ADT 2001 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

The other charges of $49.9 million consist primarily of contract cancellation costs and non-recurring charges relating to an

environmental remediation project.

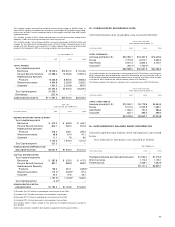

The Healthcare and Specialty Products segment recorded restructuring and other non-recurring charges of $21.7 million, of

which charges of $9.0 million are included in cost of revenue, related primarily to the closure of manufacturing plants. The follow-

ing table provides information about the restructuring and other non-recurring charges related to the Healthcare and Specialty

Products segment recorded in Fiscal 2001:

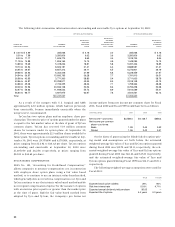

SEVERANCE FACILITIES-RELATED OTHER

NUMBER OF NUMBER OF

($ IN MILLIONS) EMPLOYEES RESERVE FACILITIES RESERVE RESERVE TOTAL

Fiscal 2001 charges 1,100 $15.2 5 $ 5.4 $1.1 $21.7

Fiscal 2001 utilization (444) (4.2) (2) (0.2)

—

(4.4)

Ending balance at September 30, 2001 656 $11.0 3 $ 5.2 $1.1 $17.3

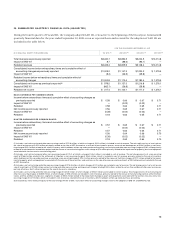

Included in the $16.9 million restructuring and other non-

recurring charges are the cost of announced workforce reduc-

tions of $4.9 million for the elimination of 941 positions

primarily in Brazil; the cost of facility closures of $4.8 million for

the shut-down and consolidation of 3 facilities; and other

charges of $7.2 million consisting of the write-off of non-facility

assets and other direct costs. At September 30, 2001, substan-

tially all of these restructuring activities were completed. The

remaining balance at September 30, 2001 of $4.2 million, of

which $1.0 million is included in accrued expenses and other

current liabilities and $3.2 million is included in other long-

term liabilities on the Consolidated Balance Sheet, is primarily

for payments on non-cancelable lease obligations.

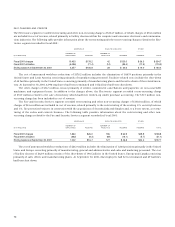

In Fiscal 2000, the Fire and Security Services segment

recorded restructuring and other non-recurring credits of

$11.2 million related to revisions in estimates of the Company’s

1997 restructuring activities for amounts lower than originally

recorded. Actions under the Company’s 1997 restructuring

plans have been completed.

In Fiscal 2000, the Healthcare and Specialty Products seg-

ment recorded a net merger, restructuring and other non-recur-

ring credit of $10.9 million. The $10.9 million net credit consists

of charges of $11.1 million related to U.S. Surgical’s suture busi-

ness and charges of $7.9 million, of which charges of $6.4 mil-

lion are included in cost of revenue, related to exiting U.S.

Surgical’s interventional cardiology business. All of these

restructuring activities have been completed. Also recorded was

a credit of $29.9 million representing a revision in estimates of

prior years’ merger, restructuring and other non-recurring

accruals, of which $19.7 million related primarily to the merger

with U.S. Surgical and $10.2 million related to the Company’s

1997 restructuring accruals. The $19.7 million credit relates to a

revision in estimates of severance reserves of $4.2 million, facil-

ity reserves of $4.5 million and other reserves of $11.0 million.

In Fiscal 2000, the Telecommunications segment recorded a

non-recurring charge of $13.1 million incurred in connection

with the TyCom IPO.

In addition to segment charges (credits), the Company

recorded non-recurring charges of $275.0 million in Fiscal 2000

as a reserve for certain claims relating to a merged company in

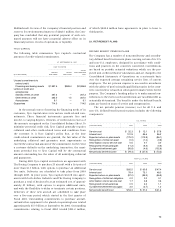

The cost of announced workforce reductions of $15.2 mil-

lion includes the elimination of 1,100 positions primarily in the

United States consisting primarily of manufacturing and sales

personnel. The cost of facility closures of $5.4 million consists of

the shut-down of 5 manufacturing and administrative facilities

in the United States. At September 30, 2001, 444 employees had

been terminated and 2 facilities had been shut down.

The other charges of $1.1 million consist primarily of the

cost for lease buyouts and distributor termination fees. In addi-

tion to the charges above, the Healthcare and Specialty Products

segment recorded a non-recurring charge of $35.0 million

related to the sale of inventory, which had been written-up

under purchase accounting. The $35.0 million non-recurring

charge has been included in cost of revenue.

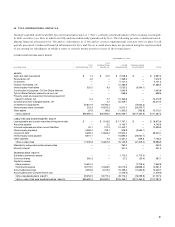

In addition to segment charges, the Company recorded a

net credit of $163.4 million, consisting of a non-recurring credit

of $166.8 million related to the settlement of litigation in which

the Company was provided with an ongoing OEM arrangement

valued at $166.8 million and a non-recurring charge of $3.4 mil-

lion related to severance. At September 30, 2001, $35.5 million of

the $275.0 million litigation reserve established in Fiscal 2000

remains in accrued expenses and other current liabilities on the

Consolidated Balance Sheet, and $1.4 million relating to the

$3.4 million severance charge remains in accrued expenses and

other current liabilities on the Consolidated Balance Sheet.

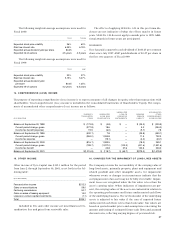

2000 CHARGES AND CREDITS

In Fiscal 2000, the Electronics segment recorded a net merger,

restructuring and other non-recurring credit of $90.9 million,

which consists of credits of $107.8 million and charges of $16.9 mil-

lion. The merger, restructuring and other non-recurring credit of

$107.8 million, of which a credit of $6.3 million is included in cost

of revenue, is related to the merger with AMP and costs associated

with AMP’s profit improvement plan. The $107.8 million credit

consists of a revision in estimates of severance reserves of

$55.2 million, facility reserves of $7.8 million and other reserves of

$44.8 million. The restructuring and other non-recurring charges

of $16.9 million, of which $0.9 million is included in cost of rev-

enue, is related to restructuring activities in AMP’s Brazilian oper-

ations and wireless communications business.