ADT 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

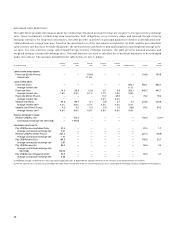

The following table sets forth revenue and operating

income and margins for the Healthcare and Specialty Products

segment:

($ IN MILLIONS) FISCAL 2001 FISCAL 2000 FISCAL 1999

Revenue, before

accounting change $8,833.3 $6,467.9 $5,742.7

Operating income, before

certain (charges) credits and

accounting change $2,070.6 $1,527.9 $1,386.0

Operating margins, before

certain (charges) credits and

accounting change 23.4% 23.6% 24.1%

Revenue, after

accounting change $8,812.7 $6,467.9 $5,742.7

Operating income, after certain

(charges) credits and

accounting change $1,804.4 $1,439.8 $ 890.9

Operating margins, after certain

(charges) credits and

accounting change 20.5% 22.3% 15.5%

The 36.6% increase in revenue, before accounting change,

in Fiscal 2001 over Fiscal 2000 resulted primarily from acquisi-

tions and, to a lesser extent, organic growth. These acquisitions

included: General Surgical Innovations, Inc. (“GSI”) in Novem-

ber 1999; Radionics in January 2000; Fiber-Lam in March 2000;

Mallinckrodt Inc. (“Mallinckrodt”) in October 2000; and Inner-

Dyne, Inc. (“InnerDyne”) in December 2000. The revenue

increase was somewhat offset by the sale of our ADT Automo-

tive business. Excluding the impact of these acquisitions and

this divestiture, revenue increased an estimated 5.9%.

The 12.6% increase in revenue in Fiscal 2000 over Fiscal

1999 was primarily the result of increased sales at Tyco Plastics

and Adhesives and Tyco Healthcare and, to a lesser extent, ADT

Automotive. The increases for Tyco Healthcare were due to

organic growth and, to a lesser extent, acquisitions. These acqui-

sitions included: Graphic Controls Corporation and Sunbelt

Plastics, both in November 1998; Batts, Inc. in April 1999; GSI

in November 1999; Radionics in January 2000; and Fiber-Lam in

March 2000. Excluding the impact of these acquisitions, revenue

for the segment increased an estimated 8.2% in Fiscal 2000 over

Fiscal 1999.

The 35.5% increase in operating income, before certain

(charges) credits and accounting change, and the slight

decrease in operating margins, before certain (charges) credits

and accounting change, in Fiscal 2001 compared to Fiscal 2000

was due to the acquisition of Mallinckrodt, which generally has

lower operating margins than other businesses in this segment.

Operating income and margins, after certain (charges)

credits and accounting change, include restructuring and other

non-recurring and impairment charges of $256.4 million, as well

as a decrease of $9.8 million relating to the adoption of SAB 101,

in Fiscal 2001, as compared to net merger, restructuring and

other non-recurring and impairment charges of $88.1 million in

Fiscal 2000.

The 10.2% increase in operating income, before certain

(charges) credits and accounting change, in Fiscal 2000 over

Fiscal 1999 was due to increased sales volume at Tyco Health-

care, Tyco Plastics and Adhesives and, to a lesser extent, ADT

Automotive, slightly offset by a lower operating margin per-

centage at Tyco Healthcare principally due to higher raw mate-

rials costs.

In addition to the items discussed above, the substantial

increase in operating income and margins, after certain

(charges) credits in Fiscal 2000 over Fiscal 1999, was due to net

merger, restructuring and other non-recurring and impairment

charges of $88.1 million in Fiscal 2000 compared with net

merger, restructuring and other non-recurring charges of

$495.1 million in Fiscal 1999.

Telecommunications

Tyco’s subsidiary, TyCom Ltd. (“TyCom”), is a leading indepen-

dent provider of undersea fiber optic networks and services, and

its products and services include:

• designing, engineering, manufacturing and installing under-

sea cable communications systems; and

• servicing and maintaining major undersea cable networks.

Beginning in the fourth quarter of Fiscal 2000, TyCom

began the design, manufacture and installation of a global

undersea fiber optic network, known as the TyCom Global

NetworkTM (“TGN”). In the third quarter of Fiscal 2001, TyCom

began operating, maintaining and selling bandwidth capacity

on the TGN.

The following table sets forth revenue and operating

income and margins for the Telecommunications segment:

($ IN MILLIONS) FISCAL 2001 FISCAL 2000 FISCAL 1999

Revenue $1,863.2 $2,539.7 $1,623.8

Operating income, before

certain charges $ 414.6 $ 529.7 $ 325.1

Operating margins, before

certain charges 22.3% 20.9% 20.0%

Operating income, after

certain charges $ 414.6 $ 516.6 $ 325.1

Operating margins, after

certain charges 22.3% 20.3% 20.0%