ADT 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

REVENUE AND OPERATING INCOME AND MARGINS

Electronics

Electronics’ products and services include:

• designing, engineering and manufacturing of electronic con-

nector systems, fiber optic components, wireless devices, heat

shrink products, power components, wire and cable, relays,

sensors, touch screens, smart card components, identification

and labeling products, energy solutions, power products,

switches and battery assemblies.

The AMP merger occurred in April 1999, but, as required

under the pooling of interests method of accounting, Fiscal 1999

results are presented as though the companies had been com-

bined since the beginning of Fiscal 1999. The following table sets

forth revenue and operating income (loss) and margins for the

Electronics segment:

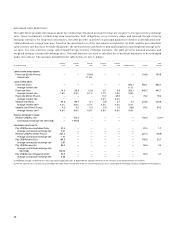

($ IN MILLIONS) FISCAL 2001 FISCAL 2000 FISCAL 1999

Revenue, before

accounting change $13,052.1 $11,417.7 $7,043.5

Operating income, before

certain (charges) credits and

accounting change $ 3,310.9 $ 2,759.9 $1,052.5

Operating margins, before

certain (charges) credits and

accounting change 25.4% 24.2% 14.9%

Revenue, after

accounting change $13,107.5 $11,417.7 $7,043.5

Operating income (loss),

after certain (charges) credits

and accounting change $ 2,848.4 $ 2,850.8 $ (22.3)

Operating margins, after certain

(charges) credits and

accounting change 21.7% 25.0% (0.3%)

The 14.3% increase in revenue, before accounting change,

in Fiscal 2001 over Fiscal 2000 resulted primarily from acquisi-

tions. These acquisitions included: Siemens Electromechanical

Components GmbH & Co. KG (“Siemens”) and AFC Cable Sys-

tems, Inc. (“AFC Cable”) in November 1999; Praegitzer Indus-

tries, Inc. (“Praegitzer”) in December 1999; Critchley Group PLC

(“Critchley”) in March 2000; the electronic OEM business of

Thomas & Betts in July 2000; CIGI Investment Group, Inc.

(“CIGI”) in October 2000; and Lucent Technologies’ Power Sys-

tems business unit in December 2000. Excluding the impact of

these acquisitions, revenue increased an estimated 0.3%, which

reflects an economic slowdown in the computer and consumer

electronics and communications industries and, to a lesser

extent, the effect of foreign exchange rates.

The 62.1% increase in revenue in Fiscal 2000 over Fiscal

1999 was predominantly due to acquisitions and, to a lesser

extent, organic growth. These acquisitions included: Glynwed

International, plc in March 1999; Raychem Corporation

(“Raychem”) in August 1999; Siemens and AFC Cable in

November 1999; Praegitzer in December 1999; Critchley in

March 2000; and the electronic OEM business of Thomas & Betts

in July 2000. Excluding the impact of these acquisitions, rev-

enue increased an estimated 13.1%.

The 20.0% increase in operating income and the increase in

margins, before certain (charges) credits and accounting

change, in Fiscal 2001 compared with Fiscal 2000 was primarily

due to acquisitions and improved margins at both Tyco Printed

Circuit Group and AMP. These increases were somewhat offset

by decreased operating income and margins at Allied Tube and

Conduit resulting from higher raw material prices.

Operating income and margins, after certain (charges)

credits and accounting change, include restructuring and other

non-recurring and impairment charges of $485.0 million, par-

tially offset by an increase of $22.5 million relating to the adop-

tion of SAB 101 in Fiscal 2001, as compared to a net merger,

restructuring and other non-recurring credit of $90.9 million in

Fiscal 2000.

The substantial increase in operating income and margins,

before certain (charges) credits, in Fiscal 2000 compared with

Fiscal 1999 was primarily due to the acquisitions of Raychem

and Siemens and improved margins at both AMP and Tyco

Printed Circuit Group. The improved operating margins, before

certain (charges) credits, in Fiscal 2000 compared with Fiscal

1999 resulted from increased volume, improved pricing and con-

tinuing cost reduction programs following the AMP merger.

In addition to the items discussed above, the substantial

increase in operating income and margins, after certain

(charges) credits, was due to a merger, restructuring and other

non-recurring net credit of $90.9 million in Fiscal 2000 com-

pared with a restructuring and other non-recurring charge of

$1,074.8 million in Fiscal 1999.

Fire and Security Services

Fire and Security Services’ products and services include:

• designing, installing and servicing a broad line of fire detec-

tion, prevention and suppression systems, and manufacturing

and servicing of fire extinguishers and related products;

• designing, installing, monitoring and maintaining electronic

security systems;

• designing and manufacturing valves and related products;

and

• providing a broad range of consulting, engineering and con-

struction management and operating services for water,

wastewater, environmental, transportation and infrastruc-

ture markets.