ADT 2001 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Tyco Plastics and Adhesives had a good year and made

important moves to position itself for future growth.

Through the acquisition of MacFarlane Plastics in

Scotland and Manuli Tape in Italy, it expanded its

plastics and tape businesses to Europe for the first time.

The fragmented European markets have great potential

for consolidation.

>TYCO CAPITAL

Pre-tax earnings at our Tyco Capital unit, which includes

our subsidiary, Tyco Capital Corporation, were $506 mil-

lion for the period from June 1 (the date we acquired

CIT) to September 30, 2001. Revenues for the same

period were $2.0 billion. Earnings were strong because of

improved margins, operating efficiencies and stable

credit standing following the acquisition by Tyco. Assets

are $51 billion.

Although the rough economy dampened volume growth

at some Tyco Capital businesses (with retail sales soft,

for example, the factoring business showed little

growth), it boosted profitability in other segments. In

2001 banks retreated from the middle market, which

opened up new lending opportunities for us. Tyco

Capital’s business in providing secured restructuring

financing was very strong.

When vendors begin wondering whether their customers

will be able to pay their bills, they seek credit experts

to collect, service or even guarantee their receivables.

This business showed dramatic growth for Tyco Capital

in 2001.

Tyco Capital also divested $5 billion of its loan portfolio,

exiting non-strategic businesses such as manufactured

housing and recreational vehicle lending, as well as

auto leasing. This allows the proceeds to be invested in

higher-margin businesses.

>LOOKING FORWARD

In 2001, Tyco demonstrated that, despite difficult busi-

ness conditions, it could indeed grow its business in vir-

tually any environment. We believe we can continue to

do so, and that we can deliver consistent growth for

investors in the future.

We are in excellent businesses, and everywhere we look

we see opportunities to expand by creating new prod-

ucts, by moving into new markets and sometimes by

acquisitions. We are poised to deliver many years of

exciting returns.

And we have the people who can make it happen. Tyco’s

240,000 employees faced tough challenges last year, but

they came through marvelously. We knew they were

outstanding performers before; we are even more aware

of it now. They are the ones who produce the great

products that improve millions of lives every day. I salute

them for all that they have done in the past year and for

what they will accomplish in the future. My thanks to

one and all.

Sadly, Philip Hampton, a person who greatly helped us

prosper, passed away in April. Phil was a long-time board

member and we are profoundly grateful for his service.

We will all miss his wisdom, judgment, vision and

insight. His contributions were extraordinary.

Thank you again, fellow shareholders, for your support.

L. DENNIS KOZLOWSKI

CHAIRMAN OF THE BOARD AND CHIEF EXECUTIVE OFFICER

DECEMBER 3, 2001

Results and charts are before non-recurring charges and credits,

extraordinary item s and accounting rule changes.

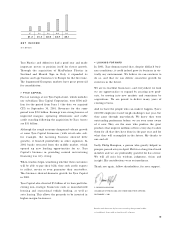

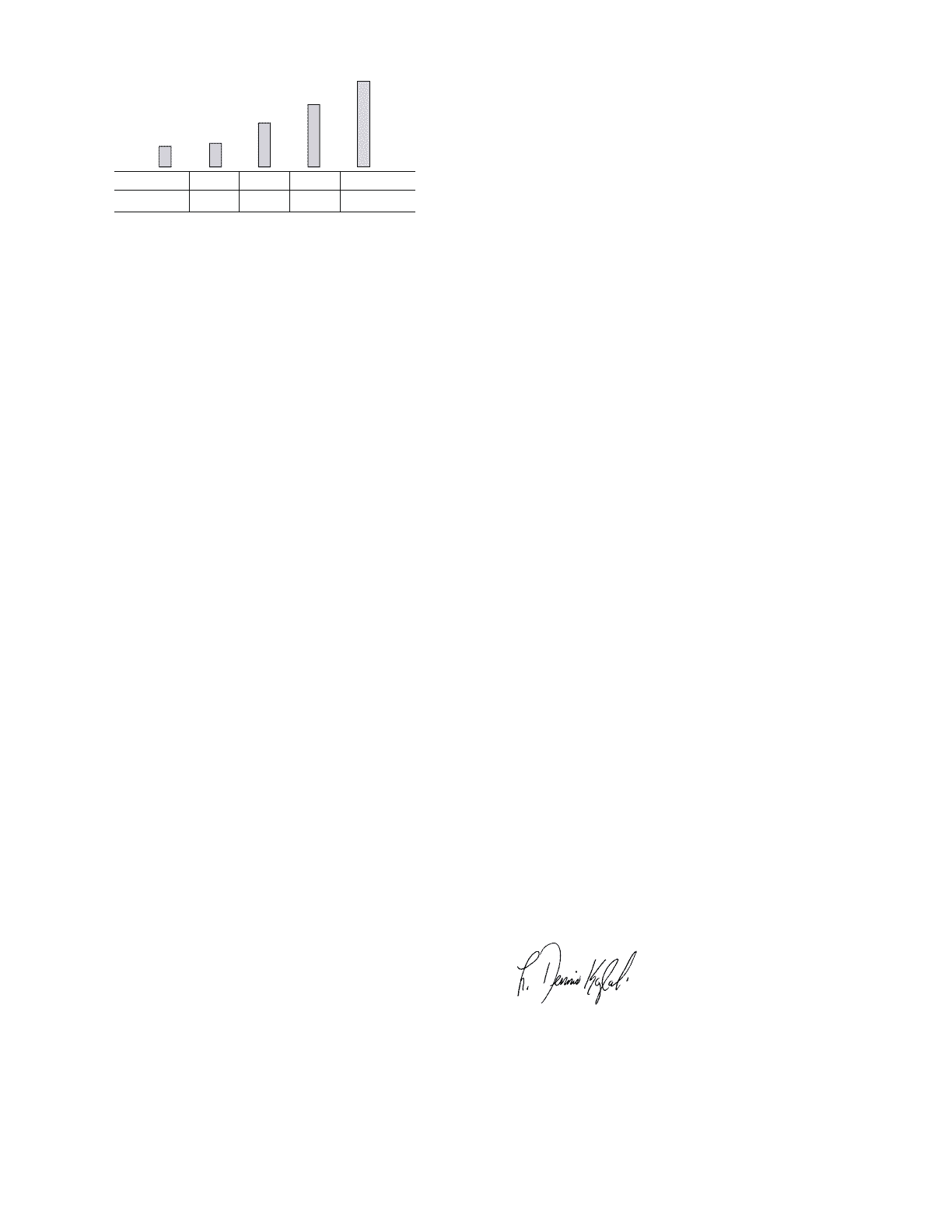

NET INCOME

$ in billions

97 98 99 00 01

$1.2 $1.4 $2.6 $3.7 $5.1