ADT 2001 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

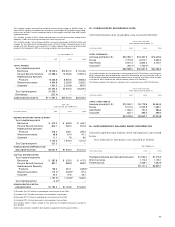

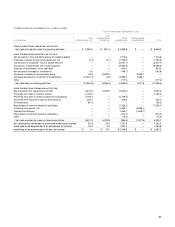

CONSOLIDATING STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED SEPTEMBER 30, 1999

TYCO

TYCO INTERNATIONAL OTHER CONSOLIDATING

($ IN MILLIONS) INTERNATIONAL LTD. GROUP S.A. SUBSIDIARIES ADJUSTMENTS TOTAL

CASH FLOWS FROM OPERATING ACTIVITIES:

Net cash provided by operating activities $ 254.3 $ 60.7 $ 3,234.8 $

—

$ 3,549.8

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of property, plant and equipment, net (0.5)

—

(1,632.0)

—

(1,632.5)

Acquisition of businesses, net of cash acquired

——

(4,901.2)

—

(4,901.2)

Disposal of businesses, net of cash sold

——

926.8

—

926.8

Net decrease (increase) in investments 81.7

—

(71.2)

—

10.5

(Increase) in intercompany loans

—

(4,132.4)

—

4,132.4

—

(Increase) in investment in subsidiaries (1,013.6)

——

1,013.6

—

Other

——

(247.7)

—

(247.7)

Net cash used in investing activities (932.4) (4,132.4) (5,925.3) 5,146.0 (5,844.1)

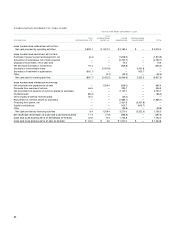

CASH FLOWS FROM FINANCING ACTIVITIES:

Net proceeds from (repayments of) debt

—

4,080.4 (1,136.6)

—

2,943.8

Proceeds from exercise of options and warrants 714.5

—

157.9

—

872.4

Dividends paid (75.0)

—

(112.9)

—

(187.9)

Intercompany dividends received (paid) 59.5

—

(59.5)

——

Repurchase of common shares by subsidiary

——

(637.8)

—

(637.8)

Financing from parent, net

——

4,132.4 (4,132.4)

—

Capital contributions

——

1,013.6 (1,013.6)

—

Other (0.6)

—

(6.5)

—

(7.1)

Net cash provided by financing activities 698.4 4,080.4 3,350.6 (5,146.0) 2,983.4

NET INCREASE IN CASH AND CASH EQUIVALENTS 20.3 8.7 660.1

—

689.1

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 2.5 6.7 1,063.7

—

1,072.9

CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 22.8 $ 15.4 $ 1,723.8 $

—

$ 1,762.0

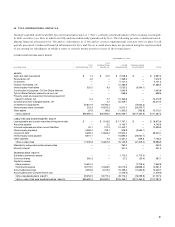

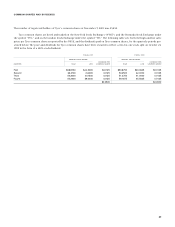

31. SUBSEQUENT EVENTS

On October 26, 2001, TIG sold $1,500.0 million 6.375%

notes due 2011 under its $6.0 billion shelf registration state-

ment in a public offering. The notes are fully and uncondition-

ally guaranteed by Tyco. The net proceeds of approximately

$1,487.8 million were used to repay borrowings under TIG’s com-

mercial paper program.

On November 13, 2001, Tyco completed the acquisition of

Sensormatic Electronics Corporation (“Sensormatic”), a leading

supplier of electronic security solutions to the retail, commercial

and industrial market-places. The acquisition was accomplished

through an exchange offer followed by a short-form merger and

is valued at approximately $2.3 billion, including the assump-

tion of $116 million of net debt. An aggregate of approximately

48 million common shares of Tyco were issued for all the out-

standing capital stock of Sensormatic.

On November 19, 2001, TIG issued €500 million 4.375%

notes due 2005, €685 million 5.5% notes due 2009, £200 million

6.5% notes due 2012 and £285 million 6.5% notes due 2032, uti-

lizing the capacity available under TIG’s European Medium

Term Note Programme established in September 2001. The

notes are fully and unconditionally guaranteed by Tyco. The net

proceeds of $1,726.6 million were used to repay borrowings

under TIG’s commercial paper program.

On December 18, 2001, the Company completed its amalga-

mation with TyCom and each of the approximately 56 million

TyCom common shares not owned by Tyco were converted into

the right to receive 0.3133 of a Tyco common share. Upon com-

pletion of the amalgamation, TyCom became a wholly-owned

subsidiary of Tyco, and each outstanding option to purchase

TyCom common shares is exercisable for Tyco common shares,

with the number of Tyco shares equal to the number of TyCom

common shares issuable upon exercise immediately prior to the

consummation multiplied by the exchange ratio of 0.3133. The

per share exercise price for the Tyco common shares issuable

upon the exercise of TyCom options equals the exercise price per

TyCom common share, at the price such options were exercisable

prior to the amalgamation, divided by the exchange ratio. In

addition, each outstanding TyCom restricted share was con-

verted into a restricted Tyco common share based on the

exchange ratio. The options and restricted shares will be subject

to the same terms and conditions that were applicable immedi-

ately prior to the amalgamation.