ADT 2001 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

Mallinckrodt. In view of the Company’s financial position and

reserves for environmental matters of $268.5 million, the Com-

pany has concluded that any potential payment of such esti-

mated amounts will not have a material adverse effect on its

financial position, results of operations or liquidity.

TYCO CAPITAL

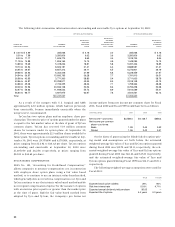

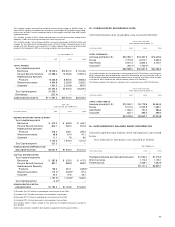

The following table summarizes Tyco Capital’s contractual

amounts of credit-related commitments.

AT SEPTEMBER 30, 2001

DUE TO EXPIRE

TOTAL

WITHIN AFTER OUTSTANDING

($ IN MILLIONS) ONE YEAR ONE YEAR 2001

Unused commitments to

extend credit:

Financing and leasing assets $1,997.4 $389.4 $2,386.8

Letters of credit and

acceptances:

Standby letters of credit 267.3

—

267.3

Other letters of credit 365.5 1.5 367.0

Acceptances 9.1

—

9.1

Guarantees 714.5

—

714.5

In the normal course of meeting the financing needs of its

customers, Tyco Capital enters into various credit-related com-

mitments. These financial instruments generate fees and

involve, to varying degrees, elements of credit risk in excess of

the amounts recognized on the Consolidated Balance Sheet. To

minimize potential credit risk, Tyco Capital generally requires

collateral and other credit-related terms and conditions from

the customer. It is Tyco Capital’s policy that, at the time

credit-related commitments are granted, the fair value of the

underlying collateral and guarantee must approximate or

exceed the contractual amount of the commitment. In the event

a customer defaults on the underlying transaction, the maxi-

mum potential loss to Tyco Capital will be the contractual

amount outstanding less the value of all underlying collateral

and guarantees.

During 2001, Tyco Capital entered into an agreement with

The Boeing Company to purchase 25 aircraft with a list price of

more than $1.3 billion, with options to purchase an additional

five units. Deliveries are scheduled to take place from 2003

through 2005. In prior years, Tyco Capital entered into agree-

ments with both Airbus Industrie and The Boeing Company to

purchase a total of 88 aircraft (at an estimated cost of approxi-

mately $5 billion), with options to acquire additional units,

and with the flexibility to delay or terminate certain positions.

Deliveries of these new aircraft are scheduled to take place

over a five-year period, which started in the first quarter of

Fiscal 2001. Outstanding commitments to purchase aircraft,

rail and other equipment to be placed on operating lease totaled

approximately $5.3 billion at September 30, 2001. Outstanding

commitments relating to Fiscal 2002 totaled $901.2 million,

of which $840.2 million have agreements in place to lease to

third parties.

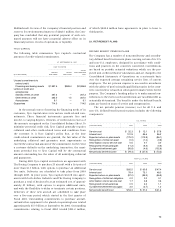

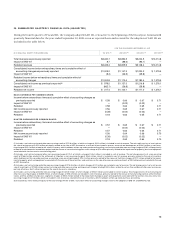

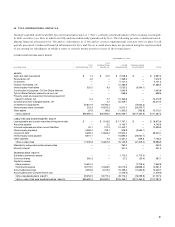

23. RETIREMENT PLANS

DEFINED BENEFIT PENSION PLANS

The Company has a number of noncontributory and contribu-

tory defined benefit retirement plans covering certain of its U.S.

and non-U.S. employees, designed in accordance with condi-

tions and practices in the countries concerned. Contributions

are based on periodic actuarial valuations which use the pro-

jected unit credit method of calculation and are charged to the

Consolidated Statements of Operations on a systematic basis

over the expected average remaining service lives of current

employees. The net pension expense is assessed in accordance

with the advice of professionally qualified actuaries in the coun-

tries concerned or is based on subsequent formal reviews for the

purpose. The Company’s funding policy is to make annual con-

tributions to the extent such contributions are tax deductible as

actuarially determined. The benefits under the defined benefit

plans are based on years of service and compensation.

The net periodic pension (income) cost for all U.S. and

non-U.S. defined benefit pension plans includes the following

components:

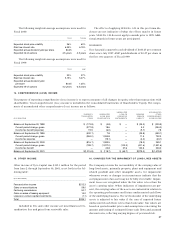

U.S. PLANS

($ IN MILLIONS) 2001 2000 1999

Service cost $ 32.3 $ 12.1 $ 37.8

Interest cost 131.9 84.6 86.2

Expected return on plan assets (175.2) (112.8) (96.1)

Recognition of initial net asset (1.0) (1.0) (0.9)

Amortization of prior service cost 0.6 0.7 3.0

Recognized net actuarial gain (11.2) (6.4) (0.6)

Curtailment/settlement gain (56.8) (4.6) (102.6)

Net periodic benefit income $ (79.4) $ (27.4) $ (73.2)

NON-U.S. PLANS

($ IN MILLIONS) 2001 2000 1999

Service cost $ 65.5 $ 60.9 $ 47.4

Interest cost 79.4 75.1 48.0

Expected return on plan assets (97.0) (85.3) (56.8)

Recognition of initial net obligation 0.2 0.2 0.1

Amortization of prior service cost 1.7 0.8 0.6

Recognized net actuarial loss 0.5 2.3 1.1

Curtailment/settlement loss (gain) 3.0 (2.7) 1.2

Net periodic benefit cost $ 53.3 $ 51.3 $ 41.6