ADT 2001 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2001 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

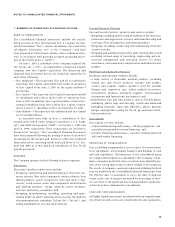

ACCOUNTING AND TECHNICAL PRONOUNCEMENTS

In June 2001, the Financial Accounting Standards Board

(“FASB”) issued SFAS No. 141, “Business Combinations,” and

SFAS No. 142, “Goodwill and Other Intangible Assets.” SFAS

No. 141 requires all business combinations initiated after

June 30, 2001 to be accounted for using the purchase method. In

addition, companies are required to review goodwill and intan-

gible assets reported in connection with prior acquisitions, pos-

sibly disaggregate and report separately previously identified

intangible assets and possibly reclassify certain intangible

assets into goodwill. SFAS No. 142 establishes new guidelines

for accounting for goodwill and other intangible assets.

In accordance with SFAS No. 142, goodwill associated with

acquisitions consummated after June 30, 2001 is not amortized.

The Company implemented the remaining provisions of SFAS

No. 142 on October 1, 2001. Since adoption, existing goodwill is

no longer amortized but instead will be assessed for impairment

at least annually. We are currently determining the impact of

adopting this standard under the transition provisions of SFAS

No. 142. Goodwill amortization expense for Fiscal 2001 was

$597.2 million.

In June 2001, the FASB issued SFAS No. 143, “Accounting

for Asset Retirement Obligations.” SFAS No. 143, addresses

accounting and reporting for obligations associated with the

retirement of tangible long-lived assets and the associated asset

retirement costs. This statement is effective for fiscal years

beginning after June 15, 2002. We are currently assessing the

impact of this new standard.

In July 2001, the FASB issued SFAS No. 144, “Impairment

or Disposal of Long-Lived Assets,” which is effective for fiscal

years beginning after December 15, 2001. The provisions of this

statement provide a single accounting model for impairment of

long-lived assets. We are currently assessing the impact of this

new standard.

FORWARD-LOOKING INFORMATION

Certain statements in this report are “forward-looking state-

ments” within the meaning of the U.S. Private Securities Litiga-

tion Reform Act of 1995. All forward-looking statements involve

risks and uncertainties. All statements contained herein that are

not clearly historical in nature are forward-looking, and the

words “anticipate,” “believe,” “expect,” “estimate” and similar

expressions are generally intended to identify forward-looking

statements. Any forward-looking statement contained herein,

in press releases, written statements or other documents filed

with the Securities and Exchange Commission, or in Tyco’s

communications and discussions with investors and analysts in

the normal course of business through meetings, webcasts,

phone calls and conference calls, regarding the consummation

and benefits of future acquisitions, as well as expectations with

respect to future sales, earnings, cash flows, operating efficien-

cies, product expansion, backlog, financings and share repur-

chases, are subject to known and unknown risks, uncertainties

and contingencies, many of which are beyond our control,

which may cause actual results, performance or achievements to

differ materially from anticipated results, performances or

achievements. Factors that might affect such forward-looking

statements include, among other things, overall economic and

business conditions; the demand for Tyco’s goods and services;

competitive factors in the industries in which Tyco competes;

changes in government regulations; changes in tax require-

ments (including tax rate changes, new tax laws and revised tax

law interpretations); results of litigation; interest rate fluctua-

tions and other capital market conditions, including foreign cur-

rency rate fluctuations; economic and political conditions in

international markets, including governmental changes and

restrictions on the ability to transfer capital across borders; Tyco

Capital’s ability to access funding sources on a cost-effective

basis, its credit loss experience and the adequacy of its credit loss

reserve; the timing of construction and the successful operation

of the TyCom Global Network; the ability to achieve anticipated

synergies and other cost savings in connection with acquisi-

tions; and the timing, impact and other uncertainties of future

acquisitions.