer increased 8.2%

in 2006 and 20.0% in 2005. The significant increase in

2005 was primarily due to the increase in subscribers

related to AT&T Mobility’s acquisition of AWE.

• Higher roaming and long-distance costs, partially offset

by a decline in reseller expenses in 2006. The reseller

decrease resulted from a decrease in minutes of use on the

T-Mobile network of more than 50% for 2006. In 2005, higher

roaming and long-distance costs and increased USF and

regulatory fees related to the increase in the customer base.

• Increased payments in 2005 to T-Mobile for the use of its

network in California and Nevada, as well as expenses

related to operating, maintaining and decommissioning

TDMA networks that duplicated GSM networks while

integrating the networks acquired from AWE.

Equipment sales expenses increased $178, or 3.5%, in 2006

and $2,195 in 2005. The increase in 2006 was due to in-

creased handset upgrades of 11.2% and an increase in the

average cost per upgrades and accessories sold, partially

offset by the decline in the average cost per handset sold to

new customers. The increase in 2005 was primarily due to

higher handset unit sales associated with the 46.1% increase

in gross customer additions in 2005, existing customers

upgrading their units and the continued migration of former

AWE customers to AT&T Mobility service offerings, which

required new handsets. Total equipment costs continue to be

higher than equipment revenues due to the sale of handsets

below cost to customers who committed to one-year or two-

year contracts or in connection with other promotions.

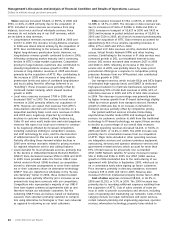

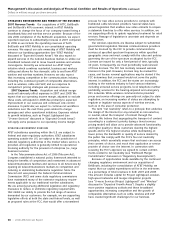

Selling, general and administrative expenses decreased

$200, or 1.7%, in 2006 and increased $4,298 in 2005.

The decline in 2006 was due to decreases in general and

administrative expenses of $296, partially offset by an

increase in selling expenses of $96. The increase in 2005

expenses was due to increases in general and administrative

expenses of $2,913, primarily due to the acquisition of AWE,

and selling expenses of $1,385 due to the increase in gross

customer additions previously mentioned.

The decline in selling, general and administrative expenses

in 2006 was due to the following:

• Decreases in billing and bad debt expense of $378

primarily due to fewer account write-offs and cost-

savings related to transitioning to one billing system.

• Decreases in other administrative expense of $108 due to

a decline in legal related expenses, lower employee costs

and employee-related benefits due to a decrease in the

number of employees, lower IT and other professional

services expense and a federal excise tax refund accrual.

• Decreases in customer service expense of $87 due

to a decline in the number of outsourced call center

professional services and lower billing expenses.

• Increases of $147 primarily related to increased prepaid

card replenishment costs and higher migration and

upgrade transaction costs.

• Increases in other expense of $130 due to higher

warranty, refurbishment and freight costs.

• Increases in selling expense of $96 due to an increase

in sales expense, partially offset by a decrease in net

commission expenses. The decline in net commission

expense was due to reductions in average activation and

agent branding expense, partially offset by an increase in

direct commission expense.

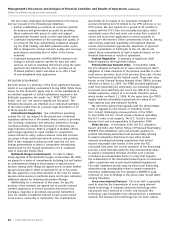

The increase in selling, general and administrative expenses

in 2005 was due to the following:

• Increases in customer service expense of $960 due to a

higher number of employees and employee-related

expenses related to the significant increase in customers

as well as customer retention and customer service

improvement initiatives.

• Increases in other administrative expense of $926

primarily due to incremental expenses associated with

the acquired AWE administrative functions.

• Increases in billing, bad debt and other customer

maintenance expense of $766 primarily due to the

significant increase in AT&T Mobility’s customer base.

• Increases in commission expense of $494 and advertising

and marketing expense of $429.

• Increases in sales expense of $462 primarily due to

increased sales personnel costs associated with the

acquired AWE sales force.

• Increases in upgrade commissions of $261 due to the

increased customer migration and handset upgrade

activity.

The expenses above also include integration costs of $123

in 2006 and $264 in 2005, such as employee-termination

costs, re-branding and advertising and customer service and

systems integration costs.

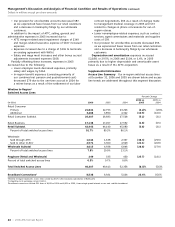

Depreciation and amortization expenses decreased $139,

or 2.1%, in 2006 and increased $3,498 in 2005.

Depreciation expense increased $310, or 6.4%, in 2006

primarily due to depreciation associated with the property,

plant and equipment related to ongoing capital spending for

our GSM network, partially offset by expense declines due

to equipment that had become fully depreciated in 2006.

Depreciation expense increased $2,249 in 2005 primarily due

to incremental depreciation associated with the property,

plant and equipment acquired in the AWE acquisition along

with depreciation related to AT&T Mobility’s expansion of its

GSM network and accelerated depreciation on certain

TDMA network and other network assets based on the

projected transition of network traffic to our GSM network.

The 2005 increase included $417 of integration costs.

Amortization expenses decreased $449, or 25.5%, in 2006

and increased $1,249 in 2005. The decline in 2006 was due to

declining amortization of the AWE customer contracts and other

intangible assets acquired, which are amortized using an

accelerated method of amortization. The increase in 2005 was

primarily due to a full year’s amortization of the AWE customer

contracts and other intangible assets acquired in October 2004.