AT&T Wireless 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 : :

2006 AT&T Annual Report

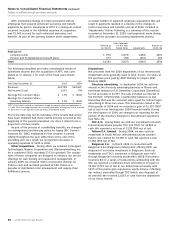

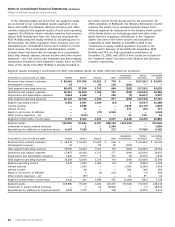

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

component of accumulated other comprehensive income in

the accompanying Consolidated Balance Sheets. Gains and

losses resulting from exchange-rate changes on transactions

denominated in a currency other than the local currency are

included in earnings as incurred.

We have also entered into foreign currency contracts to

minimize our exposure to risk of adverse changes in currency

exchange rates. We are subject to foreign exchange risk for

foreign currency-denominated transactions, such as debt

issued, recognized payables and receivables and forecasted

transactions. At December 31, 2006, our foreign currency

exposures were principally Euros, British pound sterling,

Danish krone and Japanese Yen.

Derivative Financial Instruments We record derivatives

on the balance sheet at fair value. We do not invest in

derivatives for trading purposes. We use derivatives from time

to time as part of our strategy to manage risks associated

with our contractual commitments. These derivatives are

designated as either a hedge of the fair value of a recognized

asset or liability or of an unrecognized firm commitment (fair

value hedge), or a hedge of a forecasted transaction or of

the variability of cash flows to be received or paid related to

a recognized asset or liability (cash flow hedge). Our derivative

financial instruments primarily include interest rate swap

agreements and foreign currency exchange contracts. For

example, we use interest rate swaps to manage our exposure

to changes in interest rates on our debt obligations (see

Note 8). We account for our interest rate swaps using

mark-to-market accounting and include gains or losses

from interest rate swaps when paid or received in interest

expense on our Consolidated Statements of Income. Amounts

paid or received on interest rate forward contracts are

amortized over the period of the related interest payments.

All other derivatives are not formally designated for

accounting purposes (undesignated). These derivatives,

although undesignated for accounting purposes, are entered

into to hedge economic risks.

We record changes in the fair value of fair value hedges,

along with the changes in the fair value of the hedged asset

or liability that is attributable to the hedged risk. Gains or

losses upon termination of our fair value hedges are recog-

nized as interest expense when the hedge instrument is

settled.

We record changes in the fair value of cash flow hedges,

along with the changes in the fair value of the hedged asset

or liability that is attributable to the hedged risk, in “Accumu-

lated other comprehensive income,” which is a component of

Stockholders’ Equity. The settlement gains or costs on our

cash flow hedges are amortized as interest expense over the

term of the interest payments of the related debt issuances.

Changes in the fair value of undesignated derivatives are

recorded in other income (expense), net, along with the

change in fair value of the underlying asset or liability, as

applicable.

Cash flows associated with derivative instruments are

presented in the same category on the Consolidated State-

ments of Cash Flows as the item being hedged.

When hedge accounting is discontinued, the derivative is

adjusted for changes in fair value through other income

(expense), net. For fair value hedges, the underlying asset or

liability will no longer be adjusted for changes in fair value,

and any asset or liability recorded in connection with the

hedging relationship (including firm commitments) will be

removed from the balance sheet and recorded in current-

period earnings. For cash flow hedges, gains and losses that

were accumulated in other comprehensive income as a

component of stockholders’ equity in connection with hedged

assets or liabilities or forecasted transactions will be recog-

nized in other income (expense), net, in the same period the

hedged item affects earnings.

Employee Separations In accordance with Statement

of Financial Accounting Standards No. 112, “Employers’

Accounting for Postemployment Benefits,” we establish

obligations for expected termination benefits provided to

former or inactive employees after employment but before

retirement. These benefits include severance payments,

workers’ compensation, disability, medical continuation

coverage and other benefits. In accordance with Statement

of Financial Accounting Standards No. 141, “Business

Combinations” (FAS 141), severance accruals recorded for

the BellSouth and ATTC acquisition related to the acquired

employees were included in the purchase price allocation

(see Note 2). At December 31, 2006, we had severance

accruals of $263, of which $240 was established as

merger-related severance accruals. In accordance with

FAS 141, severance accruals for BellSouth employees were

included in the purchase price allocation (see Note 2).

At December 31, 2005, we had severance accruals of $410.

Pension and Postretirement Benefits See Note 10 for a

comprehensive discussion of our pension and postretirement

benefit expense, including a discussion of the actuarial

assumptions.

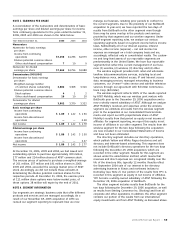

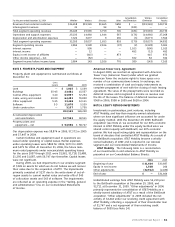

NOTE 2. ACQUISITIONS, DISPOSITIONS, VALUATION

AND OTHER ADJUSTMENTS

Acquisitions

BellSouth Corporation In December 2006, we acquired

BellSouth in a transaction accounted for under FAS 141.

BellSouth was the leading communications service provider

in the southeastern U.S., providing wireline communications

services, including local exchange, network access, intraLATA

long-distance services and Internet services to substantial

portions of the population across nine states. BellSouth also

provided long-distance services to enterprise customers

throughout the country.

Under the merger agreement, each share of BellSouth

common stock was exchanged for 1.325 shares of our

common stock. We issued 2.4 billion shares to BellSouth

shareholders, giving them an approximate 39% stake in the

combined company, based on common shares outstanding.

Based on the $35.75 per share closing price of our common

stock on the New York Stock Exchange (NYSE) on December

29, 2006, the last trading session before the closing of the

merger, consideration received by BellSouth shareholders was

approximately $86,900.

Based on the average closing price of our common stock

on the NYSE for the two days prior to, including, and two days

subsequent to the public announcement of the merger (March

5, 2006) of $27.32, capitalized merger-transaction costs and

other items, the transaction was valued, for accounting

purposes, at $66,798.