ADT 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

2. ACQUISITIONS AND DIVESTITURES

FISCAL 2001

During Fiscal 2001, the Company purchased businesses for an

aggregate cost of $19,554.2 million, consisting of $8,800.2 mil-

lion in cash, net of cash acquired, and the issuance of approxi-

mately 211.2 million common shares valued at $10,435.4 million,

plus the fair value of options assumed of $318.6 million. In addi-

tion, $894.4 million of cash was paid during the year for pur-

chase accounting liabilities related to current and prior years’

acquisitions, which includes approximately $105.7 million relat-

ing to purchase price adjustments and earn-out liabilities on

certain acquisitions and $51.5 million in transaction costs paid

related to the acquisition of CIT. The cash portions of the acqui-

sition costs were funded utilizing net proceeds from the

issuance of long-term debt and Tyco common shares and net

proceeds from the disposal of businesses. Debt of acquired com-

panies aggregated $40,643.2 million, including $39,050.9 mil-

lion of debt of CIT. Each acquisition was accounted for as a

purchase, and the results of operations of the acquired compa-

nies have been included in the Company’s consolidated results

from their respective acquisition dates.

In connection with these acquisitions, the Company

recorded purchase accounting liabilities of $1,120.0 million for

the costs of integrating the acquired companies and transaction

costs. Details regarding these purchase accounting liabilities are

set forth below. In Fiscal 2001, the Company spent a total of

$9,694.6 million in cash related to the acquisition of businesses,

consisting of $8,800.2 million of cash in purchase price for these

businesses (net of cash acquired) plus $894.4 million of cash

paid out during the year for purchase accounting liabilities

related to current and prior years’ acquisitions.

At the time each purchase acquisition is made, the Com-

pany records each asset acquired and each liability assumed at

its estimated fair value, which amount is subject to future

adjustment when appraisals or other valuation data are

obtained. The excess of (i) the total consideration paid for the

acquired company over (ii) the fair value of tangible and intan-

gible assets acquired less liabilities assumed and purchase

accounting liabilities recorded is recorded as goodwill. As a

result of acquisitions completed in Fiscal 2001, and adjustments

to the fair values of assets and liabilities and purchase account-

ing liabilities recorded for acquisitions completed prior to Fiscal

2001, the Company recorded approximately $19,902.1 million in

goodwill and other intangible assets in Fiscal 2001.

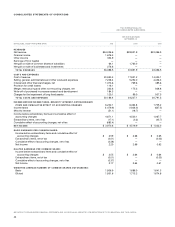

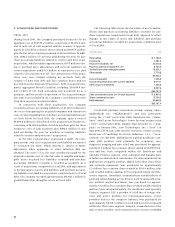

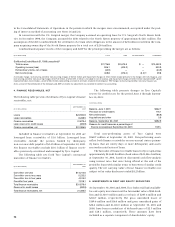

The following table shows the fair values of assets and lia-

bilities and purchase accounting liabilities recorded for pur-

chase acquisitions completed in Fiscal 2001, adjusted to reflect

changes in fair values of assets and liabilities and purchase

accounting liabilities recorded for acquisitions completed prior

to Fiscal 2001:

($ IN MILLIONS) 2001

Receivables $ 1,728.0

Inventories 1,081.6

Finance receivables, net 30,203.3

Property, plant and equipment, net 8,735.2

Goodwill and other intangible assets 19,902.1

Other assets 7,774.8

69,425.0

Accounts payable 1,306.9

Accrued expenses and other current liabilities 6,014.1

Other long-term liabilities 1,906.6

9,227.6

$60,197.4

Cash consideration paid (net of cash acquired) $ 8,800.2

Share consideration paid 10,754.0

Debt assumed 40,643.2

$60,197.4

Fiscal 2001 purchase acquisitions include, among others,

Mallinckrodt Inc. (“Mallinckrodt”) and CIGI Investment

Group, Inc. (“CIGI”) in October 2000, InnerDyne, Inc. (“Inner-

Dyne”) and Lucent Technologies’ Power Systems business unit

(“LPS”) in December 2000, Simplex Time Recorder Co. (“Sim-

plex”) in January 2001, Scott Technologies, Inc. (“Scott”) in

May 2001, CIT in June 2001 and the electronic security systems

businesses of Cambridge Protection Industries, L.L.C. (“Secu-

rityLink”) in July 2001. Mallinckrodt, a global healthcare com-

pany with products used primarily for respiratory care,

diagnostic imaging and pain relief, was purchased for approxi-

mately 65.2 million Tyco common shares valued at $3,096.9 mil-

lion and has been integrated within the Healthcare and

Specialty Products segment. CIGI, a designer and manufacturer

of inductors and isolation transformers for telecommunications

applications, primarily modems, Digital Subscriber Lines (DSL)

and network equipment, was purchased for approximately

2.3 million Tyco common shares valued at $118.9 million, plus

cash of $29.6 million, and has been integrated within the Elec-

tronics segment. InnerDyne, a manufacturer and distributor of

patented radial dilating access devices used in minimally inva-

sive medical surgical procedures, was purchased for approxi-

mately 3.2 million Tyco common shares valued at $178.0 million

and has been integrated within the Healthcare and Specialty

Products segment. LPS, a provider of a full line of energy solu-

tions and power products for telecommunications service

providers and for the computer industry, was purchased for

approximately $2,501.0 million in cash and has been integrated

within the Electronics segment. Simplex, a manufacturer of fire

and security products and communications systems including