ADT 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

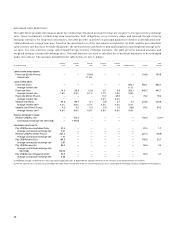

The following table sets forth revenue and operating

income and margins for the Fire and Security Services segment:

($ IN MILLIONS) FISCAL 2001 FISCAL 2000 FISCAL 1999

Revenue, before

accounting change $10,529.1 $8,506.6 $8,086.5

Operating income, before

certain (charges) credits and

accounting change $ 2,019.3 $1,464.0 $1,308.9

Operating margins, before

certain (charges) credits and

accounting change 19.2% 17.2% 16.2%

Revenue, after

accounting change $10,253.2 $8,506.6 $8,086.5

Operating income, after certain

(charges) credits and

accounting change $ 1,690.6 $1,475.2 $1,336.1

Operating margins, after certain

(charges) credits and

accounting change 16.5% 17.3% 16.5%

The 23.8% increase in revenue, before accounting change,

in Fiscal 2001 over Fiscal 2000 resulted primarily from higher

sales volume and increased service revenue in fire protection in

North America and Asia and higher revenues in the worldwide

electronic security services business. The increases were due pri-

marily to a higher volume of recurring service revenues and, to

a lesser extent, the effects of acquisitions. These acquisitions

included: Flow Control Technologies (“FCT”) in February 2000;

Simplex Time Recorder Co. in January 2001; Scott Technolo-

gies, Inc. (“Scott”) in May 2001; and the electronic security sys-

tems businesses of Cambridge Protection Industries, L.L.C.

(“SecurityLink”) in July 2001. Excluding the impact of these

acquisitions, revenue increased an estimated 9.9%.

The 5.2% increase in revenue in Fiscal 2000 over Fiscal 1999

resulted primarily from increased sales in the worldwide elec-

tronic security services business and higher sales volume in fire

protection operations in North America, Asia and Australia. The

increases were due primarily to a higher volume of recurring

service revenues and, to a lesser extent, the effects of acquisi-

tions in the security services business. These acquisitions

included: Entergy Security Corporation in January 1999;

Alarmguard Holdings in February 1999; Central Sprinkler

Corporation in August 1999; and FCT in February 2000. In

August 1999, we sold certain businesses within this segment,

including The Mueller Company and portions of Grinnell Supply

Sales and Manufacturing. Excluding the impact of these acquisi-

tions and divestitures, revenue increased an estimated 11.9%.

The 37.9% increase in operating income, before certain

(charges) credits and accounting change, in Fiscal 2001 over Fis-

cal 2000 was primarily due to acquisitions and increased service

volume in the fire protection business in North America and

Asia and worldwide security business. The increase in operating

margins, before certain (charges) credits and accounting

change, was primarily due to increased service revenues in fire

protection and improved margins at both the valve operations

and at Tyco Infrastructure (formerly known as Earth Tech).

Operating income and margins, after certain (charges)

credits and accounting change, include restructuring and other

non-recurring and impairment charges of $144.9 million, as well

as a decrease of $183.8 million relating to the adoption of SAB

101, in Fiscal 2001, as compared to a restructuring and other

non-recurring credit of $11.2 million in Fiscal 2000. As required

under SAB 101, we modified our revenue recognition policies

with respect to the installation of electronic security systems as

of the beginning of the fiscal year. See Consolidated Items

—

Cum ulative Effect of Accounting Changes.

The 11.8% increase in operating income, before certain

(charges) credits, in Fiscal 2000 over Fiscal 1999 reflects

increased service volume in security operations in the United

States and fire protection businesses in North America and Asia.

The increase in operating margins, before certain credits, was

due to increased sales volume in both security services and fire

protection offset slightly, in the case of security services, by

the costs of the reorganization of the security services’ dealer

program and internal sales force during the first two quarters

of Fiscal 2000.

In addition to the items discussed above, operating income

and margins, after certain (charges) credits, reflect restructur-

ing and other non-recurring credits of $11.2 million in Fiscal

2000 and $27.2 million in Fiscal 1999.

Healthcare and Specialty Products

Healthcare and Specialty Products include:

• a wide variety of disposable medical products, including

wound care and closure products, syringes and needles,

sutures and surgical staplers, products used for vascular

therapy and respiratory care, infant medical accessories,

incontinence products, anesthetic supplies, electrosurgical

instruments and laparoscopic instruments;

• polyethylene film and film products such as flexible plastic

packaging, plastic bags and sheeting, coated and laminated

packaging materials, tapes and adhesives, plastic garment

hangers and pipeline coatings for the oil, gas and water distri-

bution industries; and

• ADT Automotive’s auto redistribution services, which was

sold on October 6, 2000.